The events which occurred yesterday displayed how twisted this all is…and how far they will go to ensure markets remain propped. They will not be allowed to fall. Trade and Economic advisor, Peter Navarro, came out yesterday evening saying the US China trade deal is “over”. It caused mayhem in the financial markets. The stock market futures dropped (take a look at the lows of the large candle and wick), we saw a run into the US Dollar and the Yen. Just as soon as those words came out of Navarro’s mouth, the tweet storm was unleashed. Navarro walked back those comments and even denied saying the deal is over. The narrative turned to the trade deal is on hold, to now the trade deal is fully intact. The campaign to clean up this mess has been completed. Market futures recovered and opened higher. For those interested in my thoughts on the US and China, they can be read here. I do believe this is a Thucydides trap, and you need to remember the Chinese can remain patient. They know a US election is coming up. They would rather deal with a weaker Democratic President than President Trump. They also know that President Trump needs higher stock markets for re-election and to be able to use “Keeping America Great”. I argued that the Chinese know this, and this actually increased the danger of a financial market war (China selling off treasuries etc). China also knew that if stock markets began to fall, President Trump would be the one desperate for a trade deal and the Chinese could then dictate the terms. This does add a new twist on the effects of the Federal Reserve in the markets, as many fund managers are saying markets remain propped because of the Fed. Obviously they are talking about Fed policies, but it is hard to ignore the possibility of the Fed doing more…as we know they are already buying corporate bond ETFs and individual corporate bonds.

It is also worthy to note that Peter Navarro wrote the book “Crouching Tiger: What China’s Militarism Means for the World”. In the book, he argues for America to use her military dominance (while she still holds this) to pressure the Chinese. This was the similar strategy of Steve Bannon who left the White House claiming the President did not listen to his advice on how to approach China. That the US should have said that China has 72 hours to remove all assets from the South China Sea, otherwise the US Navy and Airforce would remove them.

Can people really trust the trade deal news now after this fiasco? The way this was all cleaned up afterwards should definitely have your attention. Perhaps Navarro was telling the truth, but in this world where markets must remain up, lies are more powerful than the truth. For me, I want to see how China reacts. We know the rumour about China buying more US agriculture, but quite frankly, any US President could do that. This needs to include more than just buying agriculture. By the way, our Soybeans trade which called on the break a few weeks back is still progressing well.

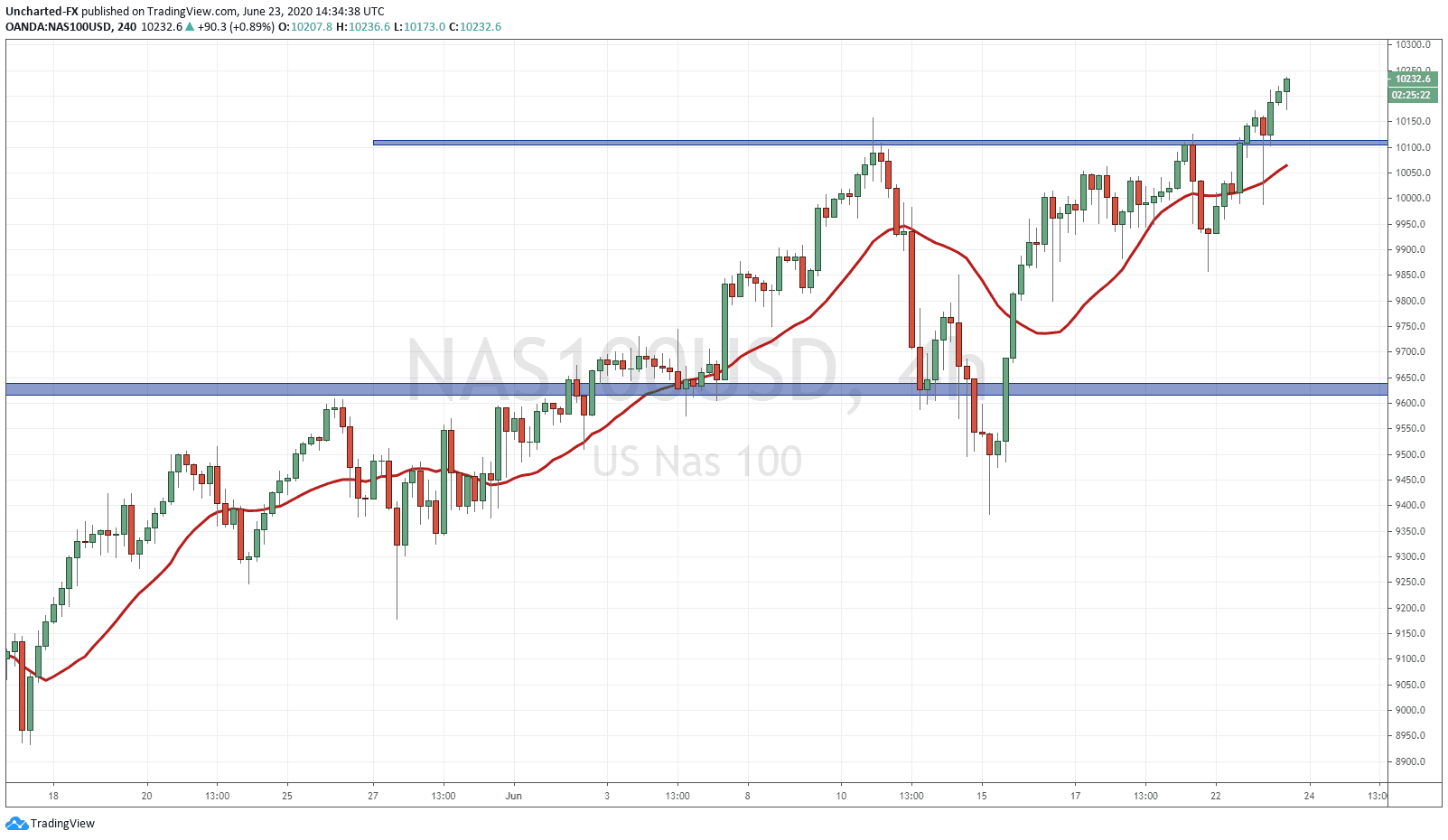

Equities recovered from the overnight onslaught as financial media is dubbing it. The Nasdaq did close above previous candle close bodies yesterday, but is now quite comfortably over the wick and confirming new all time record highs. Something else that I have been saying would happen. This is all about chasing yield, and markets remain the only place to go to obtain it. This is only going to strengthen as bond yields fall and when the Western central banks go to negative interest rates. It really is a buy the dip and do not bet against the Fed type market. The only thing that could bring markets down is a black swan event…yesterday was just a preview of what a confirmed black swan event could do to markets.

Another case for the Nasdaq is the retail trader. With many people working from home, or having no jobs, there has been an increase in people day trading the markets for money. Sports betting is also up there, and I think this will only increase as North American tournament style leagues (NHL, MLS) return. However, if you are a fund manager, tech just seems to be the place to go for value. If you think we will overcome this pandemic, then these tech companies will continue to thrive. A lot of them did not require government bailouts and can continue to operate with their employees working from home. We have already seen new highs in Facebook, Amazon, Apple, Netflix, Microsoft just to name a few. This will continue as long as the Nasdaq continues its momentum.

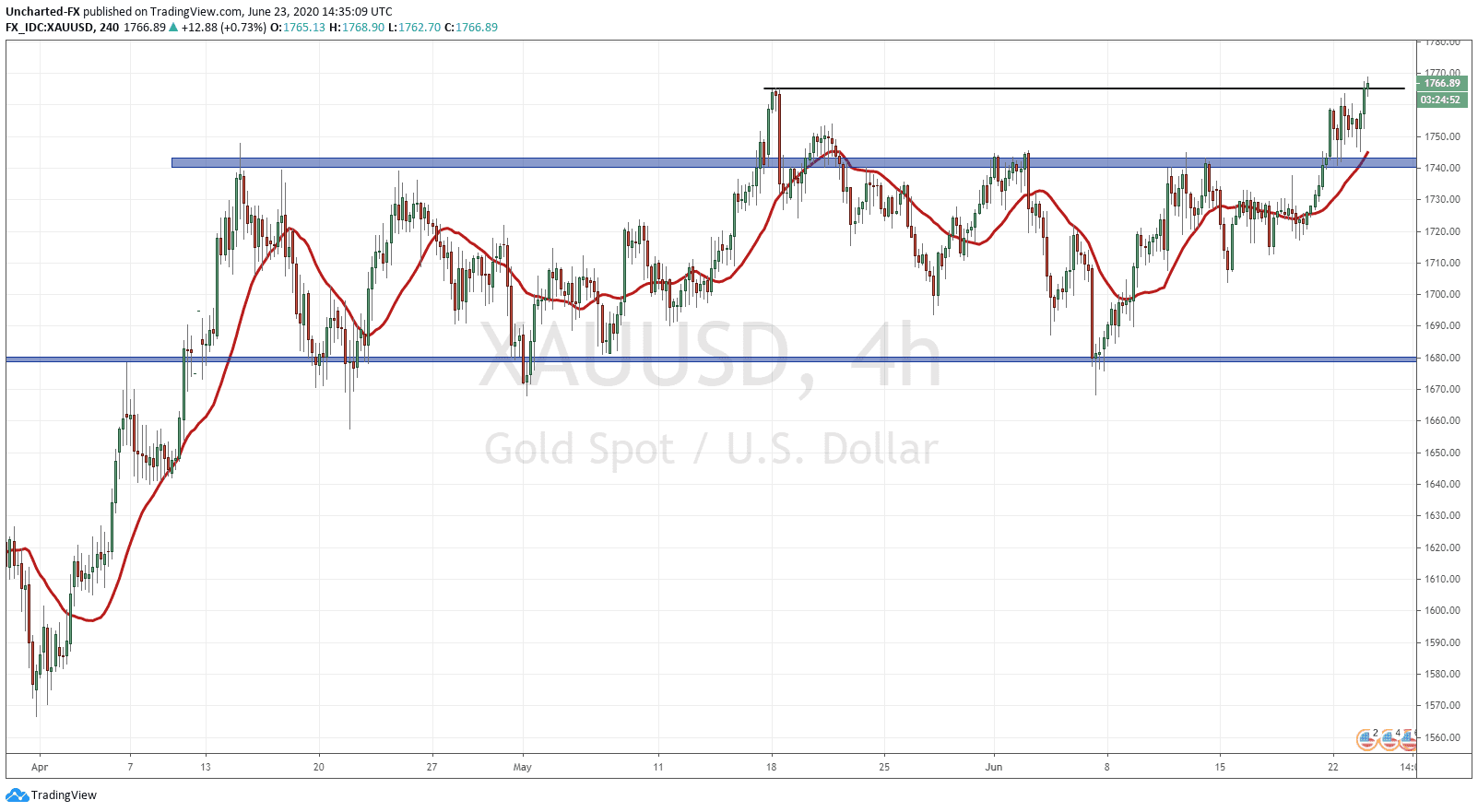

Something that caught my attention was the move in Gold. Many of you know I wrote a possible short trade. I was looking for a head and shoulder pattern in Gold. It did not play out and I am fine with that. There are plenty of other opportunities out there, and my trade did not trigger. This is why awaiting candles to close and breaks are important for your criteria.

1740 was a major resistance zone because it held for multiple times. We got the break above. Now take a look at the 4 hour chart above. After the break, price pulled back to 1740 and retested previous resistance now turned support. Look at the reaction. You can see buyers stepped in by the wicks and then it got even stronger with a close above the highs at 1760.

I have always maintained a bullish stance on Gold for the long term. I was thinking a pullback would occur before the larger move but this may prove to be wrong. Gold is the ultimate confidence crisis asset. People run into it when they lose confidence in governments, central banks and the fiat currency. All these are apparent now or are coming to fruition. Also, with bonds now yielding a tiny amount, fixed income traders need to make yield. Ray Dalio has said Gold could overtake bonds as the new risk off asset. It doesn’t make sense to hold bonds for that tiny amount of yield when you can put that money in Gold, which acts as a safety trade similar to bonds, but have a chance to make yield because Gold can move over 3% in a month (can actually happen in one day given these market environments).

The next levels on Gold I have on watch are 1780-90, which was a resistance zone multiple times in the past, and then the big one, the all time highs at around 1920. I do think Gold will make all time highs eventually, I just did not think it could happen as quickly as this year. We will keep our tabs on this, and of course the Gold miners. Our GDX call is still on track and technically we are still in the beginnings of a GDX bull market.

Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA