Two weeks ago, we wrote about LiveWell (LVWL.V) because we liked the company. It was trading at .67. Despite a grumpy two weeks in the weed markets, LVWL is up 20% to .83 in that 2-week time frame.

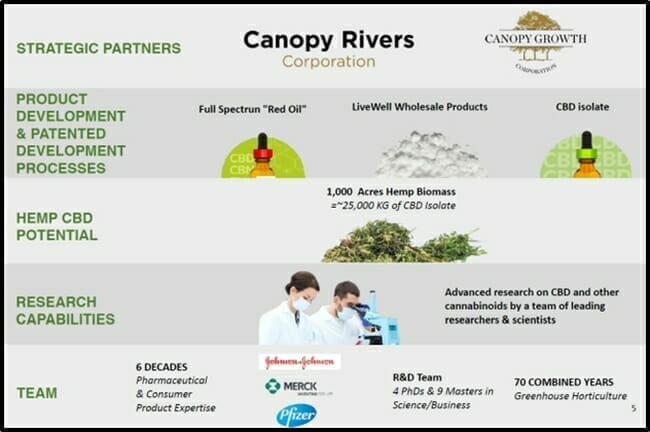

Now an Equity Guru client – LiveWell is focused on advanced research on CBD and other cannabinoids – developing and distributing prescription, consumer health and wellness products.

CBD is a non-psychoactive cannabis compound. Demand for CBD products in the health and wellness sector is exploding

Livewell is also building greenhouses in Ontario and Québec and is supported by business partners such as Canopy Growth (WEED.T) and Canopy Rivers (TSXV: RIV.V).

A couple of days after our initial LVWL EG article, LiveWell announced a partnership with a CBD company called Vitality CBD Natural Health Products.

Vitality is a fully integrated, hemp processing and CBD isolation and wholesaling company, with operations in Eureka, Montana – operating under the State Farm Act. Its demonstration plant is scaling to full manufacturing – pushing production capacity to over 3,000 kilograms per day of CBD isolate.

This new partnership signed a term sheet with Global Wellness Distributors – a Nevada entity controlled by a U.S. private equity firm, for the supply of CBD wholesale products in North America.

The Term Sheet covers a period of 15 months with an option for 4 renewable one-year terms.

Global Wellness will:

- distribute CBD isolate

- distribute distillate

- distribute full spectrum CBD oil

- pay a $3 million US dollar deposit to the new partnership for initial CBD supply

Beginning January 2019, Global Wellness will distribute at least 1,000 kilograms per month.

“Starting April 2019 to March 2020, the minimum quantity increases to 3,000 kilograms per month, for a total minimum quantity of 39,000 kilograms over the 15-month contract period.”

Current wholesale market data reveals CBD isolate pricing ranging between CND $8,600 and CND $13,200 per kilogram, based on the quality and purchase volume.

To put that in perspective, gold is currently worth $52,000 a kilogram.

At the low end of the estimate, by weight, CBD isolate is worth 6X less than gold. 10X more than silver. 430X more than almonds.

Volume comparisons are trickier, but not insurmountable.

1 gram of Water = 1 milliliter. Assuming CBD oil and virgin olive oil have a similar specific gravity, 1 kilogram of CBD isolate = 14 liters CBD isolate.

At $8,600 per 14 liters, by volume, CBD isolate is 8X more valuable than Glenlivet 12-Year Old Single Malt Scotch Whiskey, 16 X more valuable than Alentanjo Italian 2015 red wine, and 300X more valuable than coconut water.

An 8-ounce glass of CBD is worth about $142.

At face value, the 15-month supply agreement with Global Wellness Distributors is worth a minimum of $335 million CND.

We say, “minimum” because that figure is based on the lowest weight (39,000 kgs) and price ($8,600/kg) projections.

Global Wellness and the new partnership will “co-share net profits”.

The mathematical formula for divvying up that pie has not yet been released. And let’s be clear: the $335 million is a projection – and it is sales we are talking about – not profit.

All CBD products being supplied under the Term Sheet will be derived from industrial hemp and contain no more than 0.3% THC content, making it suitable for the health and wellness market.

LiveWell has secured 1,000 acres of Canadian industrial hemp biomass for the purpose of extracting and producing cannabinoid-based products for distribution in Canada,” wrote Equity Guru’s Chris Parry, “It’s true that others out there are buying up hemp and turning it into CBD products, but there’s hemp and there’s hemp.”

“The good CBD hemp, the stuff you want because CBD is the point of the exercise and not making paper products, that’s a sticky, resinous plant and farmers hate it because it gums up their combine harvesters.”

LiveWell isn’t just a premium indoor farmer with an oil-extraction factory.

The company has conducted extensive research on CBD and is becoming an expert in isolation of cannabinoids for use in prescription and consumer health products.

“We recognized early on that a large scale, reliable source of CBD is required, and we have assembled the assets and partnerships to provide it,” stated David Rendimonti, President and CEO of LiveWell. “This is one of several partnerships we have developed that allows LiveWell to generate significant revenues at a nominal cost and no outlay of capital.”

The Term Sheet is subject to customary due diligence and execution of a definitive agreement by November 30, 2018.

On November 26, 2018 LiveWell announced that it will voluntarily delist its common shares from the TSXV. LiveWell listing on the CSE will “start today and the delisting from the TSXV will take place in the near future.”

The Brightfield Group of Chicago estimates the North American market for CBD from hemp could reach USD $22 billion by 2022.

Is it time for a glass of Glenlivet?

Why not? It’s relatively cheap.

Full Disclosure: LiveWell is now an Equity Guru marketing client, and we own stock.