Last week Molson Coors (TAP.N) and Hydropothecary (HEXO.T) announced a joint venture to develop cannabis infused beverages, with 57.5% of ownership to Molson.

On the day of the announcement HEXO.T jumped $0.48 CAD and even though Aphria released impressive financials,it dropped $0.94 CAD. There was a growing feeling among investors that Aphria (APH.T) was going to land this deal.

Once the news broke many believed that Aphria got snubbed, but what if they never wanted the deal in the first place?

The release about the deal that Molson cut with HEXO is thin on details. It amounts to the two companies engaging in a joint venture that explores the idea of drinkable cannabis consumer product. There isn’t even yet a product, let alone a distribution agreement, and the closest thing to an equity investment is some warrants that give Molson the RIGHT to buy a portion of HEXO. Later. If they feel like it.

It is still an unknown if the masses want to drink weed, and it appears as though Aphria’s CEO Vic Neufeld is not ready to jump into a deal with a big alcohol player just yet.

In an August 8th interview with James West regarding Molson, Neufeld was asked “what happened?”. Neufeld replied;

‘it’s not what happened, it’s what didn’t happen, and what didn’t happen is a major global beer brand making a real big statement in this space”.

Constellation’s hedge

In November, 2017 Canopy (WEED.T) announced they received a $245 million CAD investment from big alcohol player Constellation Brands (STZ.N) in exchange for 9.9% equity in Canopy. In June 2018, Constellation Brands increased its bet and acquired $200 million CAD worth of convertible debt securities issued by Canopy.

Constellation may be betting on Canopy’s success to hedge against a potential drop in sales from their alcohol brands. Georgia State University found that alcohol purchases decreased by 15 % in counties in states with medical marijuana laws. Counties where cannabis could be legally obtained had 20% lower alcohol sales than neighboring counties across state borders where it was still outlawed.

California legalized cannabis on January 1st, 2018. California has always been known as a key destination for partiers from the US and around the world.

The Beach Boys said it best:

I been all around this great big world

And I seen all kinds of girls

Yeah, but I couldn’t wait to get back in the states

Back to the cutest girls in the worldI wish they all could be California

I wish they all could be California

I wish they all could be California girls

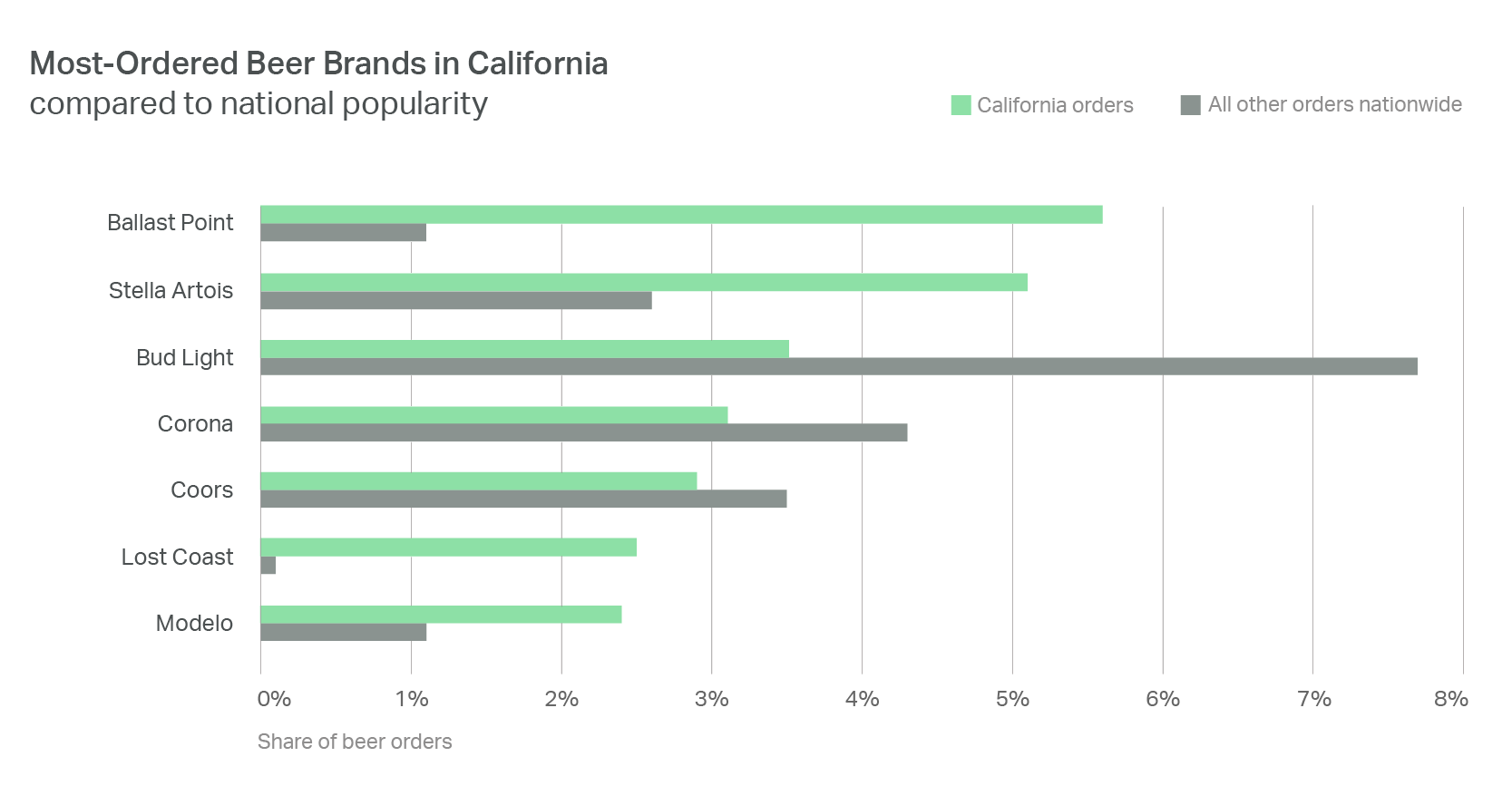

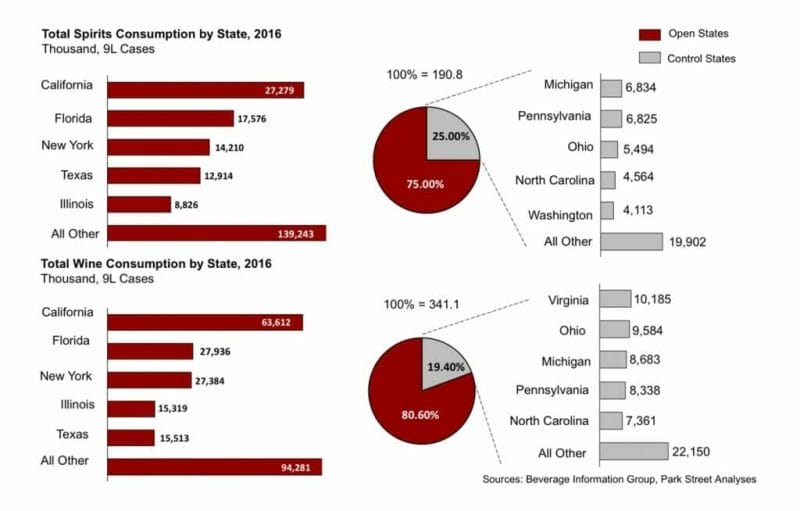

Constellation Brands owns Corona – the third most popular beer in California according to Bevspot. California also dominates liquor sales in the US, according to Park Street.

If the negative alcohol sales trend continues to spread, Constellation Brands will undoubtedly be happy they they hedged their bet in favor of the cannabis sector, even if this was purely an investment and they don’t develop a cannabis infused beverage line with Canopy.

Wouldn’t it be nice?

Cannabis plus alcohol, sounds great in theory, but there aren’t solid sales numbers for this product yet. These are some early theories:

- Cannabis has a very strong and distinct taste which is quite different than anything else currently being sold in the beverage market.

- The connoisseurs of both products may not want to combine the two. Neufeld stated in the above West interview that he ‘doesn’t want cannabis in his alcohol, or alcohol in his cannabis.” These drinks are branded as fun, weekend type drinks. Many people looking to party enjoy the act of smoking cannabis, and the taste of drinking beer, wine or highballs.

- Some people associate negative feelings with the idea of being both drunk and stoned, and with companies like Tinley (TNY.C) branding their non-alcoholic drinks to look alcoholic, this may cause an uncomfortable mental image. Tinley did $4,027 in sales in Q1 of 2018.

- The products aren’t discrete and could draw attention as the labeling so closely resembles alcohol, as opposed to an energy drink or can of soda.

- People have been smoking cannabis and drinking alcohol for thousands of year, this the first time the two have been combined on any kind of large scale.

- Some of the most popular cannabis products (CBD oil, CBD tinctures, topicals, vape pens) have been successful at promoting the healthy aspect of cannabis. These cannabis beverages will likely need to include large amounts of sugar or sweeteners to be attractive to consumers. Hemplify’s Lemon Lime Hemp Extract drink has 20mg of sugar alcohol in a 296 ml bottle.

Soo……..

Is that good news about Tinley?

Still optimistic about Tinley?

I’m optimistic about it. I actually think there’s most definitely a market of people who want weed in their drink. I’m diabetic, so removing sugar from alcohol would be a gamechanger for me, allowing me to ‘drink’ with friends without getting hungover/hypoglycemic.