The Branding Rush

Chris wrote something last week that I believe crystalized in a discussion that he and I had a few weeks ago regarding the growing urgency among the investor class surrounding the branding of Canadian cannabis products. As investors look for companies who are prepared for The Shift To Retail®, companies are going out of their way to show the market that they have brands – the best brands! – and that their brands will be recognizeable and popular.

I find discussion of cannabis brands as assets in venture-stage companies tiring, and here’s why.

Leaving aside the fact that there is no way to establish a consumer brand without consumer access to the branded product, the concept that any company or agency can develop a product that will leave a lasting impression on the cannabis consuming public after hosting a few focus groups is ridiculous. It’s a concept invented by ad agencies, and sold to companies who fear being left behind. Naturally, group testing can help show what labels and packaging will do the best, but the consumers come back for the product they like the best and become familiar with. The multi billion dollar ad budgets of soda and beer giants serve to secure enough impressions for a logo to remain front of mind with consumers, but it’s the memory, taste and feeling that those impressions invoke that sends them back to the store. Branding is important, but not more important than product and the only way to know which products work at scale is to push enough to lose money if it doesn’t work.

Thus far, not even the commercial recreational cannabis products that do exist have been tested in the wild.

Nonetheless, the concept of branding and marketing is front and centre for new marijuana ventures who are trying to convince the market that they’re going to be able to move units, despite the fact that, at the moment, many of these companies have no units that could be moved even if they were given the green light.

I have a theory about why.

Easy to do, but not everyone can do it. You know?

Riding the rise of the indy retail entrepreneurs

Un-ironically, branding and marketing are concepts that the the general public is very familiar with. In recent years, they have become a religion of sorts. The lexicon of advertising has taken on the property of prayer and mantra among a public with access to a supply of customers that is theoretically the size of the internet.

Today, a person sick of being yelled at by a boss about not having correctly stapled their TPS reports is susceptible to the idea that they can spend a few hours a day marketing some kind of drop-shipable product to whoever might buy it. These days, anything worth buying is made in a Chinese sweat shop. Once the warehousing and shipping is taken care of, all an entrepreneur really has to do to earn their end is market. A bit of twitter and instagram… draw some traffic to the interesting blog content… set up the offer, stay on top of the mailing list… how hard could that be?

A few Neil Patel webinars are as good as a Harvard PhD in branding and marketing and, that knowledge having been secured, a newly minted entrepreneur can get busy driving traffic to his web store, and be flush with time to play with their kids! The days of being a wage slave are over! In the platform economy, the business owner gets paid off the top (after the platform gets paid, the fulfilment partner gets paid, the bank gets paid, and they put some aside to plan for returns and taxes).

The Here’s what happened column has been sceptical of e-retail platform Shopify (SHOP.T), but they’ve consistently proven us wrong and today have a $17.2B valuation, consistently beating 52 week highs. It was built off of a large and growing client base that uses the platform to sell all manners of things, including, now, businesses built around Shopify’s services (so meta!). The success of the businesses that use the platform are hit and miss. It’s largely a function of the popularity and uniqueness of the product being offered. The stores that do well are, of course, “well branded,” but lasting success belongs to the owners who work hard to ensure that they remain both unique and consistent.

In short, marketing is very well marketed.

Among the investor class, good branding has become a sigil of sorts for access to retail consumers. The un-valuable (and possibly valueless) branding ability of pubcos is being worked into the valuations of cultivators, partly by offering investors a grasp on the retail vertical. It’s the final frontier. If the companies can cut out the middle man, that’s good. Right?

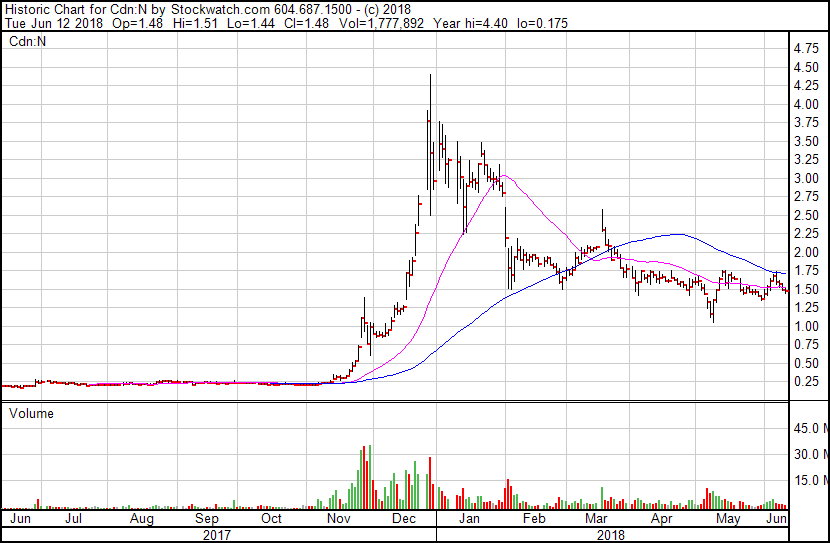

The high-visibility vaporiser e-retailer who telegraphs pole position in the race to become the e-retailer of choice to the Canadian marijuana market is drawing a sideways chart, and it’s about time I got around to talking about Namaste Technologies (N.V)

Despite a longstanding habit of not getting emotional over stocks, I’ve developed a love/hate duality over Namaste that has become a full-on Jungian battle. I am not a Namaste shareholder at the moment, but it certainly isn’t for lack of exposure.

Best in the branding business

As a longstanding advocate of direct-access IR, the way Namaste does shareholder communications really hits me where I live. Every year, public companies spend untold billions on IR efforts that are either designed to keep shareholders a safe distance from management, or to do not much of anything at all. Depending on the circumstances, those might not be approaches without purpose. Many large cap companies have more to lose than gain by direct engagement, and are wise to keep their executives off of social media. But in venture-stage small cap, investors want a sense of whether or not a team can pull off what they say they’re going to. If a company gives them access, they will watch, and Namaste is savvy enough to know that.

Company Founders Sean Dollinger and Kory Zelickson aren’t afraid to tell anyone who will listen that they’ve got a better handle on marketing than anyone, and it’s hard to call them wrong. The eyeballs part of IR comes naturally to them. The Namaste team was able to get a simple narrative out to an audience hungry for pot deals with a violent kind of efficiency. High-motor social media channels, regular news releases and a flurry of features and wire editorials surrounded the company’s rise to a peak market cap of $425 million in December of 2017. The articles being circulated were keen to label Namaste “The Amazon Of Pot“.

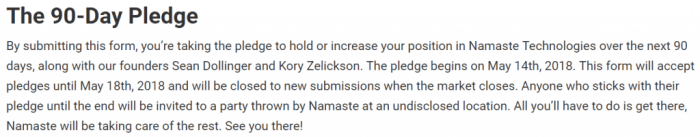

When Namaste blew its top with the rest of the pot market, the company doubled down. Infamously, when the stock started to slide, CEO Sean Dollinger promised to hold an enormous party for the shareholders who held through the summer. The unconventional move was widely mocked (including by EG chief Chris Parry), and the chuckles appear to have gotten to Dollinger, at least a little. I infer this not through mind reading, but by watching the company’s weekly television show.

The IR revolution will be no rerun, brother.

The IR revolution will be live.

Dollinger and Zelickson have hired former BNN contributor Mark Bunting to host a live-to-youtube video call with one or both of them and a series of affiliated guests once a week. After a chat with the guest, and discussion of a few pre-selected segments, Bunting lobs up a few softball questions and takes some more from the ~1,000 person audience contributing by chat.

Naturally, these guys are keen to talk about how they’re going to brand and market their way to e-retail weed kingdom while an adoring public cheers them on in the comments. There is a class of people around their age who have read all of the Tim Ferris books and just get it, so the Namaste koolaid flies through the digital checkouts. They aren’t trading several million shares per day in volume by accident.

The 420 live shows are what got me wondering if the company’s web marketing strength is their only dimension. For most of the show, the N execs take discussions about the value of keeping customers happy and the merits and drawbacks of affiliate marketing sideways. They always give away some merch, and offer special discounts to viewers via promo code. Confronted with basic questions about their general business (as opposed to the marketing part of their business), our hosts often look lost.

On the most recent episode (June 20th), Bunting MCs an excited discussion between the founders of concentrate vape device Shatterizer and Zelickson. They talk about the merits of the product, the similarity between the two companies (both put customers first!), how great Namaste has been with branding support, (it’s more than just hardware, you have to think of it as a brand… and they’re building a community around the brand…). They mention a few times how concentrate vapeing is “the fastest growing” segment of the cannabis market, and it goes on for about 12 minutes until Bunting finally asks Zelickson what kind of market share and margins they could expect to see from this segment of the business (question begins at 11:46):

Around 13 minutes, he threatens to discuss the concentrate market in general, but only really gets as far as the fact that it’s larger in the US because of different regulations. He expects growth in Canada. He’s proud to do it with exciting, amazing, awesome, partners like Shatterizer who are just so cool, you guys. Really really, really, really amazing. Truly.

Perhaps a test of thine faith…

Zelickson and Dollinger are loving the hell out of their first public venture. The marketing and branding chops that they earned in the e-retail trenches selling knockoff handbags have found a natural home in public venture capital, as a flock of true believers hang off of their every word, because these are guys that walk the walk. SEDI filings have Dollinger on record as the beneficial owner of 20.2 million shares of Namaste. Zelickson’s holdings totalled 8.1 million shares on May 11th, when he ceased to be a reporting insider.

Namaste announced on May the 14th that founder Kory Zelickson had given up his role as COO (and his requirement to report his trades along with it) to become Vice President of Business Development and Investor Relations. The new COO, Brian Daliver, owns 202k shares of Namaste.

That same day, Namaste put up the since-deleted form inviting true believers to pledge their loyalty. Grizzle had the foresight to take a screenshot.

Namaste hasn’t yet been able to trade above the $1.73 they closed at on the day they asked the investing public whose side they were on, anyway? and promised to throw a rager for anyone who stuck around for the summer.

We have no way of knowing how much stock Zelickson was holding when he set his baseline, whether he kept his pledge, or why anyone would want to party with Dollinger and Zelickson.

Namaste is among the top volume traders on the Venture, so 8 million shares wouldn’t be very hard to pepper off, but it would sure stick out on a SEDI report. In marketing they call that “bad optics.”

And there’s more where that came from

I’ve gone through Namaste’s public filings and their many, many press releases, and watched more of those live streams than I care to admit. Namaste is a company created out of the accumulation of web assets, an inventory of vaporizers and paraphernalia, non-binding agreements, investments in other companies with a similar lack of meaningful assets, and the knowledge required to put those things together in a way that creates revenue. They did it with expert timing, in a market hungry for pot deals, with a torrent of information so broad it was nearly impossible to parse. Now, we’re watching a live-to-web version of two guys who are trying to make a public company out of a marketing perpetual motion machine, and I honestly think it’s as likely to work as to fall apart.

In part 2, we’re going to take a deep dive into this young company’s financial statements and have a look at the revenue that their top-knotted CEO is so proud of, where it came from, and what Namaste is doing with it. Plus, some more choice cuts from 420 live.

Until then…

(feature image courtesy flickr user RhianneBurgess)