There’s nothing I usually find less interesting than company news about one company bringing on an exec from another company.

Sure, when you’re a startup or a pubco junior, it helps to have some folks aboard who’ve been there before but, usually, you’re just subbing one guy for another, and the ship keeps on sailing as it was.

“Have you met Larry? Larry’s from Canaccord and has 12 years as a financial analyst. Boy howdy, is Larry gonna supercharge our operation!”

“OMG, we got Larry from Canaccord? BUY! BUY!“

So, yeah.

But this one is interesting, and mostly because of who they’ve got, and how.

The Green Organic Dutchman Holdings Ltd. (TGOD.T) has added several key executives including chief financial officer, general counsel, vice-president of sales, VP of marketing, VP of operations, and regional sales manager for Ontario and Western Canada.

They got a CFO and a lawyer, and they’re good and we’ll get to them in a second. To me, the guts of this comes in the VP ranks.

Mike Gibbons, VP sales […] over 25 years of consumer packaged goods experience in beverages and food. Mr. Gibbons spent over 15 years with Cott Corp. in roles of increasing responsibility, from senior vice-president, sales, to president of the U.S. business unit. Mr. Gibbons has experience in both branded and private label businesses, and led high-performing teams in geographic expansion, building distribution and new product introductions.

Cott, for those who don’t know, is a Canadian company with a few billion dollar market cap that ranked as the number 3 soda manufacturer in North America, and the world’s largest white label soda bottler, until recently, when they flipped their soda assets to a Dutch company for $1.2 billion and shifted into coffee, tea and waters.

What started out as a Montreal based importer of soda from the US parent company eventually became so big that it became the parent company. When you go to a restaurant and order a Coke, there’s a strong likelihood that you’re getting a Cott, because the big two, Coca Cola and Pepsi, place odious conditions on vendor deals with the little guys.

Cott doesn’t, and the product has legs. So much so that companies such as grocery mega-giant Loblaws found it much more profitable to have Cott produce their President’s Choice soda brand for them than to do it themselves.

Cott built the white label beverage business from ‘not a thing’ to a global leader, and a lot of the folks that took part in that exercise have either moved from Cott to TGOD already, or did so this week.

Andrew Pollock, VP marketing […] over 25 years experience in consumer packaged goods, retail and subscription businesses. He has worked extensively in the organic food industry and successfully commercialized a recently legalized category. Most recently at Weight Watchers Canada Ltd., Mr. Pollock helped to drive double-digit growth in a subscription service by adopting state-of-the-art digital, social and search engine optimization strategies. Mr. Pollock also led marketing at Maple Leaf Foods Inc., Canada Bread Co. Ltd. and Cott Corp.

You don’t say.

John Wren, VP operations […] joined the company from Cott Corp. where he spent 22 years, most recently as VP operations, where he was responsible for the operation of seven beverage facilities across North America.[…] At Cott, Mr. Wren was responsible for managing a manufacturing budget in excess of $60-million, a capital budget of $8-million and more than $145-million of raw material purchases.

What would the TGOD President have to say about all these Cott hires?

35+ years executive experience in CPG including VP at Cott Corporation and President & CEO at both SunPac Foods & Xyience Inc., and Board Member at Associated Brands.

So Csaba’s on board.

The biggest single day of upward stock mobility in the Canadian weed sector over the past year was when Canopy Growth Corp (WEED.T) took a big fat investment from the alcohol aggregation giant Constellation Brands (STZ.NYSE). Running up alongside that news was Tinley Beverage Company (TNY.C), which has its own stock of ex-Cott folk in the boardroom.

Jeffrey Maser, CEO and Director […] Began career at the Watt Design Group; at the time, Watt was owned by Cott Corporation and was the second-largest food and beverage branding firm in North America, and Cott was the largest cola company in the world after Coke and Pepsi.

Tinley was actually started with Cott family seed money. Tinley’s Brand Supervisor and Design guys are also ex-Cott. So too is Ted Zittell, who is the highest-ranking former-Cott exec to be working actively with a cannabis company – he’s a past President, and led the effort to get recognized, third-party brands like Virgin and Safeway to create colas based on their brands, which is the thinking behind what Canopy might do with Constellation.

Let’s be honest: The cannabis beverage industry is Cott crazy.

WHY DOES ANY OF THIS MATTER?

Cos drinks matter. They’re the ideal delivery system for all manner of product, from vitamins and minerals to protein to energy to boring old rehydration. If you had to take coffee pills instead of drinking coffee, you’d lose your mind every morning. If you had to smoke Buckley’s instead of drinking it in one foul swoop whenever you have a sore throat, you’d never not have a sore throat. And if we had to eat to take Jello shots of alcohol instead of nice single shots? Well, the divorce rate would skyrocket.

Drinks are how you’re going to get your weed, as soon as the laws can catch up to that not being a shocking thing.

Check it: Right now, if you want to get a good legal buzz on, you go to a bar and you drink a liquid that lists one of its other uses as ‘makes NASCARs run’. You take a whiskey drink, you take a vodka drink, you take a lager drink, you take a cider drink. Then you get shittered. And sometimes violent. And hung over.

But if someone offered you a cannabis drink, Health Canada thinks that’s worrying.

It doesn’t really, just so we’re clear. It’s working on how that cannabis drink can happen, but enough pearl clutchers are still working from weed education they picked up in the 60’s that the transition has taken some time.

TGOD IS GEARED TOWARDS THOSE END PRODUCTS

It has been from the start. When I spoke to the leadership team over a year ago, they had their plans for this direction laid out in full.

Sell dried flower for people to smoke? What’s even the point? It’s a low priced disposal of a product that can draw a much bigger margin if turned to oil, or a powder, and be delivered in products we already buy and have zero stigma attached to.

Gimme a whole grain bread ‘packed with the nutrition of CBD!’

Sell me a case of coconut water with CBD and vitamin D.

Let me buy a protein breakfast beverage that gives me just enough CBD to keep me level through the day.

That’s when we go from the tiny existing market (relative to those people who have no interest in partaking in the existing market) and the rest of the word.

It’s right there in the TGOD investor deck, which is an impeccably crafted masterwork of the format, by the way. The people who contributed to that presentation have developed about as close to a perfect sales deck as is possible.

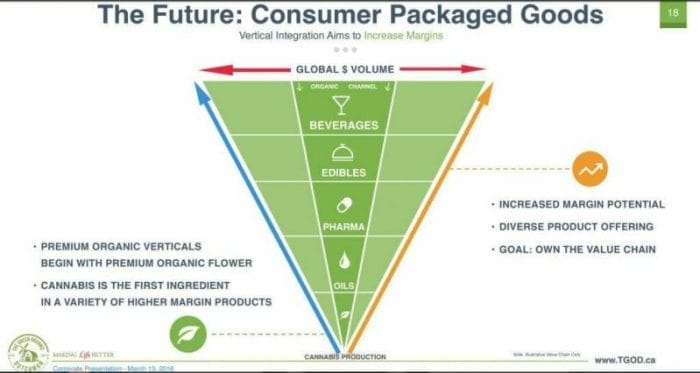

In it, as seen in the graphic above, the cannabis production game is the lowest return on the smallest part of the sector. You’re dealing not just with smokers, but with those smokers who have bothered to find a doctor who will give them a prescription, and then done all their business online, where one cannot see, taste, or experience what they’re buying ahead of time.

Also – usually what they want is sold out.

Granted, the oil business has started to pick up and will soon dwarf flower, if it hasn’t already. But vaping is still a pain. It works, but it makes you look like a dick.

So the next step up is pills, where you’d want to have a deal with a large pharmacy retailer or two. Then edibles, which is will bring on the grocery stores. Then beverages, which brings on the convenience stores.

When those products exist in a real way, you’re competing with Red Bull and Wonder Bread and Tropicana and Jamieson Vitamins.

But to get there, you need experts in bottling, branding, sales, operations, logistics. Not only has TGOD hired those people a year or two out from the laws changing, but they’ve hired the people who turned Cott into a global giant.

But they’ve also got folks from Procter and Gamble, Maple Leaf Foods, Xyience, Sun-Rype, Bedrocan, Canopy, Mega-Blox, Sulvaris Fertilizer, they have partners in Eaton, Ledcor and HCE Energy, they have a major investment from Aurora, and a supply deal with same.

Then there’s this:

That’s an all-star lineup of researchers in relevant fields, an NBA team of uber-nerds with three subs ready on the bench.

There are no shortage of folks who worry that TGOD’s unorthodox beginnings, with 4,000 small shareholders aboard in financings before it even went public, could turn into a one-day avalanche of selling when all those now in the money by as much as 4x people cash in.

But I look at it another way: If this team of people doesn’t have the engine revving hard within six months, in a way that makes selling their stock look like a dumb ass move, then it’ll be one of the bigger failures of personnel that this industry has seen to date.

And considering what they’ve put together so far… I don’t see it.

— Chris Parry

FULL DISCLOSURE: TGOD is an Equity.Guru marketing client, and that works for us.