So there I was minding my own business in a makeshift bar along Sukhumvit Road, observing the ladyboys fight the police when I was rudely interrupted by a Google Alert stating that 1-Page (1PG.ASX) was pivoting to pot.

My money is always on the ladyboys – they sure know how to wield those stilettos!

The name rings a bell and I’m forced to shift my gaze from the guy trying to flog fake Rolex watches for 20 bucks a pop. Fell for that once – never again. The watch lasted 24 hours. One of my mates bought a bunch of them, took them back to Oz and sold ’em at the pub for 100 bucks each. Nearly paid for his entire trip. Some guys get all the luck.

I know, I know – should have had the phone switched off. But if you do that, how does anyone contact you these days?

Phone rings. Oh, it’s the wife. I send it through to voicemail.

“Hey Lek, can you grab me another icy cold Leo”. She cracks it open and no sooner is it in my sweaty palm. Tastes about the same as water, but is much safer than anything which comes out of the taps.

Anyway, you end up sweating half the bottle out in short order. The other half? It does a reasonable job of wetting the whistle. Small bottles are best as they can be consumed before the day’s heat transforms the contents into a foul swill.

Leo captures about a 46% market share here in Thailand – proof tariffs work!

The sad, sad story of 1-Page Ltd

First up, the story of how 1-Page enters my consciousness. Bare with me. I beg of you.

I was actively trading the markets back in 2015, and it was my only source of income.

It’s not the fairy-tale many believe it to be.

Some days you high-five the dog, crack open a coldie at 10 AM and head to the beach, having pocketed 9K on an overnight collapse in the Dow Jones.

Other mornings you stare at the screen in disbelief before heading back to bed hoping a few more hours of sleep will stop you from selling the low. Amazing how many times this worked, in fact, it’s a trading tip I’ve never read anywhere else. You’re welcome!

Then days where your broker rings you. Never a good sign as they’re hardly inclined to call just to see how you’re feeling.

Nah, when they’re on the other end of the Al Capone, it’s because some very bad ju-ju has occurred and you owe them money. And they want it. Now. All 20K of it. Christ. (rolls a joint)

Thankfully they paid me the courtesy of NOT liquidating any of my other positions. Oils ain’t oils and brokers ain’t brokers.

Even though you scream at the dog about being assigned1 on a short put which some clown doesn’t know how to trade properly, the world starts spinning a little quicker and it feels like it’s trying to throw you off.

The bloody thing still had 3 weeks of time value left on it, but I admit it was a little deeper in the money than I would have liked. Poker Brat Phil Hellmuth comes to mind – he would lose a hand and go on tilt because some idiot had played the hand incorrectly, hitting a one-outer on the river to beat him. I understand how you feel Phil.

While I thought I would, I really don’t miss those days. Investing in small-caps is a tranquil ocean compared to the rough and tumble seas of ETOs. Small-caps are just so forgiving and a good entry price buys you a lot of time to sit and think.

We’re getting off course.

Why this period is important is because I distinctly recall how the 1PG ticker kept appearing at the top of the pile of ASX200 stocks every day. Day after day after day. The ASX had not long introduced numerals into their ticker codes so it stood out. I knew nothing about what the company did, never traded it.

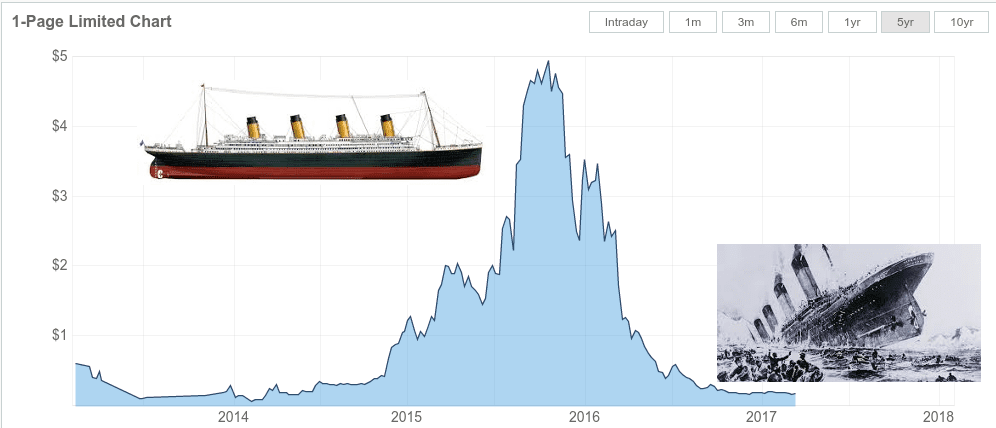

But in writing this piece and looking at the chart one thing is clear. The damn thing was on an absolute tear for most of the year. But it wasn’t to last. It never does.

Take a look at the chart. Do you see the infamous iceberg pattern?

The stock jumped from its $0.20 offer price to a high of $5.69 in less than a year. You do the math.

An insight into the madness of crowds, the animal spirits which lurk in all of us. These stocks become a confidence game, and there is big money to be made by big fish so long as a plentiful supply of smaller fish can be found.

Smart money needs dumb money to sell into – always has, always will. Let the feeding frenzy begin.

But if you’re going to pump a stock, first you need a story. And a good one at that.

Enter Femme Fatale Joanna Riley

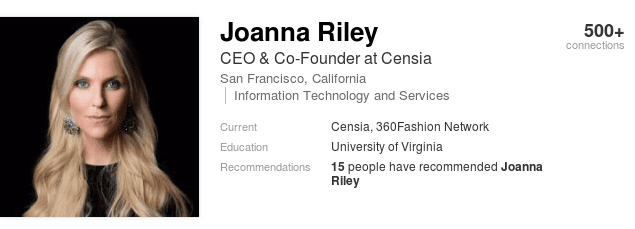

Riley (then Weidenmiller – she has reverted back to her maiden name) was the driving force behind the creation of 1-Page and its listing on the ASX.

Here’s Joanna’s LinkedIn profile:

Her own résumé is pretty impressive. A stint at the FBI as well as finding time to be an international model. Did we mention rowing at a national level?

Warning Don’t stare into those eyes too long or you’ll end marooned on a rocky outcrop. Mesmerizing aren’t they?

Assuming the shell of a defunct mining company (InterMet Resources) 1-Page launched onto the boards in late 2014 with a story of disrupting the recruitment market.

Résumés are dead. Meet One-Page Proposals, the new, new thing.

Just so happened the market was ready to hear such a story. Being in the right place at the right time never hurts, does it? Digital disruption was about to hit center stage.

According to Wikipedia the company was co-founded by Patrick G. Riley and Joanna Weidenmiller in 2011 based on the approach and founding principles of the book “The One-Page Proposal'” published by Patrick G. Riley in 2002.

According to Wikipedia the company was co-founded by Patrick G. Riley and Joanna Weidenmiller in 2011 based on the approach and founding principles of the book “The One-Page Proposal'” published by Patrick G. Riley in 2002.

Hmmm. Another Riley. A relation? Yes, Daddy dearest.

It was supposedly a bestseller, yet I couldn’t locate it on the NYT charts. We’ll assume it’s true.

Moving along.

In any case, the idea is succinct and I’m a fan of brevity in all its forms. Less is more.

Turns out they made a video together. Nothing nefarious I assure you!

This one:

The ticker wasn’t the only thing which stood out about 1-Page. The company itself was Silicon Valley-based, yet sought to list on the ASX via a backdoor listing aka a reverse merger, becoming the first Silicon Valley-based company to do so. Riley wished to avoid the dilution which came with taking VC money from the valley.

She did, however, take a state-side angel investment before embarking on her Aussie adventure – around $3 million bucks worth.

Riley rings the bell and 1-Page collects $8 mil

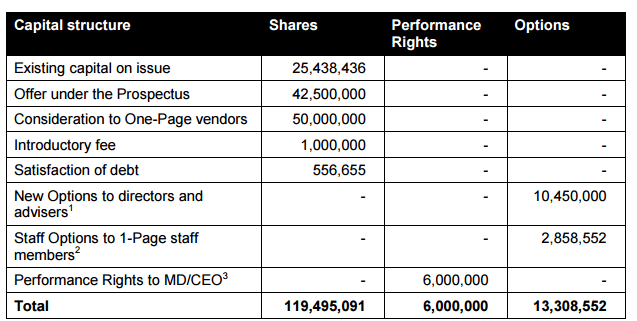

Through an IPO the company raises $8.5 million issuing 42.5 million new shares at $0.20 each.

Through an IPO the company raises $8.5 million issuing 42.5 million new shares at $0.20 each.

InterMet’s existing capital was accounted for by way of a 1:20 consolidation.

Throw in an extra 50 million or so odd shares grafted to stragglers and the register now contained close to 120 million shares on day one of 1-Page’s new structure.

How much of the pie did Riley end up with?

13.6 million 1PG shares for starters according to the 3X notice, excluding her performance rights.

This is how the capital structure of 1-Page looked after the IPO completion.

So she controlled a little over 10% of issued capital.

Unfortunately, by the time her holdings escaped escrow, the share price was back in the shitter.

But hey a million bucks still puts frittata in the fridge right?

And the 180K salary she was getting wasn’t too shabby either.

In words which would come back to haunt her, Riley was quoted back in Jan 2015, saying:

“Huge global enterprises are nervous about young, private tech companies,” she contends, because of their failure rate.

They were right to be nervous. Wasn’t it Buffet who said you only know who is swimming naked when the tide goes out? So true.

So what went wrong?

Everything starts with an idea. Was Riley’s a good one?

Résumés (CVs) suck balls. I don’t know about you but I dread having to write them and potential employers make sure to read as few as possible. Ever heard of the trick of picking up the top half of the pile and throwing them straight in the circular filing cabinet? (aka the trash can) I’m told it happens.

1-Page would revolutionize this by crafting a proposal for your new suitor instead of regurgitating the dreary details of the data-entry job you had 15 years ago and the fact you like long walks on the beach and play lacrosse whenever you get the chance.

In theory, it sounds plausible. At best. But to work, it needs the buy-in of those looking to hire you, especially if they’re looking for a beach-loving lacrosse player such as your good self.

Were there customers? Yes, a few, Red Bull one of them. The company M.O. was to sign prospective customers up for a 30-day free trial and hope they hang around afterward and pay up. They did (get ’em on board) and they didn’t (hang around).

Meanwhile, the share price was soaring. It only ever ends in tears.

But running your own outfit comes with its own challenges, and investors suspending their disbelief only lasts for so long. Eventually, the smoke and mirrors are revealed, and the house of cards tumbles.

The promised customers and revenues just never materialized.

The résumé refused to die! Seems the One-Page Proposal tapped-out in the third round, bruised and battered. Like Tyson says, everyone has a plan until they get punched in the face.

Forbes has all the gory details in their piece detailing The Rise And Fall Of 1-Page.

1-Page’s tribulations barely registered with the U.S. business press, but the company’s tale is a familiar one in Silicon Valley: an entrepreneur with visions of success and stature starts a technology company in a field where they have little experience, overpromises to clients and investors, and then severely under-delivers. But unlike the hundreds of startups that are unable to find funding and fizzle out every year, 1-Page flourished by taking advantage of a reverse merger, acquiring the dormant shell of an ASX-listed mining company and going public despite having no profits and less than $1 million in revenue. (Emphasis ours)

Ah, sales. They storm through, promising the world and then disappear in a haze of cocaine and booze, never to be seen again. Then it’s up to the little guys, who are left to turn the clients dreams into reality.

In pitches to prospective customers, Riley drilled her sales team to say that the company had powerful algorithms powering the candidate search on Source. “This was entirely a lie,” said one employee, pointing to the fact that workers at the company were manually searching databases and putting together candidate pools after obtaining the job criteria from clients.”

The “Source” of which Riley spoke was a software tool built on top of BranchOut, which 1-Page acquired shortly after going public.

Branchout was a Facebook app designed for finding jobs, networking professionally, and recruiting employees – which worked until FB decided it wouldn’t. Never good when your business model relies on someone else’s API, they can shut you down in an instant.

It helps if the sell-side is onboard too. The more snake oil salesmen, the more snake oil gets sold. The term unicorn refers to a startup company with a billion dollar valuation, and it wasn’t long before the B-word was being bandied about re 1-Page’s potential.

In one report entitled An American unicorn in kangaroo’s clothing? two analysts for Vancouver-headquartered investment bank Canaccord Genuity initiated coverage on the company by setting the expectation that it could be a billion-dollar business. The two analysts based their research on the company’s own projections that it would have 125 paying clients by the end of 2015. Revenue for that year was estimated at $4.1 million, but was expected to jump to $55.8 million in 2016 and $138 million in 2017. (emphasis ours)

FWIW, the market cap did top out around the $700 million dollar mark or so. Fistpump.

Want to read the report? Here’s the link (3MB PDF)

The story ends in the usual fashion. Administrators are called in, a board upheaval erupts and the CEO is unceremoniously dumped.

The shares have been suspended for over a year. 1-Page last traded at 16.5 cents, a far cry from the lofty $5.69 peak.

The saving grace as far as shareholders are concerned was the 8 million or so still in the bank account. Surprising as this company turned cash burn into an art form, plowing through $26 million in its short history.

Put simply, 1-Page was trying to be something they weren’t. As Forbes reported on Riley –

“She was so disconnected from reality and from what the actual product was,” said one former staffer. “What they were selling was essentially vaporware.”

Can 1PD turn a new page?

Rebirth as a cannabis concern. Can it work?

Let’s look at the official release from the ASX.

1-Page today announced it was becoming a medical cannabis company, buying 100% of the parent company of the HAPA Medical Group based in Germany, and changing its name to European Cannabis Corporation Ltd, pending approval from the ASX.

• 1-Page to pay €1.3 million for 100% control of HAPA Medical Group (“HAPA”)

• The planned opening of two medical clinics (Berlin and Dortmund) in the next 4-6 weeks.

“The HAPA team have focused on building relationships and applying for and securing the necessary licenses and permits to operate the business in Germany, secure sources of supply of pharmaceutical grade medical cannabis flower and oil, and the opening of the first two of its medical clinics in Berlin and Dortmund are expected in the next 4-6 weeks”

HAPA was only incorporated last year to take advantage of Germany’s new medicinal cannabis legislation.

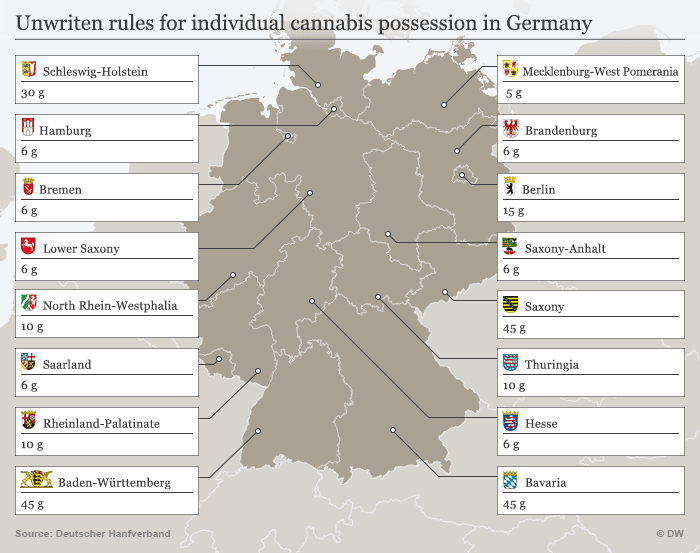

Germany also has some fairly lax rules when it comes to the recreational use of weed as well. See graphic below.

Looks to be a good place to set up shop if you’re in the weed space. Tick right there. They also provide medical coverage for patients who need medicinal cannabis and can’t afford it, a key differentiator from many other locales.

Roadblocks?

The new name will help. The legacy shareholders won’t.

Why?

Well, there’s sure to be a bunch of those 1PG shares stashed away in bottom drawers across the country. Has to be.

There are – 241 million shares on issue giving 1-Page a post-acquisition market cap of $38.6 million based on last traded price.

That’s the problem as I see it – there will be an awful lot of people who will want to get out at any decent price. Any half decent price. Any price.

That’s the problem as I see it – there will be an awful lot of people who will want to get out at any decent price. Any half decent price. Any price.

Stick 1PG in the portfolio? While it sounds crazy that’s a low market cap compared to some of its peers.

Not hard to see it trading with a market cap of 60 mil or even 100 mil if they don’t do anything stupid.

Stay tuned for further updates when news comes to light.

Meanwhile, if you’re after a real page-turner I can highly recommend “Confessions of a Bangkok Private Eye”. Warren Olson does a great job of detailing his years in the City of Angels tracking down wayward husbands.

And before you ask no, we don’t have any affiliate links with Amazon.

–// Craig Amos

FULL DISCLOSURE: The author doesn’t hold stock in 1-Page nor are they an Equity Guru marketing client.

Footnotes:

1. Option assignment occurs when the holder of the option decides to exercise their underlying rights. The clearinghouse randomly selects a holder of that particular option series to fulfill the obligations of the contract.