On December 21, 2017 – after Leonovus (LTV.V) announced plans for an initial coin offering (ICO) – 300,000 shares exchanged hands in the first 7 minutes of trading.

The buyers and sellers continued to exchange furious punishing blows.

By the end of the day, 4.5 million shares had been traded with negligible affect on the stock price (it moved 1 penny lower).

According to the press release:

“Our research indicates that our core distributed storage and distributed compute technology is significantly ahead of other firms that have completed storage/compute ICO’s – some of these firms have raised hundreds of millions of dollars in their ICO.

The Leonovus ICO will provide the company with significant non-dilutive cash resources and is a powerful economic mechanism to incent storage and compute farmers as well as app developers”.

We first wrote about Leonovus on October 19, 2017. Our principal Chris Parry efficiently condensed the story.

You’ve got a massive company with massive storage needs, but traditional storage and bandwidth for that storage goes in ebbs and flows. There are often big empty spots while the company is paying more and more for servers at places like Amazon to cover immediate surge needs.

Since then Leonovus stock has gained 105%.

“Leonovus is using the blockchain to spread things out,” explained Parry, “And to keep things handy, scale up and down as needed, prevent leakage, using multi-tier encryption, helping adhere to compliance needs, and lowering costs.”

As an example, if a company is paying $2.80 per GB per month for storage, and let’s say 32% of their data is high performance, ‘need access to it now’ storage as opposed to the rest being things that may be needed sometimes but not often (backups, project-related, archives), Leonovus says its system can save 64.6% on storage costs over on-premises, hybrid cloud, and public cloud options, which is a MASSIVE cost to big companies inside and out of the technology space.

On October 24, 2017 we commented on a strange trading pattern, and updated our readers that, “Leonovus announced a deal with a Big 6 Canadian bank and jumped by a third. They followed that up today by announcing a webinar about how their storage tech works.

LTV recently did a $13 million raise.

In the December 21, 2017 press release Leonovus confirmed that its “core business continues to be blockchain hardened ultra-secure distributed software-defined storage solutions for the enterprise.”

“This ICO will add resources and a global pool of software verification, compute and storage farms that will make our core business even more attractive to enterprise customers.”

If you like companies run by uber-smart people – Leonovus is for you.

In 2014, LTV married “The Internet of Things” to technology and blockchain, by mining the cryptocurrency Litecoin from low-end distributed smart devices – digital light bulbs!

“Imagine a world where any device with connectivity, a processor, and some storage becomes part of a globally distributed computing platform,” stated Michael Gaffney, CEO of Leonovus, “Every consumer or business in the world could become a Leonovus blockchain farmer”.

If you like companies with great Investor Relations (IR) – Leonovus is not for you.

A visit to the Leonovus website fails to reveal basic information like:

- An IR contact

- Stock price

- Financial Report

- Analyst coverage

- Fact Sheet

- CEO interview

- Project summary

- Management bios

- A corporate presentation

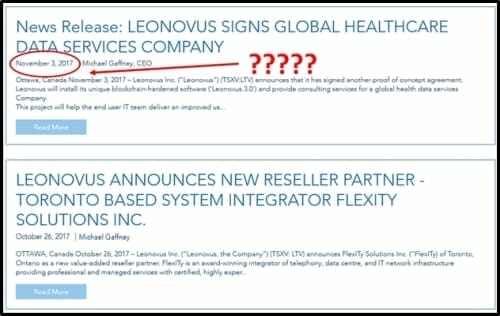

Even the “news link” has not been updated for six weeks despite heavy news flow.

That kind of sloppiness may be forgiven in the midst of blockchain mania – but it must be corrected as the sector matures – or the current shareholders will get bloodied.

Leonovus should be deploying most of its resources into technological innovation and deal making, but a public company is a 2-headed beast.

The on-going, often tedious, task of shareholder communication is important.

According to a Bain and Co. research report the “Global Cloud IT market revenue is predicted to increase from $180B in 2015 to $390B in 2020, attaining a Compound Annual Growth Rate (CAGR) of 17%.”

Full Disclosure: Leonovus is an Equity Guru marketing client, and we own stock.