Poison Pills: What they Are, How They Work, And What They Mean

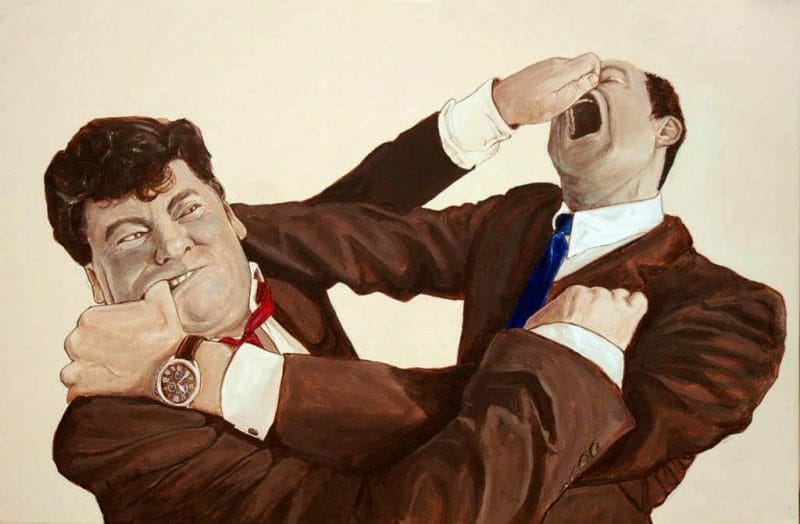

Reefer madness continues and as valuations spiral upwards in the Canadian Pot Sector, Companies are using outsized market caps to get while the gettin’s good. Yeah, yeah. “Organic growth,” and “buildout,” are great, but a pot company with a parabolic market cap really needs is some accretion!

To protect themselves from having companies bought out in a shower of paper, mid-major pubcos write a drastic shareholders’ rights agreement commonly referred to as a “poison pill,”

Why Poison Pill?

Because whoever came up with it probably read too many spy novels.

In any case, on paper, the typical rights agreement gives existing shareholders the right to purchase a share out of the company’s treasury for each share they own. If such a thing were to happen, it would complicate a takeover bid by expanding the share count and giving the company and the shareholders an opportunity to buy leverage.

In practice, these agreements are never ratified, and the rights offerings never happen. Once they’re enacted to thwart a hostile bid, a motivated bidder files a suit and asks a court to consider the agreement a contravention of various anti-trust laws, and the court agrees. The board of the company being acquired are generally hoping that the acquirer doesn’t think it’s worth the bother or, more commonly, is trying to buy time.

The Cannimed version of the poison pill starts off with the standard rights offering, then sets rules of engagement with respect to takeover bids The agreement invalidates bids for control positions that aren’t made in public and to all shareholders. It also extends a right to purchase another share to persons not included in the bid at a discount to market.

The exchange has thus far washed their hands of the agreement, and Aurora predictably doesn’t think much of it. All that is to be expected. Our job as investors is to figure out what Cannimed is after in that time that they’re buying.

[Our resident self-described “futurist” also has a take on the situation ]

Why Run Interference?

The simple answer, of course, is “a better bid”. If either Aurora or a competitor made an offer that contained cash or amounted to a significant position in a company that was a bit more mature than Aurora, it might be better received by the board. When the dust settles on Aurora’s bid (if accepted as is), we’ll be looking at an Aurora with over 800,000 shares outstanding, an under-construction greenhouse that’s among the biggest in the country, and a negative eps. They’d have the largest market cap in the sector, while still being second in production by a 60% margin. Are growth companies really supposed to be that big?

Cannimed’s management don’t think so. They’ve built an operating cultivation company with a future, thank you very much, and as far as they’re concerned, a bunch of Alberta paper flingers are trying to buy it with a stamp collection. To run interference on this (paper) bid that has become an existential threat to them, Cannimed has hired famed Toronto takeover shop Kingsgate Advisors, who most definitely mean business. The pill will buy them time to solicit other offers, and to convince the public that there is a better way.

So far, the Cannimed counteroffensive has centred around a bid of their own for Newstrike, a recently listed issue whose claim to fame appears to be the fact that they’re backed by the Tragically Hip. We haven’t been shy about our opinion that Aurora’s market cap is getting a lot of help from hype, and the whole market has to some extent. Newstrike is no exception.

Newstrike has multiple properties and some ambitious construction plans, but no actual production yet. Cannimed no doubt wants it, and could well find utility in directing the build out of their licensed properties, but one wonders if it would matter to Cannimed as a takeout target in the present if it wasn’t for the Aurora bid.

Is it a Cloak and Dagger Move?

I, too, read too many spy novels.

Let’s say that Aurora’s business looks just fine to Cannimed’s board (if overvalued). Let’s say that they figure that the only problem with the proposed “CannAurora” would be the people running it. They like their jobs and aren’t inclined to go through the build game again… they were looking forward to being titans of industry. The move here would be to convince an investor or a group of them to pick up an amount of Cannimed + Aurora stock that would amount to a control position in the post-merger company. The bid, as envisioned, would see Aurora printing 100% of their outstanding shares to buy Cannimed, and they may well be prepared to print more. If a patient group of buyers used the poison pill delay to gather a stock position, they could just let the merger happen, and show up at the next AGM with enough votes to change the board.

Kingsgate, if you’re reading, I’m available for a consult.