EDITOR’S NOTE: We believe, this year, resources will make a pretty hard move, just as cannabis and blockchain did in 2017, and because many of our investor readers are new to the mining space, we decided to bring aboard a writer who can dig deep into the details and explain what matters and why.

Greg Nolan, AKA Dirk Diggler, is a fount of mining knowledge. His brief: Take a look at mining and oil and gas explorers and producers, and tell us what he feels, positive or negative, with no fear nor favour.

We encourage readers, if they come across a phrase or concept that they don’t understand, to let us know in the comments, as we’re putting together a series of pieces that will explain terminology in greater detail. See more of Greg’s work here.

Cobalt – ‘Co’ according to the periodic table – is a pretty cool metal. My first exposure to Cobalt was while planting trees in northern British Columbia. Many of the more alluring young women in those remote wilderness settings liked to don Cobalt-Blue rain gear. I was a Co fan from the get-go.

Cobalt got its name centuries ago in Germany from freaky goblin-like subterranean creatures called ‘Kobolds’.

These pesky underground sprites were often held accountable by the early miners whenever noxious fumes were encountered from the ores they were attempting to smelt. Later, after left-brained chemistry-types were assigned smelting-duty and local folklore was tossed on the muckpile, the name somehow managed to stick. Kobold became Cobalt.

Here at Equity.Guru, Cobalt, and several of the better positioned Ontario based companies – companies that have dug their heels into the exploration side of the equation – have seen their fair share of the limelight. And understandably so. Cobalt is, afterall, a very cool metal. Not only is it a key component in lithium-ion batteries used in today’s EV and mobile communications industry, it’s applications enter into many facets of our everyday lives without our even realizing it.

Bubble babble:

I’ve heard talk recently that Cobalt may be in a bubble. This first price chart suggests that these folks might be onto something. To say that interest in this ‘battery metal’ has increased exponentially over the past 2 years would be an understatement. Prices have increased roughly 120% in the last 12 months alone (see price chart below).

The reality, however, is that Cobalt is coming off of a very low base after a brutal bear market in commodities. At roughly US$37.00, we’re nowhere near levels witnessed 9 years ago (see chart below). With demand expected to rise 20% per annum and supply constraints creating heaps of stress across the entire lithium-ion battery space – constraints that could put the Cobalt market into deficit in the coming years due to our rapid conversion to EVs – NO. I do not believe we’re in bubble territory. Not even close.

“The dominant trends in 2018 will be tight supply and increasing demand leading to higher prices, driven by rising demand primarily from the EV industry,” said Benchmark Mineral Intelligence’s Caspar Rawles.

The Supply Conundrum:

By now, we’re all well versed on the role the DRC plays in the Cobalt supply chain – some 60% plus – and the jarring images that have emerged from that African nation involving a serious child-labour problem (Unicef estimates that 40,000 children work as artisanal miners in southern DRC, many of them in the Cobalt industry). This has prompted some of the larger Cobalt consumers to ATTEMPT to source their product in jurisdictions that employ a greater ethical/social standard.

Recently, leading carmakers including Volkswagen (VOWG.DE), Toyota (TM.NYSE), Ford (F.NYSE), BMW (BMWG.DE), Honda (7267.T), Jaguar (TAMO.NS) and Volvo Trucks (VOLV-B.ST) formed a “Drive Sustainability” partnership – pledging to “uphold ethical and socially responsible standards in their purchases of minerals for an expected boom in electric vehicle production”.

Finding sufficient and stable Co sources outside of the DRC is the mother of all challenges for these larger Cobalt consuming companies. The DRC represents > 60% of current global production. What’s a company like Tesla or Apple to do?

“I still struggle to see where an ample supply of Cobalt will come from to satisfy most EV demand projections,” said Chris Berry of House Mountain Partners and the Disruptive Discoveries Journal. “With the realization that additional mining capacity will be needed to satisfy EV demand, the eyes of the market have started to shift towards smaller-market-cap companies that are development stage and looking at funding opportunities,” Barry added.

Here’s a question: will the larger companies pay a premium for ethically sourced cobalt in the coming years? Will manufacturers go directly to an ethically positioned miner in order to secure supply, rather than wading through the whole supply-chain rigmarole? Certain companies – a new breed of explorer – may be positioned to fill those needs quite neatly.

My Spidey-Sense must’ve been tingling. I just found this article online: Apple in Talks to Buy Cobalt Directly From Miners

The Cobalt Camp Three:

Three ‘ethical’ Ontario based Cobalt exploration companies: First Cobalt Corp (FCC.V), Castle Silver Resources – now just rebranded ‘Canada Cobalt Works’ (CCW.V) and Cobalt Power Group (CPO.V)

Last September, First Cobalt Corp (FCC.V) made it abundantly clear to the market that they are unwilling to operate in jurisdictions where human rights, specifically those regarding children, are at issue. The companies sole focus is now on the Ontario Cobalt Camp, a camp centered in one of the friendliest mining jurisdictions in the world. This is an aggressive company. Through their recent mergers with Cobalt One and CobalTech Mining, their presence today in this historic mining camp is vastly different than it was only a few short months ago.

The recently merged companies represent a Pure-Play on Cobalt exploration. With over 10,000 hectares of the Ontario Cobalt Camp under its control, this is, without a doubt, THE biggest cobalt exploration company on the planet. Period.

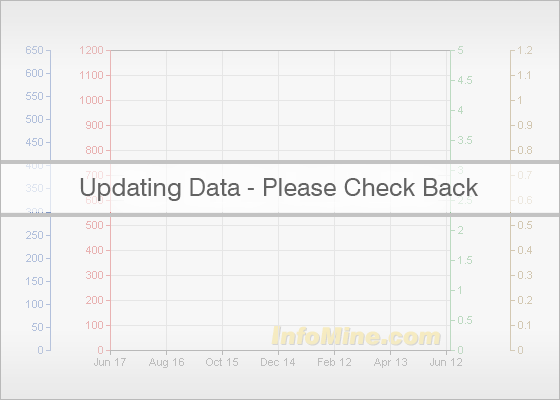

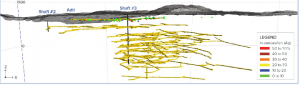

In a camp where 50 million pounds of cobalt and 600 million ounces of silver were mined over a 60 year period, FCC controls 45% of the region with over 50 historic mines residing within its borders. FCC has work to do. For the first time in the camps history FCC is applying modern geoscience techniques to the discovery generation process. After recently cashing up to the tune of some $30M, they’re not wasting any time. 26,500 meters will be drilled across 13 high priority targets in 2018. That’s one helluva program.

Meanwhile, results from a 7k meter winter drill program are flowing in. Results thus far have been mixed, but should be viewed in the context of a ‘technical success’. These are smart guys. As they drill into structures and table results, they’ll update their geological models in order to better hone in on potential mineralization.

What I hope to see out of FCC in the coming weeks/months is a monster hit of disseminated mineralization assaying .3 to .5% Cobalt over 50 meters or better. That would truly signal game-on for this company.

Select (recent) drill results from their 7k winter program include:

15.7 metres of 0.12% Co, including 6.2 metres at 0.21% Co, at their Kelley mine target.

and

2.0 metres of 0.78% Co and 0.83% Ni, including 1.1 metres of 1.35% Co and 1.47% Ni, at their Bellellen mine target.

Commenting on the Bellen assays, Trent Mell, President & Chief Executive Officer, stated:

“First assays from Bellellen drilling confirm the grades found in muckpile material sampled in 2017 and support our view that we now have a third area of interest in the Cobalt Camp. The Bellellen structure has adequate strike length to remain a priority target. Our 2018 drill strategy is to test several new target areas to confirm the cobalt grades of known systems throughout the Camp and then focus on those of sufficient size to support large tonnage operations.”

Speaking of ‘muckpile material’, there could be substantial near-term production potential in these heaps of muck. ‘Muck’: those piles of discarded rock that previous miners left behind believing they were of zero value. It turns out that this waste material is sporting some pretty sexy grades. It also turns out that FCC has muckpiles scattered all across its 10k hectares of geologically prospective terrain. Wherever there was historic mining activity, there’s potential for mineral-rich muck. FCC has over 50 historic mines within its borders – you gotta know management is eager to systematically probe the potential of this neglected resource.

This just in… First Cobalt Begins Drilling in Cobalt North. Highlights from this Feb 21st 2018 news release:

- Three distinct mineralized areas identified in Cobalt South to date: Woods Extension Zone, Keeley South Zone and Bellellen Mine

- Initial Cobalt North drill program to consist of 16 holes for 3,500m to follow up on polymetallic mineralization found in muckpile grab samples that returned grades of up to 0.65% cobalt with 4,990 g/t silver and up to 1.79% copper with 56 g/t silver

- Drill hole targeting in Cobalt North guided by new 3D geological model based on extensive historic data compilation and 2017 regional field mapping

Trent Mell, President & Chief Executive Officer, commented on the above release:

“In our first drill campaign, we successfully identified three distinct cobalt mineralized zones in Cobalt South that warrant follow up. As we focus on Cobalt North for the second leg of the winter drill campaign, we have combined a rich set historical data with our own field work to build a 3D geological model. In Cobalt North, we have several opportunities to identify resources in different styles of mineralization that would not have been considered historically. We believe this program will increase our options to find new cobalt resources in the Camp.”

Strategic asset:

Aside from its considerable geological potential, FCC has an asset that is likely the envy of the sector: It owns the only fully permitted Cobalt extraction refinery in the entire Cobalt Camp. Actually, there are only 3 of its kind in all of North America. This opens the door to a number of near-term production scenarios, including processing ore from other producers.

The Hunger:

FCC has completed 2 merger deals in recent months. One gets a sense that this is an acquisition hungry company, one whose appetite has yet to be satiated. According to Paul Matysek, FFC’s Chairman, they are now looking at companies that are further along in the development cycle; companies that are closer to producing this most highly sought after metal. Matysek stated in a recent Commodity-TV interview that FCC is currently looking at 3 or 4 such companies. Hmmm….

I’d be remiss not to mention that FCC likes to do friendly deals; they like to retain talent – Operational DNA if you will – from the companies they merge with. I wonder who it is, exactly, they are currently in talks with?

Castle Silver Resources Inc (CSR.V), now called ‘Canada Cobalt Works‘ (CCW.V), is another well positioned Ontario Cobalt Camp company using modern exploration technology to sleuth their way to a significant new discovery.

Where FCC appears to be focusing its efforts on the potential for disseminated Cobalt mineralization (lower grade spread out over a wide area) which would be amenable to bulk mining methods, CSR is taking a long hard look at its underground network of uber rich vein hosted mineralization.

In November 2017, after drilling 1.55% cobalt, 0.65% nickel, 0.61 g/t Au and 8.8 g/t Ag over 0.65 meters from 3.85 meters depth at their Castle mine property, Frank Basa, president and chief executive officer, commented:

“Once again we’ve demonstrated how historical operators overlooked the potential for cobalt, gold and base metals at the Castle mine as they focused exclusively on the extraction of high-grade silver.” He then added, “We will carry out trenching to follow-up on an array of new near-surface targets generated by this drilling in the immediate vicinity of the Castle mine, but our priority now is to complete final preparations to carry out critical trenching and drilling of untested structures on the first level of the mine.”

After tabling the following underground values from a series of mini bulk samples at their Castle mine property in an early December 2017 news release:

- 3.1% cobalt in sample CSR-UG-T-2 (mini-bulk)

- 1.04% cobalt in sample CSR-UG-T-3 (mini-bulk)

- 2.3% cobalt in sample CSR-17-10 (composite from the two mini-bulk samples)

Basa had this to say:

“The cobalt grades we’re encountering underground are extremely encouraging and supports our original thesis that past operators may have left much behind at Castle in their strict focus on mining high-grade silver”.

Curiously, previous underground samples also contained respectable levels of gold mineralization.

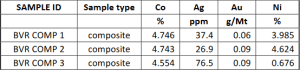

After tabling the following exciting results from their Beaver Mine property, a project located further south and to the east of their Castle mine project:

Ceo Basa commented:

“The Beaver Property played an important role in the mining history of the town of Cobalt as a very high-grade silver producer. These sampling results reinforce our excitement regarding the cobalt potential of this strategically located property which is patented ground owned 100% by CSR. The Beaver complements our flagship Castle Property and gives shareholders additional leverage to a robust cobalt market”.

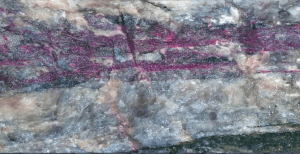

Reading assay tables, attempting to connect the dots and piece things together, can be a challenge at the best of times. In this video, we get a rare look at Cobalt mineralization as it exists in its natural setting. Ceo Basa takes us underground at the Castle Mine and walks us along a narrow vein of 1.5 to 1.8% Cobalt mineralization that runs for approx 1.7 kilometers. 1-point-anything-percent Cobalt is rich rock. Very rich rock. I came away from this guided (video) tour rather impressed…

[youtube https://www.youtube.com/watch?v=CzaYLIj_SP8]

The company recently stoked its coffers with a $1M PP priced at $0.35 per unit (one share plus a full 2 year warrant priced at $0.50) – ceo Basa now has ample funds to do what he does best: explore.

‘Canada Cobalt Works‘, is one to keep a close eye on… for a number of obvious reasons.

Cobalt Power Group (CPO.V). Their stated mission: “To give investors access to the green revolution by creating a company that aims to become a leading supplier of cobalt – a critical component of lithium-ion batteries.”

CPO has been aggressive in its acquisition of geologically prospective projects in the Ontario Cobalt Camp. It’s impressive portfolio of properties recently attracted the interest of one Hochschild Mining (HOC:LON), who agreed to the purchase Cdn $635K worth of the companies stock. This could be the tip of the iceberg, the beginning of a trend in large miners carving out a stake in smaller ‘ethically inclined’ Cobalt exploration companies. Institutions could follow, and of course, so could the Tesla’s and Apple’s of the world. Once again, I just discovered this article online.

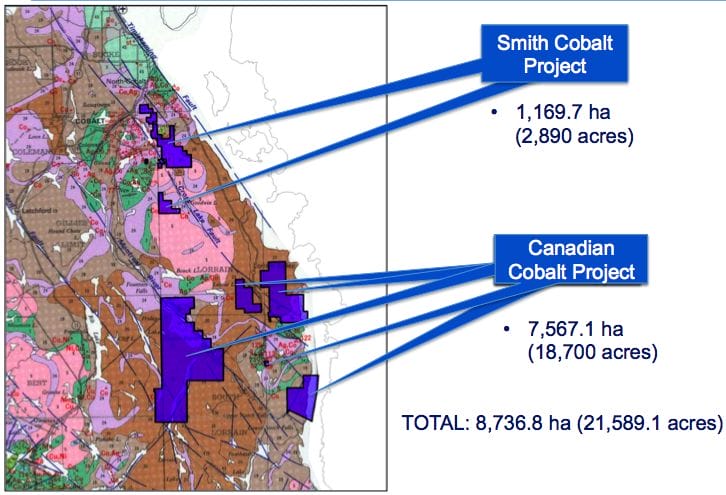

Meanwhile, we’re waiting on results from a phase 2 drill program on the companies Smith Cobalt project, one encompassing some 16 holes for a total of 2,306 meters.

Continuing along its aggressive acquisition strategy, the company recently announced yet another land grab in the historic Ontario Cobalt Camp. This new acquisition in the Gillies Limit Township area adds another 2.944 hectares of prospective ground onto their already extensive project portfolio.

Highlights from this recent transaction:

Regarding this acquisition, Dr. Andreas Rompel, President & CEO commented, “Our company continues to accumulate valuable assets within the prolific Cobalt Camp”. Adding, “Our aim is to become the most important player in the region. Acquisition and intelligent exploration will help drive us to that end”

Summary:

This is the first time in Canadian mining history that a lens has been focused solely on Cobalt exploration. If you believe that the ‘battery metals’ story is a trend that remains fully intact, that industry demand will continue to grow at a rapid pace and that we’re in the early stages of a serious supply crunch, all three of the above companies appear destined to acquire higher price-chart altitude in the coming months. The news-flow out of the ‘Cobalt Camp Three’ should be substantial going forward. News of a significant new discovery – or a solid plan to fast track production – should light up the area like the 4th of July. We stand to watch.

Postscript: a basket approach may be the way to go if you’re not yet positioned in any of the above 3 companies.

First Cobalt, Castle Silver and Cobalt Power Group are all Equity Guru marketing clients.

END.

~~ Dirk Diggler

FULL DISCLOSURE: Castle Silver/Canada Cobalt Works, First Cobalt, and Cobalt Power Group are all Equity.Guru marketing clients, and we own stock in CCW.

As reported by newswire.ca ‘Castle Silver Resources Inc. (TSX.V: CSR, OTC: TAKRF, FRANKFURT: 4T9B) (the “Company” or “CSR”) is pleased to announce the name change to Canada Cobalt Works Inc. which will more accurately reflect the direction of the Company. The TSX Venture Exchange has confirmed that shares will commence trading effective, Friday, February 23, 2018 under the new ticker symbol “CCW”. The tickers for OTC: TAKRF and Frankfurt: 4T9B are the same and will not be changed at this time.’

I would throw LIC.V in the mix since they seem to have some potential with Glencore. This is Glencores only play in the region for Co I think. Smaller footprint compared to the big three with about 650ha though. 2017 drill program had ( ) results like the big three.