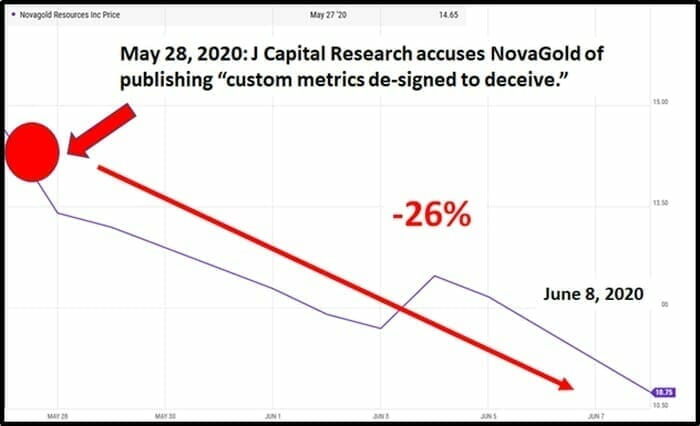

On May 28, 2020 the short seller J Capital Research, issued a negative report on NovaGold (NG.T) claiming that “For the last 15 years, NovaGold’s management team has systematically misled investors with subjective presentation of information about a deposit so remote and technically challenging that the mine will never be built.”

The report painted NovaGold’s Chairman Dr. Thomas Kaplan as a dissembler who uses flowery language and mixed metaphors to evade pointed questions.

“Executives are evasive when analysts attempt to pin them down on timing for further development,” claimed J. Capital Research.

“Our strategy is not to make any wine before its time,” pontificated Kaplan on October 3, 2018, “A wise man once told me that these kinds of assets are rarer than hens’ teeth.”

“My sense is that the moment will come in a not dissimilar way to the way that Justice Potter Stewart when answered the question, ‘How do you define pornography? I can’t define it, but I know it when I see it’,” mused Kaplan on April 2, 2020.

These cherry-picked quotes made Kaplan look like a fruit cake.

In fairness, the answer to a metals-analyst “when-question” should never include allusions to wine, chickens or pornography (a date would be more instructive).

“Under normal circumstances, a sloppy and truly meretricious report would not be met by a corporate response,” huffed Kaplan on May 29, 2020. “We believe that our shareholders are far too well-informed and knowledgeable about our Donlin Gold project, our integrity, and competence to take this report seriously.”

Unfortunately – for Kaplan and other NovaGold stakeholders – some investors did take the negative report seriously.

On June 1, 2020 Nova Gold announced that is preparing a full response J Capital Research’s hit job.

In the meantime, it is “exploring all of its legal options in various jurisdictions against J Capital Research and any other parties who may be complicit in any effort to manipulate NovaGold’s share price.”

J Capital Research Key Accusations:

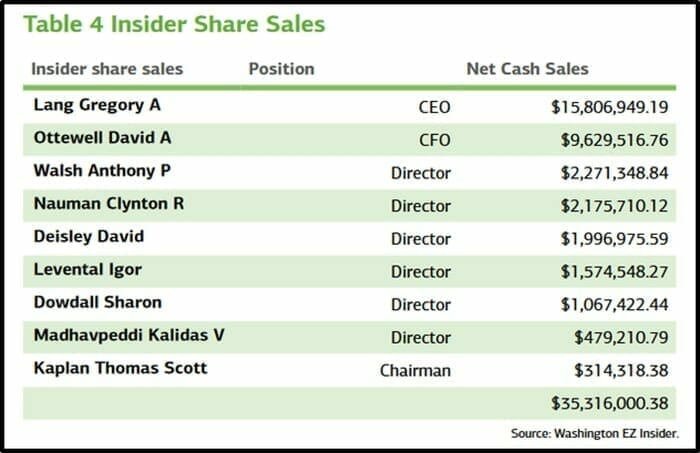

- Management has been treating this 12-person concept company like an ATM, awarding themselves base salaries that rival those of the CEOs at Newmont and Barrick.

- Management deliberately misleads investors claiming the deposit will require $6.7 billion in capital, however, the feasibility study clearly shows this number is $8 billion.

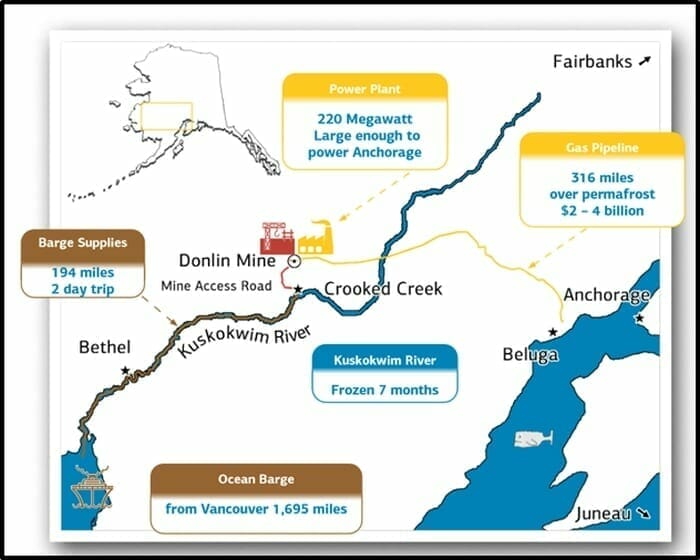

- Donlin is more an infrastructure project than a mine. The gold is in microscopic deposits in igneous rock. To power the processing machinery to grind the rock small enough that gold can be chemically leached out, Donlin would require a 220 MW power plant, sufficient to supply electricity to a city of 500,000 people.

- To fuel the power plant, management claim they can build a 316-mile pipeline.

- The proposed natural gas pipeline central to powering the project is dead on arrival.

- The terrain around the Donlin deposit is among the most inhospitable on the planet.

- Management’s game is clear: keep investors interested in the stock while they rake in huge salaries.

- The $15.4 million managers have paid themselves in cash compensation would have bought investors 80 exploration drill holes rather than the 16 drilled.

- Management paid themselves instead, because they know no new drilling or resizing of the mine will make a difference.

- Despite the limited progress (the last feasibility was produced in 2012) the CEO has awarded himself $8.3 million in cash compensation over the last five years plus over 1.8 million shares.

- Some 70% of NovaGold insider share sales were over the last 12 months, as the share price increased by 300%. The CFO’s stock in the company has halved, from around 2.2 million shares to 1 million. The CEO has reduced his net position by 26%. Clearly, the insiders have voted with their feet.

Note here that Kaplan sold less stock than the other listed insiders.

Note here that Kaplan sold less stock than the other listed insiders.

On June 08, 2020 NovaGold released a comprehensive response addressing “the multiple misleading statements”. It accused J Capital Research of “masquerading as a research firm, perpetrating what is known as a short-and-distort scheme”.

Key Highlights in NovaGold’s response:

- Donlin Gold is clearly feasible as well as one of the world’s largest and highest-grade known open-pit gold deposits

- NovaGold and its partner Barrick Gold are advancing Donlin Gold toward development in a fiscally and socially responsible manner.

- NovaGold will execute the project when the gold price, market conditions, and project optimization render it ready for development;

- J Capital Research exhibited a fundamental lack of knowledge of geology, engineering, topography, technology, accounting and financial assessment methodology.

- J Capital Research’s misrepresentations, convenient omissions, and intentional muddling of chronology exposed its deep lack of legitimacy.

What’s notable here is the NovaGold complains about J Capital Research’s “distortions” but doesn’t go so far as to assert that the report is “false”.

In hindsight, at this point, it might have been better for the management team to wander off and lick its wounds.

But in a separate June 8, 2020 press release, NovaGold’s Chairman Kaplan decided to weigh in.

If Kaplan’s primary objective was to show that he wasn’t a fruitcake – the 11,000-word clap-back got off to a bumpy start.

If Kaplan’s primary objective was to show that he wasn’t a fruitcake – the 11,000-word clap-back got off to a bumpy start.

“On Thursday morning 10 days ago, I was enjoying a particularly sweet moment, savoring a fine cup of Nespresso’s (now discontinued) Ethiopian Yirgacheffe-origin coffee – my favorite,” recounted Kaplan, “The mood was actually upbeat as my older son had narrowly avoided a ruptured appendix.”

“My tranquility was suddenly broken by a flurry of e-mails from friends and colleagues. Had I seen the “hit piece” on NovaGold?” recalled Kaplan, “I had not. When I read JCAP’s report, my first reaction was to chuckle because the piece was clearly so fallacious that I initially assumed it had been written by a child”.

This was a not a good beginning.

The J Capital Research report may be bullshit.

But it is – without a shadow of a doubt – well-written adult bullshit.

“Being held to account is something we welcome – and in fact always will. We just love it,” stated Kaplan, who went on to point out that the J Capital Research report conflated two eras of management.

“We entered the scene and began fixing it in 2009 as a white knight, and turned the company completely around after taking over management in 2012,” stated Kaplan.

Kaplan has a valid point.

If you take over management of a car-wash from a man who is later accused of shoplifting, that does not make you a petty thief.

The J Capital Research report should have focused its criticism on the purported sins/blunders of the current management.

“One can easily imagine the shock to our management team,” mused Kaplan, “It was hard for us to even find an analogy. A “sucker punch”? It sure qualified, but these can happen even among friends in a moment of weakness. So that did not seem strong enough. A Clockwork Orange-inspired, financial adaptation of the so-called ‘knockout game’? Perhaps equal in savagery, but also senseless.”

So much to unpack here.

Generally, friends do not “sucker punch” each other in “moments of weakness”.

“In the ‘Knockout Game’ the attacks are random, and the goal is to knock a victim unconscious with a single punch,” stated The Leader.

As with wine, chickens and pornography, Kaplan fouled up his metaphor.

There was nothing “random” about J Capital Research’s negative report on NovaGold.

It was a surgically targeted attack.

“If good companies and honest managements can be impugned in such ways as we are experiencing,” complained Kaplan, “then we have something of a moral, or at least civic, responsibility to do unto them as they would do unto us.”

Note to Kaplan: you can’t short a short-seller.

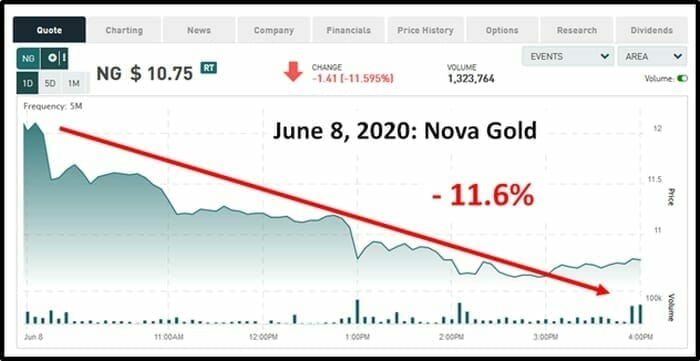

On June 8, 2020, the collective wisdom of the market listened to Kaplan’s clap-back and said, “Humph”.

“We are investigating a potential securities class action against NovaGold and its directors and officers,” stated Kalloghlian Myers LLP a Toronto law firm specializing in class actions, “If you are a NovaGold investor, please email me at garth@kalloghlianmyers.com”

“We are investigating a potential securities class action against NovaGold and its directors and officers,” stated Kalloghlian Myers LLP a Toronto law firm specializing in class actions, “If you are a NovaGold investor, please email me at garth@kalloghlianmyers.com”

“NG needs to flush out any email campaign JCAP has undertaken,” advised POG1200 on an investor bull-board, “A sudden, email receipt of bad news on a share you hold can cause the panic-sale a short-and-distort seeks. The internet can’t be taken down.”

“NovaGold remains the preeminent “gold in the ground” development stage asset, highly levered to the price of Au,” countered Eric.

“Ideally, we see a bear trap flush out below the 200 DMA briefly,” continued Eric, “where GIL readers should have their catcher’s mitts on, and are ready to scoop up stock.”

“Seeking retribution for life’s inevitable disappointments is simply pointless,” reflected Kaplan on June 8, 2020, “Doing so would not give me more time with my wife and children, or any of the myriad other pursuits that give my life both purpose and joy. And, in any event, the world needs more kindness, not less.”

This is true, although it may not calm the anxieties of NovaGold shareholders wondering if the Donlin Gold project is legit.

To date – Barrick Gold (GOLD.NYSE) – the project co-owner – has made no public statement on the negative research report by J Capital Research.

Note: on June 9, 2020 – by morning trading – NovaGold is up 6% on 700,000 shares traded.

– Lukas Kane