In recent days, US stock markets have been rising in anticipation of December CPI showing that inflation was cooling. The market expects with inflation slowing down, the Federal Reserve will either slow down or even pause interest rate hikes.

Consumer prices in December 2022 have posted their biggest monthly decline since April 2020. CPI fell 0.1% for the month, in line with expectations and estimates.

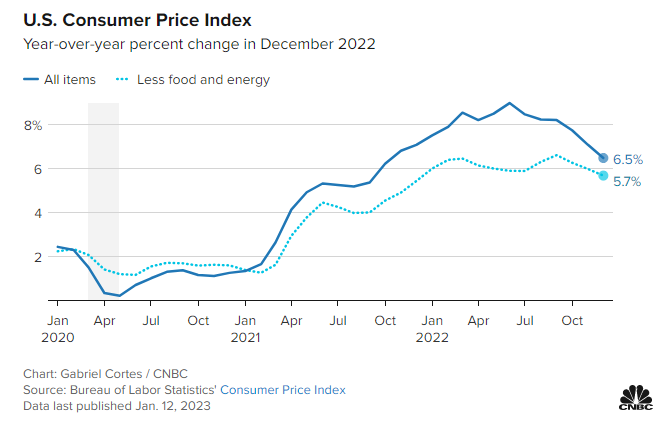

However, headline CPI rose 6.5% from a year ago. Excluding food and energy prices, core CPI rose 0.3% and was up 5.7% from a year ago.

A major drop in gasoline prices was responsible for the monthly inflation decline. Prices at the pump tumbled 9.4% for the month and are now down 1.5% from a year ago. Fuel oil slid 16.6% for the month, also contributing to a total 4.5% decline in the energy index.

Food prices increased 0.3% in December while shelter also saw another sharp gain up 0.8% for the month and now 7.5% higher from a year ago. The increase in the shelter index in December at 0.8% is the biggest since the 1990s.

While goods inflation is tumbling, services inflation soared to its highest since September 1982.

Here is what Wall Street analysts had to say:

“Inflation is quickly moderating. Obviously, it’s still painfully high, but it’s quickly moving in the right direction,” said Mark Zandi, chief economist at Moody’s Analytics. “I see nothing but good news in the report except for the top-line number: 6.5% is way too high.”

“We know that we won’t get the same kind of support from gasoline prices. So don’t expect the next report to look as good as this one,” said Simona Mocuta, chief economist at State Street Global Advisors. “But the trend is favorable.”

Bond yields continue to fall which is very positive for stock markets. It also means that the markets are pricing in a Fed pivot very soon. February’s Fed rate decision is definitely going to be interesting. Will Powell listen to the markets? Or will he continue to be hawkish and stay the course?

The US Dollar also continues to decline, once again indicating the markets are pricing in a Fed pivot or pause. The Dollar is about to test a major support zone very soon, but a move down to 100 is possible.

With the dollar dropping, gold is making a run to try and gain above $1900. With interest rates expected to pause and perhaps even drop with a recession, gold will do well. Keep an eye on those 2 year and 10 year yield charts. If they keep falling, gold will comfortably close above $1900.