The strongest vertical?

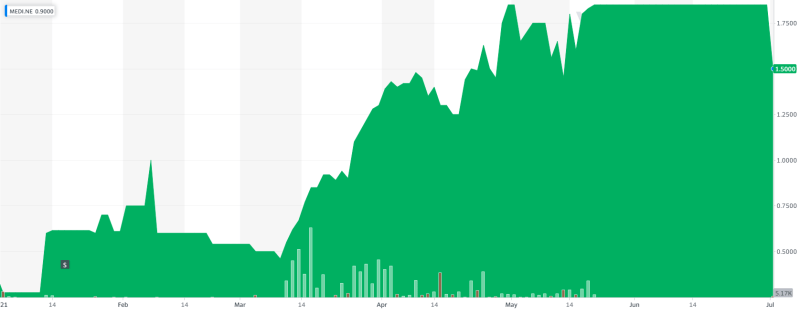

Ketamine One Capital (MEDI.NE), a company name that probably would have turned heads only 1 or 2 years ago, but now makes total sense is on a mission to be a big player in the ketamine clinic space. Ketamine clinics have arguably become the most profitable vertical in the psychedelics sector. Companies like Field Trip (FTRP.T), Novamind (NM.C), and Braxia (BRAX.C) to name a few have been crushing it on revenue, and those numbers are expected to go up post-Covid when everything opens up and society as a whole struggle with increased levels of depression and anxiety. PTSD symptoms have also increased for many as lockdowns have left many in isolation with fear of the future, many have also lost friends and relatives to the virus. Many companies are using ketamine to help with major depressive disorder, suicidality, and anxiety.

Ketamine One is moving quickly, and they are using strategic M&A to scale their company at a rapid rate. In the last few months alone the company has made a series of moves that will position itself to be at the forefront of the sweeping ketamine clinic craze. They bypassed a lot of the timely red tape by acquiring a series of converted cannabis clinics earlier this year, and have R&D projects that include virtual reality and wearable tech.

A ketamine clinic looks to be the perfect business to be in for 2021, and Ketamine One Capital has plans of becoming a major player in the space. Ketamine One has a total of : 118,269,439 Shares outstanding and is sitting at a market cap of $155 million CAD. As of May 1st 2021, the Company reported working capital of $6.6 million CAD and cash of $5.7 million CAD.

M&A

Ketamine One has been on an M&A tear for the last few months.

To date, the company has acquired 16 clinics across North America, with LOI’s signed for additional clinics. Its team is in the process of building the infrastructure needed to provide ketamine treatments through existing clinics, experienced professionals, and tech.

In May Ketamine One acquired clinical assets from Canabo Medical Corp, an already established cannabis clinic company. Ketamine One intends on expanding services offered through the network of 14 national medical cannabis clinics to include a broader scope of mental health treatments including intravenous ketamine treatments, ketamine-assisted psychotherapy, and the https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration of esketamine nasal spray. In 2020, the clinics that were operated by Canabo’s parent company generated approximately $3.5-million in revenues for Aleafia, which has since increased on an annual run-rate basis due to providing treatments related to the mental health effects of the COVID-19 pandemic.

In April the Company acquired 100% of Mindscape Ketamine & Infusions Therapy, through a cash payment of $50,000 USD and issued 94,292 Ketamine One shares equally a total value of $209,67 USD. The R&D Program being performed at MindScape will advance the creation of a proprietary IVR platform for deployment across the company’s network of clinics. The sensory-enhancing nature of IVR has been proven to help patients suffering from mental illness, and has been shown to reduce relapses1. Clinic patients who select IVR-based treatments will receive a tailored therapy plan that includes a determination of their mental state and individual goals. With over 2,000 treatments https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistered since inception, MindScape also recently expanded its service offering to provide spa-like therapeutic treatment experiences

https://equity.guru/2021/03/17/are-ketamine-clinics-a-fast-path-to-profitability-for-psychedelics-companies/

In May Ketamine One purchased all outstanding shares of KGK Science Inc. from Auxly (XLY.T) for $12.5-million CAD in the form of

$2.5 million CAD in cash and $10 million CAD in stock. Founded in 1997, KGK to date has produced 150 publications, executed over 400 clinical trials across more than 40 indications, amassed 25,000 participants in its database, and collected 10 million data points. KGK’s other existing service lines include expert regulatory support and compliance solutions, participant recruitment, research support services, and consulting services

In June, Ketamine One acquired Victoria, BC-based Integrated Rehab and Performance (IRP). IRP has performed over 10,000 unique treatments since its inception in 2017. IRP operates Canada’s first and only multidisciplinary physical therapy clinic exclusively for patients who are past or present personnel of the Canadian Armed Forces or the Royal Canadian Mounted Police, as well as first responders including firefighters, law enforcement officers, paramedics, and emergency medical technicians. Its staff of experts brings together the fields of Physiatry, Physiotherapy, Occupational Therapy, Kinesiology, and Nutrition to provide tailored, comprehensive pain management and rehabilitation programs and services. Ketamine One’s plan is to expand its offerings into veterans communities across the country. Ketamine One paid $1,000,000 in common shares with 700,000 additional shares reserved for reaching certain revenue and expansion milestones.

Ketamine One has made some really smart moves in a very short period of time. They essentially bought a turnkey business from Canabo, and have it set up that Canabo’s expertise won’t be wasted or forgotten moving forward. Their foray into tech reminds me of Cybin (CYBN.NE) approach with their partnership with Kernel. Ketamine One is headed in the right direction in terms of early stage revenue and profitability, and their other M&A activity shows that they are willing to think outside the box and not be just another generic psychedelics company.

Pingback: Expanding Mental Health Provider; 15 Clinics in North America & Cutting-Edge Clinical Research Programs: KetamineOne (NEO: MEDI) - US Newswire