Hemp is hot and Elixinol Global (EXL.ASX) is riding the wave

Hemp, the perennially uncool cousin of Mary Jane is staging something of a comeback.

Often touted as an “industrial fiber”, it has many uses, but with its low levels of THC, getting stoned isn’t one of them.

Think textiles, building materials, cooking and plastics.

Hemp is hot and about to get hotter.

Why?

1. Hemp foods were legalised in Australia in November last year.

2. US Congress is soon to vote on the Farm Bill 2018 which will transform it from a bad boy into an ordinary agricultural product in the US.

This is a game changer and will be a tailwind behind many new industries.

Elixinol Global (EXL.ASX) is well positioned to take full advantage of these changes as it already has extensive US based operations in place which are making money.

Equity Guru’s Ambassador of Quan, Chris Parry, recently took time out to chat with the lads at Follow The Money Investor Group. Check out the video below.

Jump to where Parry [23:45 mark] pounds out the points on why he likes hemp. So much so, he states “I guarantee you that in two years the majority of Canadian farmers will be growing hemp and little else.”

Elixinol at a glance

There’s a lot to like about Elixinol at the moment, looking at their latest investor presentation.

- A tightly held float, with a large portion of shares escrowed until 2020 means they’re somewhat scarce. When it likely punches into blue-sky in the coming days there won’t be much selling pressure meaning buyers will have to pay up to get orders filled.

- The company has just booked its maiden profit and posted half-yearly revenue of 14.9 million. In fact, it’s one of the few ASX pot stocks to be making any money.

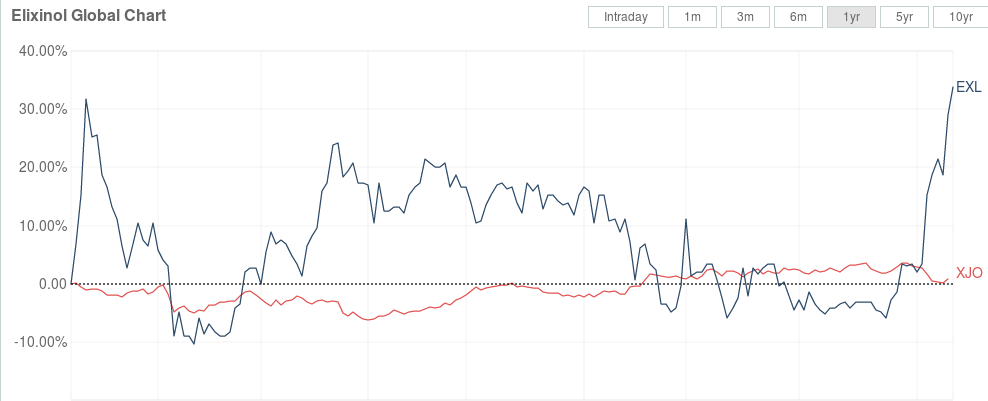

- A share price which has held up incredibly well through 2018, outperforming many in the sector.

Above: EXL vs the S&P ASX 200 (XJO). Coutesy MarketIndex

We called it a buy a few months ago and told readers to add it to their watchlist for the back half of 2018. Anyone who took heed is now in profit with the stock punching up against its all-time high of $1.99, recorded back on the 11th January 2018.

Retail still a basket case

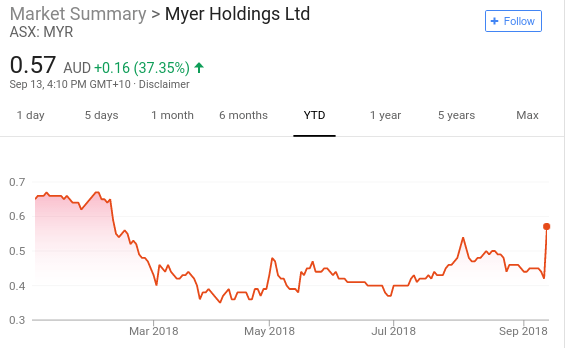

I noticed Myer jumped yesterday and it reminded me of a market-call I nearly made back in February this year. Always on the lookout for good contrarian plays, Myer easily fit the bill, even at that stage.

The stock would continue to fall, eventually putting in a low of 36c.

This past week Myer announced an eye-watering loss of $486 million.

One bright spot was that Myer’s online sales rose 34.1 per cent to $192.5 million.

Myer (MYR.ASX) has a long and chequered history, which looks a little like this:

- It has been around forever – well, pretty much anyway. They opened their first store back in 1900 (you read that right) when Sidney Myer , a Russian immigrant, teamed up with brother Elcon and set up shop in Bendigo, Victoria.

- In 1985 Myer was welcomed into the fold of the Coles Myer group which would dominate retail sales for the next two decades.

- Coles Myer divested the Myer part in 2006, offloading it to a private equity consortium comprising TPG (Texas Pacific Group) and the Myer family (who held a 5% stake).

- TPG walking away with a motza after floating it in 2009 for $4.10 a share then quickly squirreling the IPO proceeds to the Caymans, out of reach of the taxman.

- Business aside, the SP has withered away to just 13% of its IPO price since being floated.

Back to the story.

Even had a title for the piece: Is Myer (MYR.ASX) a contrarians wet dream? (cue the reader complaints!)

Then something happened. I lost conviction in making the call.

I COULDN’T BRING MYSELF TO DO IT.

Holding a market opinion is one thing, but putting it down on paper for all to see is something else altogether – so the publish button was never pressed.

As investors, it’s worth examining our motives even on trades we didn’t take as this can reveal a lot about our trading psychology.

In essence, I’m part of the problem. When I shop these days, it’s usually online. I’m not alone, and there’s a good chance you do the same.

So I felt like an imposter driving anyone towards retail. I don’t do shopping terribly well. Whenever I’m dragged kicking and screaming to the mall there are never enough man-seats to manspread on while waiting for wife 2.0 to assess the new range of shoes and handbags.

My wardrobe consists of: 4 beer singlets, 4 tailored short-sleeve shirts (one must have an Indian tailor in Bangkok, an absolute necessity!), 3 pairs of hiking shorts from L.L Bean, a pair of jeans, a pair of trainers (not that I train!), sandals, thongs (the sort that go on your feet!) and a few pairs of socks I stole from the bowling alley.

Oh and plenty of undies. I don’t do commando either.

That’s it, the whole shebang. Would fit nicely into a backpack should I ever need to bug out quickly.

The Peter Lynch coming out of me, I guess as I’m not a big believer in the future of bricks and mortar retail. Eventually, these companies will go the way of the dinosaur.

This isn’t new news or fake news.

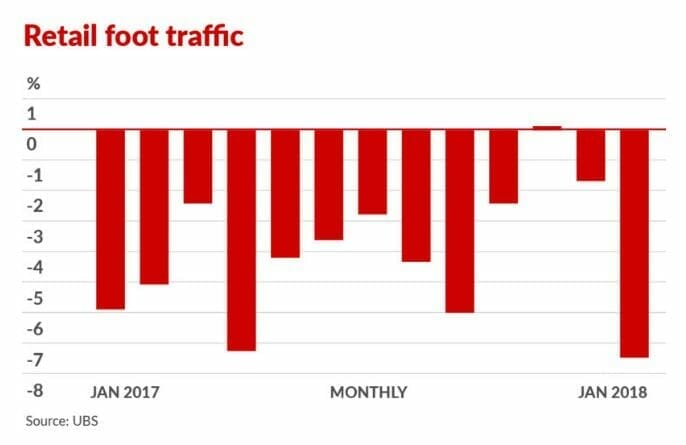

Just take a look at this chart before you invest in a retailer who doesn’t have a profitable online operation up-and-running.

As a society we’re becoming more comfortable with buying everyday items on the internet, which means we’re not walking into shops as much as we used to.

Then there’s Sir Frank Lowy offloading Westfield as a ‘top of the market’ play, and a sign that he could see what was coming. Shopping malls don’t look too good when they’re full of ‘To Let’ signs now, do they?

Sometimes it’s the trades we don’t take which stick in our mind.

Your ASX commentator,

–// Craig Amos

PS: I’d be remiss not to give a quick shout out to my old mate Slick with the Penrith Panthers taking on the Sharks this weekend. Go the Panthers!

(feature image via giphy.com)

FULL DISCLOSURE: Neither Elixinol Global nor Myer are Equity Guru marketing clients.