We got a twitter DM a while back from a shareholder of battery tech company and EG marketing client Nano One technologies (NNO.V). This person was of the “true believer” archetype. They’ve bet on the future of energy tech, and are bullish on the sector and comfortable with NNO’s position in it. They’re betting that this $110 M (at the time) battery research company out of Burnaby would soon create tech that is integral to an exploding energy storage market. And they weren’t getting “impatient,” per-se… just sort of checking their watch.

NNO.V having dropped 17% on about 10x their average trading volume the week prior may have given them that pit-of-your-stomach feeling that happens on roller coaster drops, so our twitter follower was, y’know… just asking.

Our reply to the April 12th DM was that we weren’t aware of anything in particular or different going on at Nano. The stock rallied inter-drop on that April 6th sell-off, bouncing off its low and absorbing the selling, then smoothed out over the next few days. So we saw no fundamental or technical reason to change our mind about the company. Swings like that are bound to happen. This is small cap. Conversely: this is small cap. We reminded the shareholder that markets run on news, and Nano hadn’t been giving us much to read.

We got our Nano News on Thursday, and the market liked what it saw. It’s easy to forgive thin news flow for a company that really delivers when it publishes.

Background

Nano’s angle in battery research is to enable the building of these batteries with proprietary High Voltage Spinels, making them cheaper, and capable of higher output, while also giving them a higher rate capability (the number of times a battery can be depleted and re-charged before losing capacity). It’s an obvious approach from an engineering standpoint, but a clever approach to venture growth. Capacity gets all the attention, but manufacturers are bound to be interested in service life. If a company sells an electric car that won’t hold a charge after two years, it’ll be the last one that company sells. We learned in January that the company is collaborating with a top-tier auto company on the creation of advanced electrodes that make EVs more commercially viable.

The people at Nano haven’t called me since last September when I called them “lab rats,” but they may not have understood that I meant it as a term of endearment. The context in that post was that research engineers are a frugal bunch which makes them well suited to get the most out of every shareholder dollar and protect the equity. The general criticism of tech-heads as leaders in pubcos is that they’re prone to produce news that practically has to be run through google translate to be understood and creates more confusion than confidence. This often can’t be helped in companies who are working in advanced materials, but there’s a way to do it right and Nano has it down to a science in this April 19th release. Someone should put this in a textbook. Let’s break it down.

Anatomy of A Tech Press Release Done Right

Nano kicks it off by straight up telling us what the tech is and what it’s used in. It’s “stabilizes cathodes for use in advanced lithium ion batteries,” and they’ve applied for a patent. Anyone who didn’t skip the chem class where they explained cathodes and anodes is with us so far.

From there, the company’s principal scientist Stephen Campbell – Dr. Stephen Campbell – starts the explanation of why it matters by telegraphing the fact that this company is designing a commercial, industrial process.

“The innovation applies a coating to particles of cathode material without adding steps to our process,” explained Dr. Campbell, “and this reduces degradation and resistance between the cathode and the electrolyte in lithium ion batteries. We are encouraged by the preliminary results of our findings as this could help solve long-standing degradation mechanisms, enable energy dense battery designs, and increase the number of times that a battery can be recharged over its lifetime.”

Nano One Press Release April 19, 2017. Emphasis added.

Talk about knowing your audience! Savvy cleantech investors are quick to red-flag momentum-riding companies who fling around buzzwords (disruption! innovation! green future!) to hit conscious investors where they live. That type of thing is usually good for a bump, but it doesn’t last. This isn’t that, and Nano wants to make sure we know it. The Company has reasonable, achievable, high-value commercial goals, and they’ve explained them to us in plain English by the time we’re done paragraph 2. It’s a summary, but not a dumbing-down. In our experience a little bit of respect for the reader’s intelligence can go a long way.

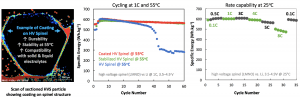

They follow that up with a cross section of the spindles the coating and some charts.

We’re going to have to take their word for the picture of the spinel coating, but readers know we love a good chart, and these don’t disappoint.

The middle chart is clear: Coated and stabilised versions of their spinel do not suffer the energy mass drop-off that we see in their un-coated counterparts after 40 cycles.

The chart on the right didn’t sink in right away, but made good sense once we were made to understand that the C in this case stands for “coulomb”, which is a unit of charge:

Coulomb (C). This is an SI derived unit of an electric charge. The amount of charge that is accumulated per second of a 1 amp current is measured as 1 coulomb (C). This measurement was named after Charles-Augustin de Coulomb, another French physicist.

thanks to upsbatterycenter.com for the definition

The chart has the battery using the Nano coated spinel holding less specific energy, but re-charging considerably faster than its lithium counterpart leading up to the 30th cycle.

The release goes on for another paragraph about the importance of this coating process to the development of high-voltage cathodes and their collaboration with European and Asian auto and auto parts companies and, in a fit of pure genius, gives us permission to stop reading.

A detailed and technical explanation of the opportunity is provided below.

This makes everyone happy. The heads who want to know what’s going on here hold off on the angry emails, because they get what they want, raw and uncut, without it having to be diluted for investors. The studious or information-inclined who want to plod through it with a technical dictionary or their old physics textbooks can have at it. And the rest of us got the goods right off the top. No searching through it or piecing it together, and we don’t even have to pretend that we read it!

We did read it and it is interesting, and not too hard to follow. It goes into the potential of the company’s High Voltage Spinels to impact all sorts of different types of batteries used in different types of applications, and that the coating is what could really make it happen.

Nano has about doubled in market cap since I called its principals lab rats in September, and they’ve done it through straight one-foot-in-front-of-the-other hard work. If they continue their matter-of-fact approach to dealing with the investing public, we expect that the market will continue to track their pace of IP growth.