It wasn’t a hurricane.

It wasn’t a tornado.

It was more like an Indian Summer.

Sometime over the last year, there was a significant weather change in the blockchain sector: things got over-blown, over-hyped and over-heated.

According to a recent financial article:

If you want a quick boost to your company’s share price, adding “blockchain” to your name will work – at least for a while. The average share price of such companies has risen more than threefold since such name changes, according to Reuters data, with experts comparing the practice to a similar rush during the dotcom bubble.

In the last 12 months, the share price of Hive (HIVE.V) fell from $5.37 to $1.37, while the share price of Riot (RIOT.NASDAQ) fell from $29 to $7.

Amongst the carnage of pretenders, good companies are emerging – alive and well – and starting to generate revenue.

HashChain (KASH.V) is one of those companies.

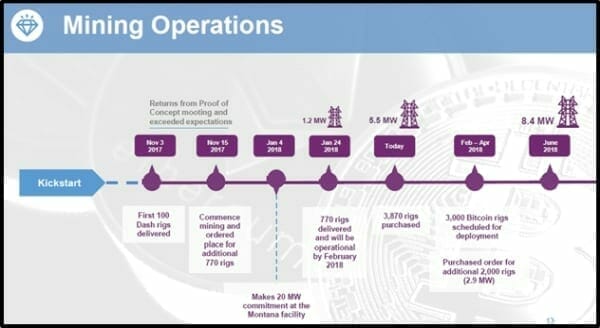

On January 4, 2018 HashChain announced that it has secured a space for mining operations of up to 20 megawatts in Montana, USA, while signing a purchase order for 5,000 cryptocurrency mining rigs (“Rigs”).

The CEO Patrick Gray is a blockchain wizard who sold his first tech start-up to Xerox for $220 million, and later became the youngest executive in Xerox’s history, leading a team of 35 developers in the Xerox Litigation Services division.

Gray is a “company-builder” – not a “market guy” – which is a good thing.

The Blockchain sector doesn’t need promoters, it needs innovators.

HashChain is a diversified blockchain company with three divisions.

- Tapping low-cost North American power, cool climate and high-speed Internet to maximizing the number of mining ‘wins.’ HashChain currently operates 100 Dash mining Rigs, 770 Bitcoin Rigs, and has purchased an additional 3,000 Rigs. Once all Rigs are operational HashChain will consume about 5.8 megawatts of power.

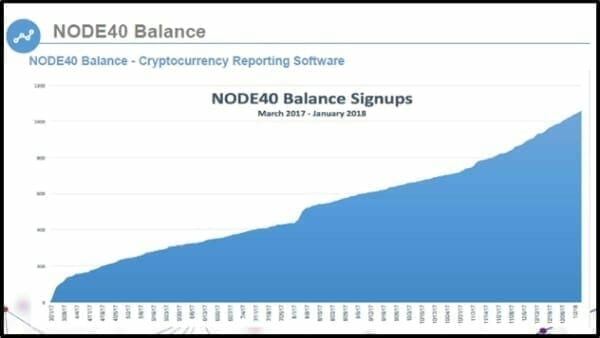

- HashChain acquired assets of NODE40, a blockchain technology company that developed NODE40 Balance, a new SaaS product making cryptocurrency tax reporting simpler and more accurate. The solution allows cryptocurrency users and traders to accurately report their capital gains and losses.

- NODE40 is also one of the leading masternode server-hosting providers for the Dash network and is seeking additional alternate coin masternode hosting.

The purchase of the NODE 40 business is part of HashChain’s move to diversify its business beyond cryptocurrency mining with additional blockchain-based solutions.

On March 13, 2018 HashChain announced that its Balance cryptocurrency accounting software, adds support for Gemini, a rising digital asset exchange that spans multiple wallets of digital currency holders.

Balance is a Software-as-a-Service (SaaS) offering that allows cryptocurrency users to meet tax requirements in their respective countries by analyzing the blockchain to report capital gains and losses for Bitcoin, Bitcoin Cash, Ethereum, Litecoin and DASH.

This space is about to get hot.

The IRS addressed digital currency transactions in Notice 2014-21 – which states that virtual currency is “treated as property” for federal tax assessments

Cryptocurrencies such as Bitcoin can be classified as business property, which means taxpayers must declare gains and losses on transactions.

Similar noises are coming out of the UK.

According to an article in The Guardian,

“The rollercoaster ride for some cryptocurrency investors could be about to take another tax-time lurch, as the taxman looks for his share of transactions made using bitcoin and its like. Wild fluctuations in the value of digital currencies have exposed investors to tax bills.”

Right now, it’s a bit of a shit show.

The IRS and it’s UK counterpart, really don’t know how to track small purchases made in Bitcoin.

But if you think the tax collectors are about to apply a blanket capital gains tax exemption to a massive growing class of investments – you’re crazy.

Balance supports blockchain transactions created with software wallets where it calculates the value of each transaction, tracking the cost basis and the number of days the investment was held.

It’s a nifty piece of software which spits out a user-friendly spreadsheet that can be shared with your accountant.

Gemini is a licensed digital asset exchange that allows customers to execute transactions in Bitcoin and Ether digital currencies. It complies with New York Banking Law.

Users can now download raw transaction data from their Gemini account as a spreadsheet and upload the file directly into HashChain’s Balance software.

The integration is designed to support any digital currency Gemini might add in the future.

On March 8, 2018, HashChain announced the deployment of 770 mining rigs – bringing Kash’s total number of operating Rigs to 870, and a total of 1.23 megawatts (MW) towards cryptocurrency mining.

Another purchase order for 3,000 Rigs has been completed. The first 2,000 rigs are expected to arrive in the next two weeks, followed by 1,000 more at the end of April.

Upon deployment of all the 3,000 purchased Rigs, HashChain will have a total of 3,870 Rigs in operation and be mining with approximately 5.8 MW of power.

“The agile deployment of the 770 Rigs highlights HashChain’s commitment to executing on its stated strategy to scale mining operations,” stated Gray, “This is a key step toward realizing the Company’s goal of operating at 5.8 megawatts by the middle of 2018.”

HashChain has remained focused on expanding its mining operations and diversifying its business

“Our investments in large volume mining ideally located, software that aids crypto investors in navigating an impending regulatory environment, and masternode businesses place the Company in a strong position to deliver on our goal of expanding Hashchain’s scope of blockchain based businesses.”

A year ago, KASH was trading at $1.75.

You can buy it now for .31.

No-one enjoyed that slide.

The current market cap is $33 million.

Many companies with “blockchain” in the title have been exposed without a viable business, customer base, or proof-of-concept.

Hashchain is not one of them.

After a long brutal winter of blockchain discontent, it is still alive, healthy and growing.

Full Disclosure: HashChain is an Equity Guru marketing client, we also own stock.