“No Deadline” for Tariff Man

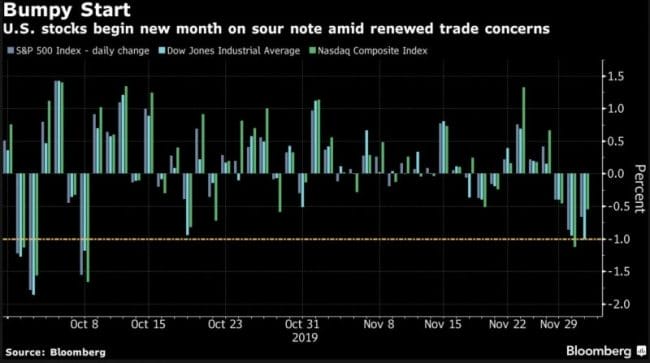

Stocks dropped and bonds rallied in global markets shortly after President Trump fired his tariff weapon to France and Latin American Countries yesterday, and announced today that there is “no deadline” for reaching a trade deal with China. He added that he liked “the idea of waiting until after the election” to reach a deal

The news came in as a shock to investors who have already priced in the optimism regarding the deal with China, as a result, gains began to erode quickly. Tuesday’s losses also appeared to factor in Mr. Trump’s threat to expand tariffs beyond imports from China.

Dow fell by 280.23 points to 27502.81, S&P 500 declined 20.67 points, to 3093.20, and Nasdaq lost 47.34 points, to 8520.64.

Here’s the irony, for a man who keeps tweeting about the all-time highs of the stock market as a direct result of his presidency told reports today that today’s losses were “peanuts”, and that he prefers to follow unemployment figures, which have remained strong most of the year.

“I don’t watch the stock market,” Trump said. “I watch jobs.”

Alphabet leaders step down

Google founders Larry Page and Sergey Brin are stepping down as leaders of parent company Alphabet Inc., ending day-to-day involvement in the firm. Sundar Pichai, current CEO of Google, will now be running Alphabet. Page and Brin will still be controlling shareholders and stay on the board.

With great power, comes great responsibility, and Pichai will now be responsible for the conglomerate’s vast array of services and investments that range from self-driving cars to new healthcare technology. Google also acquired AI and deep learning startup DeepMind recently this year, investing heavily in the future of algorithms to improve the firm’s main search and advertising business.

“We are deeply committed to Google and Alphabet for the long term, and will remain actively involved as board members, shareholders and co-founders,” Page and Brin wrote. “In addition, we plan to continue talking with Sundar regularly, especially on topics we’re passionate about!”

The stock closed at $1,294.74, up 24% this year.

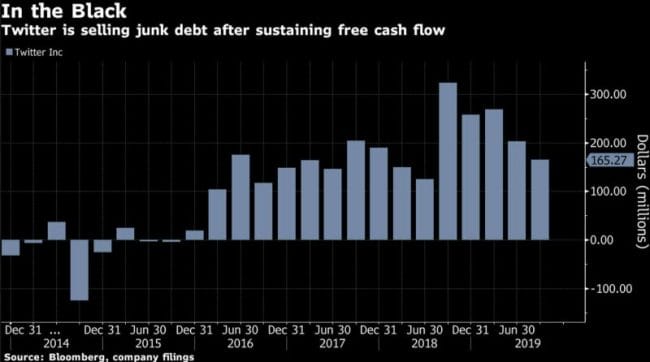

Twitter gets into Junk Bonds

Twitter has announced that it will be marketing its first-ever sale of unsecured bonds, aiming to raise $600 million as the firm attempts to recover from a disappointing third quarter.

Early guidance from a JPMorgan Chase & Co.-led underwriting group is that the eight-year bonds could carry an initial yield of around 4.5%.

Revenue rose 9% from a year earlier in the last quarter, the firm’s smallest annual increase since late 2017, below analyst estimates.

If you’re an equity investor, you might be bullish on a certain stock because you believe in its growth potential than its ability to make profits, and we’ve seen this in the case of Tesla, Beyond Meat, and ride-hailing giants like Uber and Lyft.

For debt investors, especially junk bond traders, the equation is about profits. As of Sep. 30, the firm had about $5.8 billion of cash and short term investments, and the firm would have more cash than debt even after issuing new bonds. So why issue debt?

This is interesting because its a strategy not usually adopted by firms with free cash flow. Twitter boasted $865 million in positive free cash flow last year, where firms like Netflix still aren’t profitable. But both are similar in that they are raising money by issuing junk bonds.

In a low-interest-rate environment, raising capital via debt is cheaper over issuing new equity, but the question is – why would Twitter do that? One possible answer is that the firm recently announced that it would ban political ads before the coming elections, and might be anticipating a decreased revenue in the upcoming quarter.

The world of social media is a dynamic landscape where profitability is largely dependent on the advertising revenue a firm can bring in, which in turn depends on how popular the platform is. With Facebook and Snapchat already established giants, and emerging firms like TikTok boasting aggressive user growth, Twitter has to fight for every new user.

Another answer then could be that even though Twitter isn’t a cash-burning capital intensive startup like Tesla, it could use the money to invest in growth or to pay back older investors. This makes more sense because, in the worst instance of a sharp drop in revenue for a quarter (or a year), the cash will give the firm breathing room, while reducing its liabilities on high-yielding, secured bond offerings.

The stock closed at $29.97, down 1.48 %.