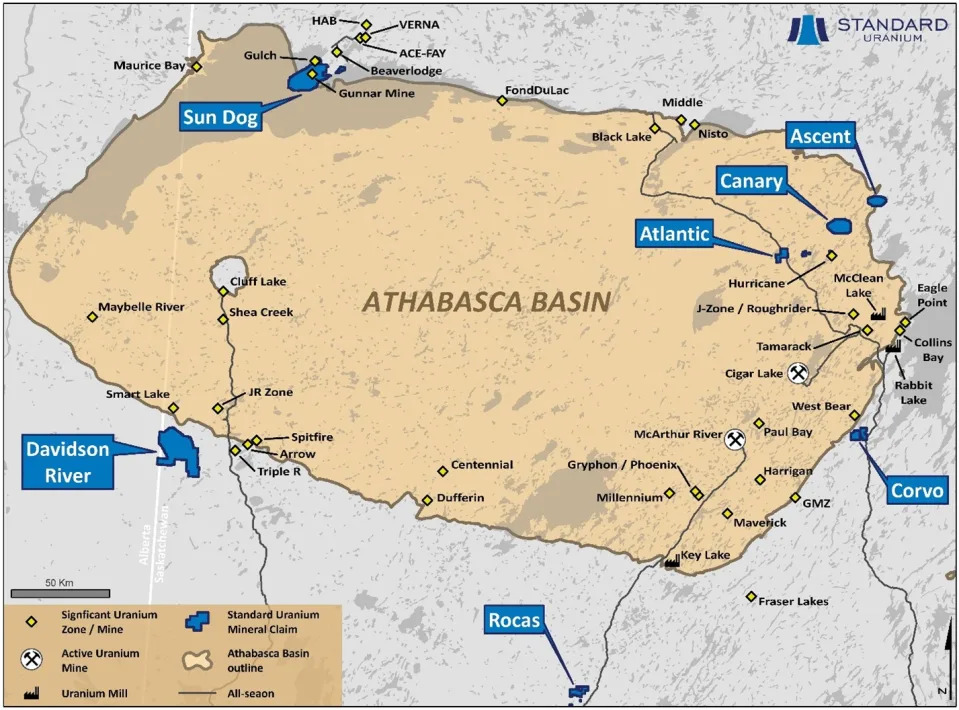

Standard Uranium (STND.V) is a junior uranium explorer operating in the Athabasca basin in Saskatchewan, Canada. The Company holds interest in over 187,542 acres (75,895 hectares) in the world’s richest uranium district.

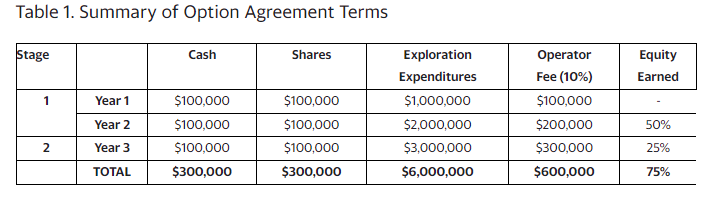

During the first stage, the Optionee can earn a fifty-percent (50%) interest in the Ascent Project by: completing cash payments totaling $200,000, arranging for the issuance of $200,000 worth of shares to the Company, and incurring $3,000,000 of expenditures, which must be completed within two years of the Option being exercised.

Stage Two starts immediately upon Summit earning a fifty-percent interest in the Project. During the second stage, the Optionee can increase their interest in the Ascent Project to seventy-five percent (75%) by completing a further cash payment of $100,000, arranging for the issuance of a further $100,000 worth of shares, and incurring an additional $3,000,000 of expenditures, which must be completed within a year from the commencement of Stage 2.

If within five years of completing the second stage, a bankable feasibility study on a defined mineral resource is completed, the Optionee has the option to acquire the remaining 25% interest in the Ascent Project by making a payment to the Company equivalent to the value of the remaining 25% interest, with such value determined by an independent third party.

Jon Bey, CEO and Chairman, commented “We are pleased to announce our third option agreement since transitioning to a project generator in July 2023. The Company now has over 22 million dollars committed to our exploration programs over the next three years. Heading into the 2024 exploration season, we will have a minimum of six exploration programs underway with four of those being drill programs at Sun Dog, Canary, Ascent and Davidson River projects. 2024 is shaping up to be our most exciting exploration year to date.”

The Company’s Ascent project is situated in the Mudjatik geological domain where several recent discoveries have been made, including IsoEnergy’s Hurricane deposit to the southwest, and is significantly underexplored relative to adjacent magnetic low/electromagnetic (‘EM’) conductor corridors. Additionally, due to the Project’s location on the eastern margin of the Basin, Ascent possesses the potential for discovery of shallow unconformity-style and basement-hosted uranium mineralization.

A critical zone is being tested on the charts. This is happening at a major support zone around the $0.045 zone. A break and close below this level would result in a drop back down to $0.02. However, the bulls are stepping and and defending this support as they have been doing so lately in the last few days and weeks.

A move higher could take us back to testing the downtrend line. A close above this downtrend line is what would get the stock going for a retest of the $0.10 zone.