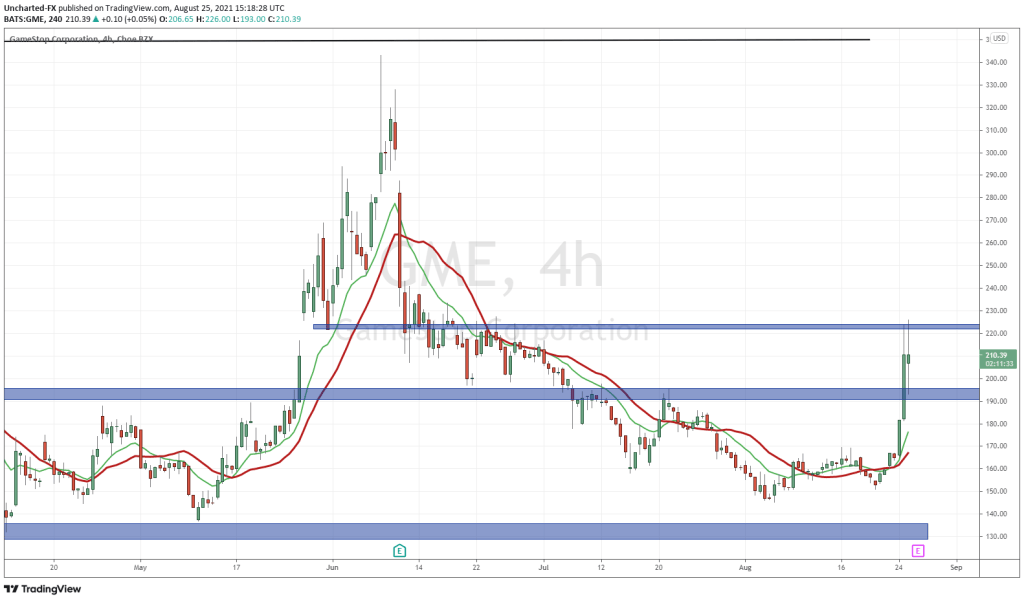

In the world of investing, history often repeats itself, but not always in the ways investors hope. The recent surge in GameStop’s stock price, ahead of its upcoming quarterly financial report, is a vivid reminder of this adage. As of late November 2023, GameStop’s shares have experienced a nearly 20% jump, reaching a two-month high. This increase is largely driven by retail traders, buoyed by a general market recovery and hopes of peaking U.S. interest rates. But beneath this veneer of optimism lies a sobering reality.

GameStop, once a staple in the gaming retail industry, is showing signs that echo the trajectories of companies like Blockbuster, Nortel, and AOL – businesses that once thrived but eventually faded into obsolescence. Despite the recent speculative rally, GameStop’s shares are still down 27% this year. This decline is a stark indicator of the company’s struggle to stay relevant in an industry rapidly transitioning to digital platforms.

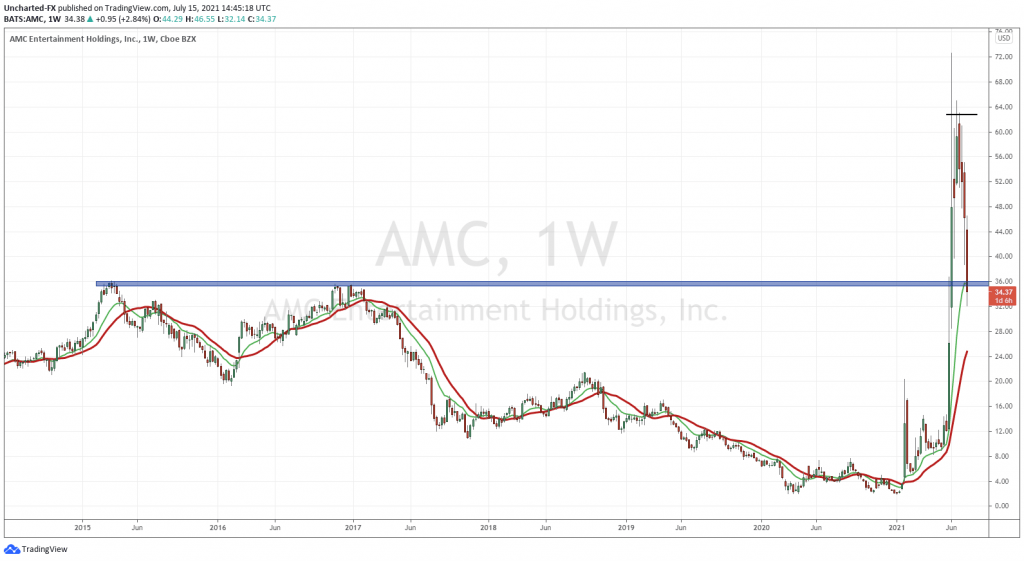

As such, in 2021, the company was made the target of aggressive institutional short sellers. The infamous GameStop short squeeze, as it became known, was a dramatic episode in financial history, highlighting the complexities and imperfections of financial markets. It began with retail investors, leveraging platforms like Robinhood and organizing on forums like Reddit’s WallStreetBets, driving up GameStop’s share price to counter heavy predatory short positions by institutional investors like Melvin Capital. This action exposed not only the vulnerabilities in the market but also the problematic nature of speculative trading and market manipulation.

The whole conflict between Main Street and Wall Street culminated on January 27, 2021 when the “stonk” climbed to $354.83 per share after getting a pat on the back from Elon Musk, one of the biggest market manipulators in social media. Robinhood, exposing itself as a greedy shill for Wall Street money and NOT the public advocate for democratized investment, restricted the purchase of GameStop shares on its platform January 28th, setting the inevitable in motion causing the SP to drop to $112.25 before market close.

Not a straightforward victory for retail investors. Many of them, lured by the hype and potential for quick profits, found themselves “holding the bag” when Robinhood shut off GameStop buying. This situation exemplified a recurring theme in financial markets: the misalignment of interests and the perils of speculative trading. Despite the initial success in pushing back against institutional short-sellers, the retail investors’ victory was short-lived.

The GameStop event also underscored the regulatory complexities surrounding financial markets. While existing regulations are dense, they often fail to protect investors effectively. The reaction from regulators and politicians was marked by calls for investigations and additional regulations, but these were often vague and did not address the core issues at play. Furthermore, the situation highlighted the limitations of regulatory interventions in real-time market dynamics and the challenges in safeguarding the interests of individual investors against market manipulations.

The company has stumbled forward since. Roaring Kitty, who started the whole movement, took his money and run from public eye, but sadly, retail investors still cling to the hope that the video game and computer accessory retailer will somehow pull itself out of the fire, soar to previous heights and defy reality indefinitely. This fantasy was further fueled when the company announced a 4-1 stock split back in June 2022 with a promise by management that its expansion in TVs and computer accessories would keep it in the black.

I wonder if GameStop’s C-Suite are familiar with Best Buy, you know, that $15.43 billion USD consumer electronics juggernaut. Best Buy pulled in $46.3 billion USD in fiscal 2023, netting $1.42 billion in income. The undeniable retail giant captures an estimated 20.4% of the total retail consumer electronics industry revenue. GameStop? Well let me tell you…

GameStop’s revenue was was listed at $1.16 billion for Q2 2023, marking a year-over-year increase of just 2.4%. While this exceeded analysts’ forecasts, it’s critical to note that such a marginal increase is not a robust sign of a turnaround and nowhere near a level that would make Best Buy shiver. A significant part of GameStop’s revenue bump came from strong software sales, likely due to major game releases like “The Legend of Zelda: Tears of the Kingdom”. However, these are sporadic events, not sustainable growth strategies.

More concerning is the drop in revenue from collectibles, which fell by 23.9%. This decline is indicative of deeper issues within the company’s business model. GameStop’s reliance on physical sales in an increasingly digital market is a critical vulnerability. The modest improvements in hardware sales and some reductions in operating costs do little to offset the fundamental challenges facing the company.

Investors optimistic about GameStop might point to its slight improvement in operational cash flow and EBITDA. However, these improvements do not change the underlying narrative. The transition away from physical to digital in gaming is a trend that GameStop seems ill-equipped to navigate successfully. Its foray into cryptocurrency, a venture that is being wound down due to regulatory uncertainties, is a testament to the company’s struggles to find a new and sustainable path forward.

Blockbuster flailed about until the bitter end under the delusion that somehow they could escape time, space and reality. They suffered from hubris and failed to adapt to a rapidly growing digital content market. GameStop’s current trajectory appears to be heading in a similar direction. The company’s recent stock price rally, fueled by speculative trading and not by fundamental business improvements, is a risky gamble for investors. As observed by market analysts, despite better-than-expected performance, the long-term outlook for GameStop remains dim, with the company far from being fairly valued.

Investors plunging their savings into GameStop are taking a dangerous gamble, betting on a company whose best days appear to be behind it. While the allure of quick gains from meme stock rallies is tempting, the history of the stock market is littered with cautionary tales of such gambles. As GameStop prepares to release its quarterly report, investors would do well to remember that not every resurgence heralds a comeback. Sometimes, it’s just a fleeting glimmer in the twilight of a once-great giant’s era.

–Gaalen Engen