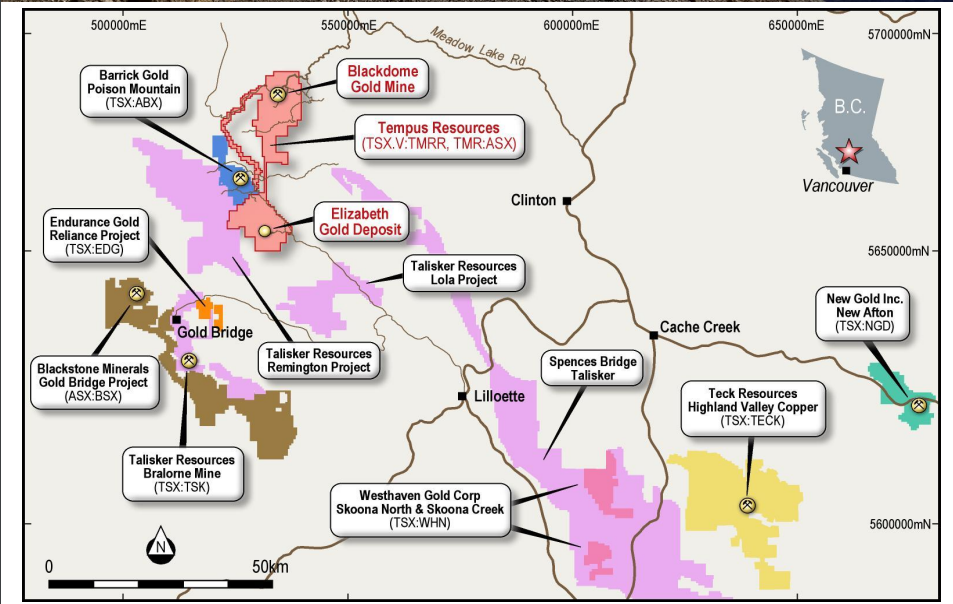

Australian-based Tempus Resources (TMRR.V, TMR.AX) is evaluating and exploring projects in British Columbia and Ecuador. In recent months, Tempus has had a focus on the flagship Elizabeth Gold Project in British Columbia.

Two press released from the Company today. The first deals with assay results from a rock sampling program completed at the Elizabeth Gold Project in July 2023. The Company also provides an update on the progress of work on its updated NI43-101/JORC resource estimate for the Elizabeth Project in British Columbia.

Assay results highlight the potential for two new areas that are prospective to host gold vein mineralization.

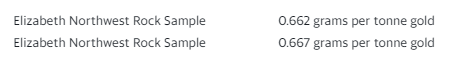

Fourteen rock samples were taken from an area to the northwest of the Elizabeth Main zone. The samples were collected within a protruding erosion-resistant outcrop which is the upper projection of Listwanite vein. Two rock samples returned anomalous gold assay results:

Three historical drill holes (E04-01, E04-03 and E04-05) indicated presence of a gold-mineralized vein structure on this area, now being called as the Listwanite Vein.

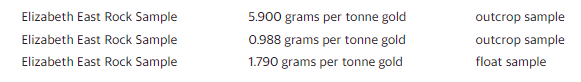

Tempus took 55 rock samples across the Elizabeth East anomaly area. Three rock samples returned anomalous gold assay results:

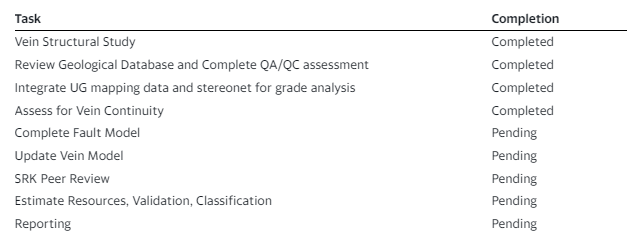

In terms of the Elizabeth mineral resource estimate, SRK Consulting continues to work on the updated resource estimate. There are a number of workstreams to be completed for the updated resource estimate including:

Tempus expects to have its updated Mineral Resource estimate complete in October. A major upcoming catalyst for the share price.

The Company also announced it has executed a binding Heads of Agreement giving it an option to acquire 100% ownership of Aurora Lithium, a private company that holds the applications for certain mineral claims including the Cormorant Pegmatite Field and the White Rabbit Lithium Prospect located in central Manitoba.

The Cormorant and White Rabbit projects are located in a newly emerging lithium district in central Manitoba defined along the Flin Flon – Snow Lake greenstone belt which extends over 250 km in length and approximately 75 km wide. The district is emerging as a new lithium belt in Manitoba and has attracted several other companies including Leeuwin Metals (ASX:LM1) with two projects in the area including the JenPeg/Cross Lake Lithium Project, located 40 km to the south of the White Rabbit Project.

Tempus Resources President and CEO, Jason Bahnsen, commented, “The Option over the White Rabbit and Cormorant lithium projects provides an excellent opportunity for Tempus to diversify its asset portfolio and enter the energy metals sector. The geological setting, historic drilling with wide pegmatite dyke intersections and proximity to other high grade lithium projects bodes well for the exploration potential of the projects. With good infrastructure and all year access, Tempus plans to explore the White Rabbit and Cormorant Projects concurrently with the Elizabeth-Blackdome gold project.”

The White Rabbit Project, with a total claim area of approximately 70 km2, is located adjacent to major railway and power infrastructure with year around road access. The project is located approximately 40 km north of the Cross Lake community and approximately 100 km southeast of the mining centre of Thompson, Manitoba.

The White Rabbit mineral claims have not yet been granted. Applications for the White Rabbit mineral claims were filed in July 2023 and are being processed by the Manitoba Economic Development and Trade. Processing time for the granting of new mineral claims varies but is expected to take several months.

The White Rabbit Project is located 40 km to the north of the Cross Lake Project owned by Leeuwin Metals (ASX: LM1), where multiple, sub-parallel spodumene bearing lithium, caesium, tantalum (“LCT”) pegmatites of up to 20 m in thickness and strike lengths of over 400 metres with assay grades +1% LiO2 have been identified.

The Cormorant Project, with a total claim area of approximately 187 km2, is located adjacent to major railway and power infrastructure with year around road access. The town of The Pas, with a population of approximately 5,000 people, is 40 km to the southwest and is a regional centre for workforce plus construction, mining and engineering services.

The Cormorant Project mineral claims have not yet been granted. Applications for the Cormorant Project mineral claims were filed in July 2023 and are being processed by the Manitoba Economic Development and Trade. Processing time for the granting of new mineral claims varies but is expected to take several months.

Bedrock geology indicates pillowed to massive mafic volcanic rocks in contact with granite bodies. Historic drilling confirms key structural trends associated with favourable LCT pegmatites in close proximity to granitic bodies.

The project has been subject to seven historical exploration drilling campaigns between 1975 and 2006. All historic drilling on the project was focussed on the identification of base metals with no assays completed for lithium and associated elements that were focussed on the discovery of base metals (no assays for lithium). Twenty historic core drill holes have been identified on the current Cormorant Project license areas.

Tempus has obtained the drill logs for six of the historic drill holes which indicate the presence of intersections of pegmatite mineralisation up to 33 metres in thickness.

Under the terms of the option agreement with Aurora Lithium, Tempus has until 30 October 2023 to complete due diligence. Tempus geologists visited the White Rabbit and Cormorant projects during the period from 10th to 15th of September, to conduct initial due diligence. The Tempus geological team was able to physically inspect the core for drill hole 180-02 that is stored by the Manitoba Geological Survey (MGS) in The Pas, Manitoba. Tempus is in the process of requesting a permit to assay sections of the core from drill hole 180-2.

Tempus is currently reviewing the historic exploration information on the projects and the findings from the site due diligence trip. Three rock samples from the White Rabbit project were collected and will be submitted for assay.

- Exclusivity Payment: In exchange for payment of a non-refundable fee of A$25,000 (the “Option Fee”) (paid), the Vendor grants the Company the exclusive right to acquire 100% of Aurora Lithium and the Cormorant Project and White Rabbit Project mineral claims that are currently in the application process with Manitoba Economic Development and Trade.

- Exclusivity Period: On payment of the Option Fee, the Company may exercise the Option at any time until the expiry of the Option Period, being the 30th October 2023.

- Settlement: Settlement under the Agreement will occur on the date that is 5 days after the date of the Company exercising the Option and any conditions precedent (as set out below), or other such date as the parties agree in writing.

- Upfront Consideration: At Settlement, the following consideration is payable by the Company to the Vendor (and/or its nominees):

- 37.5 million fully paid ordinary shares in the Company (the “Consideration Shares”); and

- 22.5 million September 2025 Options (TMRO) at strike price of A$0.075 upon exercise of the Option (the “Consideration Options”).

- Milestone 1 Payment: Upon achievement of 5 rock chip samples with greater than 1.0% LiO2 , the Company shall pay the Vendor 22.5 million performance rights, convertible to fully paid shares in the Company on or before 1 September 2028 (the “Performance Shares 1”).

- Milestone 2 Payment: Upon achievement a minimum of 3 drill holes or 3 surface trenches with minimum pegmatite mineralisation widths of minimum 10 metres with grades greater than 1.0 % LiO2, the Company shall pay the Vendor 22.5 million performance rights, convertible to fully paid shares in the Company on or before 1 September 2028 (the “Performance Shares 2”).

- Royalty: From Settlement, the Company grants the Vendor (and/or their nominee) a 2% gross revenue royalty on all minerals recovered from any of the existing White Rabbit and Cormorant Project mineral claims (the “NSR”). The Company has the option to buy-back 1% of the Royalty for A$1 million for each the Cormorant and White Rabbit Projects at any time from Settlement.

- Conditions Precedent: Subject to exercising the Option, Settlement of the acquisition will be conditional on the Company obtaining all necessary shareholder (including for the purposes of Listing Rule 7.1) and regulatory approvals.

For a deeper dive into Tempus Resources and future catalysts, be sure to check out Chris Parry’s recent article on Tempus Resources and the anticipation of the NI 43-101.

The stock has broken down below major support at $0.04. And the stock has printed new all time record lows at $0.015. Since then, the stock developed a range here with the upside resistance being $0.04. A break of this range would take us back to retest the broken support now turned resistance at $0.04. A close back above this zone would be key for a reversal. The resource estimate could be the upcoming catalyst for the recovery.

It should be noted that an earlier sign of reversal could be a close above the downtrend line that I have drawn. Price is testing the upper limits of the trendline currently. Bulls would want to see a nice strong green candle close accompanied with big volume.