In an impressive display of its rising prominence, Niocorp Developments Ltd. (NB.T) announced yesterday that it is preparing to become a member of the highly esteemed Russell 3000 Index. The announcement, part of the annual reconstitution of the Russell indexes, will take effect on June 26, 2023, following the opening of the U.S. market. This significant development is expected to elevate Niocorp’s global visibility and attract institutional investment firms that track the prestigious Russell indexes.

Established in 1984, the Russell 3000 Index is a vital benchmark that measures the performance of the largest 3,000 U.S. companies, accounting for approximately 96% of the investable U.S. equity market. By securing a spot in this index, Niocorp joins the ranks of industry giants such as Apple, Microsoft, and Meta, whose presence drives the overall performance of the index.

Mark A. Smith, the Chief Executive Officer and Executive Chairman of Niocorp, expressed his excitement for the company’s latest achievement, stating, “Being added to the Russell 3000 is another big step forward for Niocorp, after uplisting to the Nasdaq, and we believe it will significantly raise Niocorp’s global visibility with institutional investment firms that have index funds that track Russell indexes.”

Niocorp Developments Ltd. is currently focused on the development of a critical minerals project in southeast Nebraska. The project aims to extract niobium, scandium, and titanium, subject to securing sufficient project financing. Additionally, the company is exploring the potential to mine various rare earth elements from the Elk Creek project. These critical minerals play a vital role in numerous applications, including high-strength steel, specialty alloys, aerospace components, and advanced fuel cells.

To qualify for inclusion in the Russell 3000 Index, companies must meet rigorous criteria, including maintaining an average daily trading price above $1 and a market capitalization of at least $30 million. Furthermore, the company must have at least 5% of its shares trading on public exchanges, showcasing its commitment to transparency and liquidity.

Joining the Russell 3000 Index not only grants Niocorp automatic inclusion in the large-cap Russell 1000 Index or small-cap Russell 2000 Index but also provides access to the appropriate growth and value style indexes. This expanded exposure opens doors to a wide array of investment opportunities and offers increased visibility to potential investors.

The significance of this milestone cannot be overstated, as the Russell indexes collectively represent over $12.1 trillion in investor assets. Furthermore, an impressive 69% of actively managed U.S. equity institutional assets are benchmarked to a Russell U.S. index. Niocorp’s inclusion in this renowned index is a testament to the company’s progress and the confidence it instills in the investment community.

As Niocorp Developments Ltd. prepares to take its place among the elite U.S. companies in the Russell 3000 Index, its trajectory toward success is undeniably gaining momentum. The company’s focus on critical minerals, coupled with the increasing demand for niobium, scandium, and titanium, positions Niocorp at the forefront of an industry poised for remarkable growth. With enhanced visibility and access to a broader investor base, Niocorp is well-positioned to capitalize on emerging opportunities and further solidify its standing in the market.

In a competitive landscape where market recognition plays a crucial role in sustained success, Niocorp Developments Ltd.’s inclusion in the Russell 3000 Index marks a significant milestone and serves as a testament to the company’s dedication to excellence.

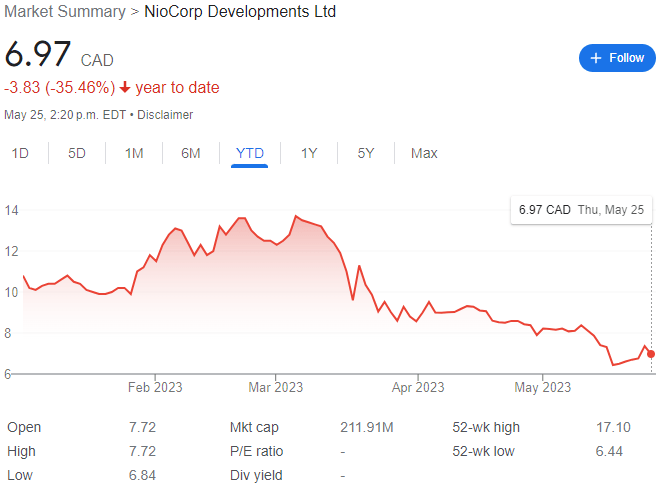

Niocorp temporarily halted trading at opening but is back to trading at $6.97 CAD per share for a market cap of $211.91 million.