When FansUnite (FANS.T) emerged on the public markets, the sports betting and e-sports gambling worlds were nascent, fast moving, full of hype, and mostly confusing places to be. Three years on, they’re not far improved, but FansUnite has managed to plot a decent path for itself in providing B2B services for companies wanting to do business on the consumer side, affiliate marketing, and the occasional bet on global sportsbooks. While their stock price isn’t at highs, they’ve managed to ride the waves well, avoid getting dragged down like so many others, and over time have actually built a strong business.

To be sure, there are a lot of bodies that have floated by them during that time; rotting carcasses that were once full of promise, many with indefensible market caps and stupid money spent financing things nobody wanted, now unable to stay afloat.

FansUnite survived that purge, just plugging away and building things for the bigger fish, with reliable revenues and at low cost.

If there was a criticism to be thrown at the company in 2023, it would have been that FANS was spread thin with too many non-core items, as it has pivoted, evolved, and chased opportunities since inception.

Along with their B2B technology solutions, FansUnite owns multiple B2C brands, such as Scottish sportsbook McBookie and Brazilian esportsbook VamosGG. On the affiliate marketing side, they own theNorth American-focused American Affiliate company, which has multiple affiliate brands, including the No. 1 live activation company, Betting Hero, and established content platform Props.com.

Today, that number reduced by one. Today, FANS cashed in.

FansUnite Entertainment has sold its wholly owned Scottish sportsbook subsidiary, McBookie Ltd., for over $5 million CDN cash.

FansUnite acquired McBookie in March 2020 for $2.2 million CDN in total consideration, including $1 million CDN in cash. Three years later, FansUnite will recognize a significant profit, selling McBookie for more than $5 million CDN in cash, over 7x their record 2022 EBITDA.

For those unacquainted, McBookie is the dominant sportsbook and online casino in that country, and has delivered three consecutive years of revenue growth since FANS came out of the starting blocks with their purchase. Under FansUnite CEO Scott Burton’s direction, McBookie achieved a gross win increase of 451% and a turnover increase of 305%. With the UK’s tightening regulations on gaming operations, selling McBookie now makes life easier going forward.

At a time when the markets aren’t making it easy for companies to raise money, being able to cash out your chips on a solid, growing, but non-core business is a definite win for the Canadian sportsbook and iGaming services company.

The sports betting industry is booming right now but, much like the industry 4 years back saw Draft Kings (DKNG.Q) and FanDuel spending 2x every cent they earned on marketing and customer acquisition during the daily fantasy sports rush, and just as we saw in the online poker industry when those companies did likewise 5 years before that, consumer side sports betting is a game of manic and constant chaos, with massive money raised, and massive money spent just to replace clients lost in ongoing churn.

It’s estimated that the global sports betting market will be worth over $155 billion by 2024, with the US market alone projected to reach $8 billion by the same year, but the amount spent buying market shares – and keeping it – is absurd.

FansUnite decided long ago not to get into that money pit and has figured out the way to thrive is to be a part of everyone else’s set-up, providing odds, games, and services, while selling customer leads to those companies for increasingly large amounts of money.

By selling McBookie, the company is positioning itself for long-term success in the online gaming industry, bulking up its cash position without dilution or debt, and freeing itself to focus harder on those areas where it’s not just growing, but thriving.

In the days when online poker was on seemingly every cable TV sports channel all day, and sweaty guys in hoodies and sunglasses that once inhabited the seedier parts of the red light district, bouncing between illegal underground games were suddenly celebrities, the folks who knew how to get people to sign up to the big sites made millions. The casino operators would offer them cash, chips, women, villas by the pool, trips around the world, and a lot more. What FansUnite has done is take that business and corporatize it, automating much of the process and earning the respect of the larger players by growing their business fast and without slipping fake accounts and conned consumers into the mix.

Now, what their companies are building, is in ever-rising demand and growing revenues should follow.

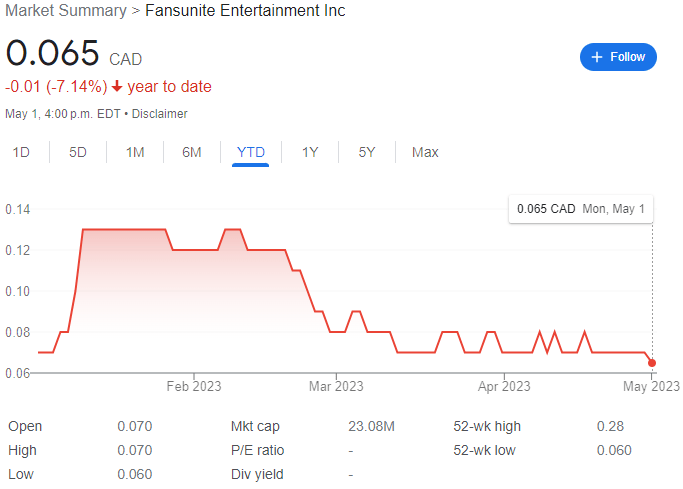

On May 1, 2023, FansUnite traded at $0.065 CAD per share for a market cap $23.08 million.

— Chris Parry

FULL DISCLOSURE: FansUnite is an Equity.Guru marketing client and we are buying in the market