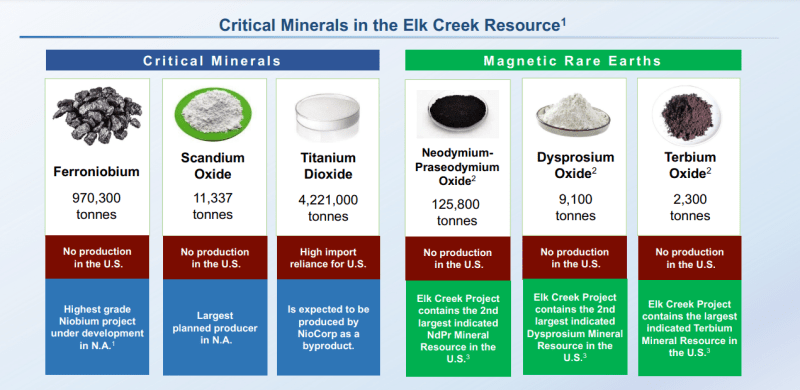

NioCorp Developments (NB.TO) is developing the Elk Creek Critical Minerals Project in Southeast Nebraska. This mine will produce strategic/critical minerals such as niobium, scandium and titanium. Several rare earths will also be produced from this mine. In fact, Elk Creek is the second largest indicated-or-better rare earth resource in the US.

Today, NioCorp announced that it has entered into a definitive agreement with a fund managed by Kingdon Capital Management LLC for the sale of an aggregate of 314,465 common shares in a registered direct offering at a price of $6.36 per share for aggregate proceeds of approximately US $2.0 million.

The Offering is expected to close on or about April 28, 2023, subject to satisfaction of customary closing conditions, including receipt of approval for listing of the common shares on the Toronto Stock Exchange.

NioCorp intends to use the net proceeds from the Offering for working capital and general corporate purposes, including to advance its efforts to launch construction of the Elk Creek Project and move it to commercial operation.

As North America’s only niobium, scandium, and titanium project, NioCorp is poised to become a major contributor to the global supply of these essential minerals. With a strong focus on sustainability, NioCorp’s minerals play a pivotal role in reducing greenhouse gas emissions through their use in electric and hybrid vehicles, renewable energy systems, lightweight transportation, and high-efficiency motors and appliances.

The global critical minerals supply chain is becoming increasingly important as these minerals are essential for numerous modern technologies and industries, including aerospace, defense, healthcare, telecommunications, and clean technologies such as solar panels, nuclear energy, and electric vehicles (EV) batteries and motors. Critical minerals encompass not just rare earth elements but also niobium, scandium, cobalt, copper, precious metals, nickel, uranium, lithium, magnesium, and many others. However, the supply chain is currently facing significant challenges due to geopolitical uncertainties and a lack of diversified sources.

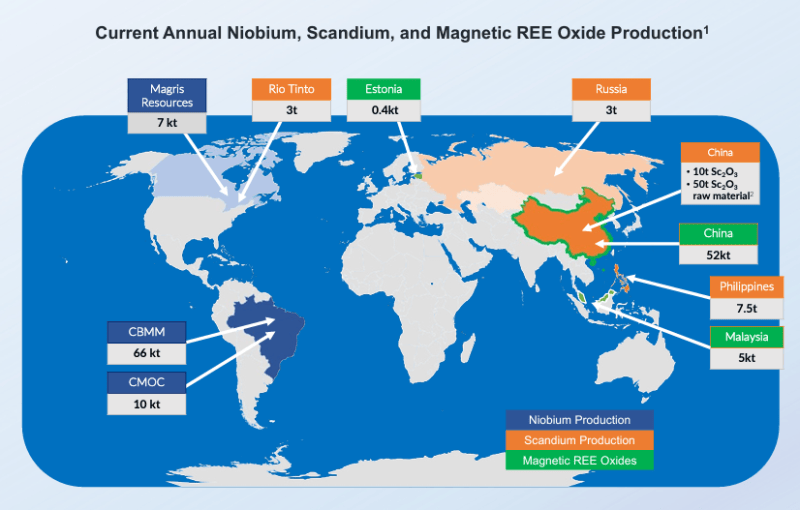

China has long been the dominant supplier of these critical minerals, controlling a majority of their production and distribution. This has resulted in an over-reliance on China for procurement by the rest of the world. G7 Panel on Economic Resilience reports that China accounts for 80% of the US’s rare earth element imports and 98% of the EU’s. This reliance is further exacerbated by the ongoing global chip and semiconductor shortage, as well as the increasing demand for clean technology, which the World Bank forecasts could require up to a 500% increase in the production of multiple mineral and metal inputs.

With the US and China relationship deteriorating, many analysts believe China will use their grasp on rare earths as a weapon. This means the US will want to prioritize rare earth metals security. Just as the events in Eastern Europe have led to energy security, with Europe and other Western nations wanting to secure energy supply and trade so they are not dependent on Russia, the same could be applied here to metals if the China relationship worsens.

NioCorp’s solution lies in the Elk Creek Project, which aims to diversify global supply and provide significant production volumes of niobium, scandium, and titanium from a low-risk jurisdiction. This will create a reliable and meaningful Scandium supply, potentially providing non-Chinese rare earths for the expansion of renewables and electrified vehicles. By utilizing an underground mineral source and environmentally responsible processing, NioCorp offers a sustainable production solution.

NioCorp is traded both on the Canadian TSX exchange, and recently began trading on the US Nasdaq exchange after completing a SPAC acquisition. Both charts and technicals look the same in terms of market structure, the only difference is the price amounts (one in Canadian Dollars, the other in US Dollars).

We have a broad range which the stock is contained within. Upside resistance comes in at the $14.50 zone, while downside support comes in at the $8.00 zone. Support is a fancy way of saying price floor, meaning traders expect buyers to step in at support. If a support level is broken, it is a bearish sign and means further downside is coming.

As you can see from the chart above, NioCorp rejected resistance at $14.50 this year and the price then broke below the previous higher low at $12.00 crossing below the 50 day moving average at the same time. This has led to a deeper move down to our support level.

Traders want to see buyers stepping in here, and we know there are buyers here as evident by the long wicked candle printed on March 21st 2023. Price did break below $8.00, but a surge of buyers stepped in and ensured no close below support and bid the price up back over $9.00.

Ideally, bulls would like to see a strong green bodied candle here, or a candle with a long wick just to confirm buyers are still defending support. Look for the stock to range at this support which would indicate an exhaustion of the current downtrend and the potential for a reversal. New trends tend to kick off at support and resistance levels.

If NioCorp bounces here, I would next watch the $10.00 level. This is an important psychological number and hence provides interim resistance.