Azincourt Energy is a Canadian-based resource exploration and development company focused on the alternative fuels/alternative energy sector. Their core projects are in the clean energy space, with uranium exploration projects in the prolific Athabasca Basin, Saskatchewan, Canada, and lithium/uranium projects on the Picotani Plateau, Peru.

Recently, Azincourt announced it had completed the 2023 exploration program at the East Preston Uranium Project. For more information on this, check out this article. The company considers the drilling results to date to be significant, as major uranium discoveries in the Athabasca Basin such as McArthur River, Key Lake, and Millennium were primarily the result of drill testing of strong alteration zones related to conductor features.

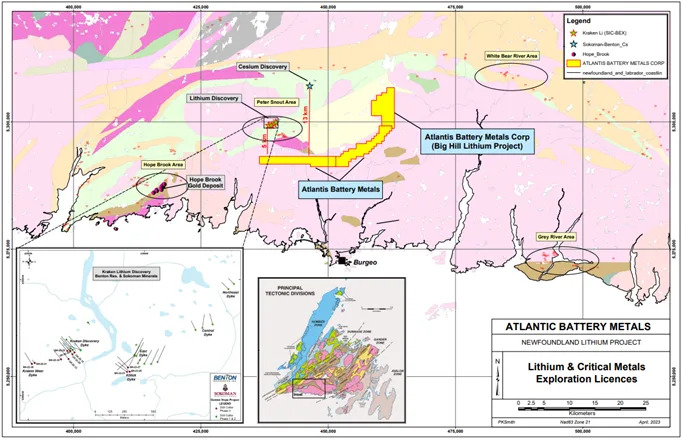

Today, Azincourt announced that it has entered into a definitive property option agreement with Atlantis Battery Metals, to which it has been granted the option to acquire up to a 75% interest in three exploration licenses covering 300 contiguous mineral claims located in the Province of Newfoundland and collectively known as the Big Hill Lithium Project.

The Big Hill Lithium Project is a 7,500-hectare Lithium-Cesium-Tantalum (“LCT”) exploration property located in southwestern Newfoundland, Canada, along the south side of the Hermitage Flexure, approximately five kilometres south of the Benton/Sokoman JV partnership discovery of the Kraken Lithium Pegmatite Field.

The Benton/Sokoman JV partnership has also discovered the cesium-tantalum-rubidium-lithium Hydra Dyke which is located 12 kilometres northeast of the Kraken Lithium Pegmatite Field.

The Kraken Lithium Pegmatite discovery features numerous granitic dykes and unmapped pegmatites in a variety of rock types with a strike length up to 40 kilometres in length. The Big Hill Lithium Property is hosted primarily in the Burgeo granite with large enclaves of older mafic paragneiss.

Recent preliminary prospecting at Big Hill has identified four known target areas. Similar structural elements are observed in the Kraken Lithium Pegmatite field although host rocks differ. These targets are known as the River, Road, MK, and Ridge Targets and will be the focus of the initial exploration.

Initial soil and rock assay results, along with other geological information are expected by mid-June.

“We’re pleased to add this project to our portfolio. The potential at Big Hill is significant,” said president and CEO, Alex Klenman. “The area is underexplored for lithium, and thanks to the highly impactful Kraken find we feel it’s extremely prospective for additional, substantial discoveries. The project has size, numerous priority targets, and the potential for many more. With year-round access this project gives us the ability to be active outside of our normal, limited, winter drilling window at the East Preston uranium project in Saskatchewan.

“The team at the optionor, Atlantis Battery Metals, has extensive exploration success in the lithium space and will provide ongoing technical support. We share the belief that Big Hill is a meaningful exploration opportunity, and their ongoing technical involvement was an important consideration in making the deal. We’re excited to utilize their expertise going forward. Overall, this is a great opportunity for Azincourt, and we look forward to announcing immediate exploration plans in the coming weeks,” continued Mr. Klenman.

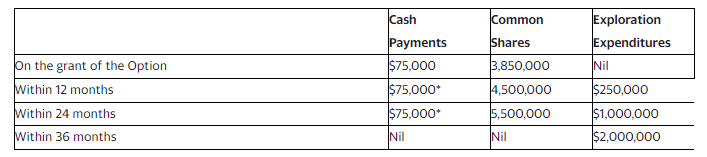

Pursuant to terms of the Option, the Company can acquire a sixty percent interest in the Project by completing a series of cash payments and share issuances, and incurring certain expenditures on the Project, as follows:

The stock has recently broken down and retested previous all time lows tested in 2020 hitting $0.04. In doing so, we have broken below this support which has been holding since 2022 at $0.045. The stock developed a range which saw an intraday break hitting new all time record lows at $0.035.

Uranium itself is weak as I have been mentioning in my recent uranium sector roundups. Until uranium reverses, there will be more downside for uranium stocks.

For bulls of Azincourt, they would want to see a strong candle close back above this support level ($0.045) to confirm a false breakdown. The fundamental catalyst which could see momentum carry through would be drill results expected in May 2023.