In last weeks uranium sector roundup, I highlighted that uranium is at a key technical point. Spot price remains above $50, but the focus should be on other uranium charts. I spotted major breakdowns in all energy commodities. Oil got shaken up with the OPEC+ production cut. While the uranium charts are currently playing out the worst fears for uranium bulls: another leg lower.

Remember: the long term fundamentals for uranium still stand. With world governments wanting to deal with the climate crisis, nuclear energy is going to play an important role being able to handle baseload power and having no CO2 emissions. You can clearly see now that many nations are reversing their stance on nuclear energy, and even being more open to the idea of building more nuclear power plants.

When it comes to the technicals, we can use the charts to jump on trends. For long term bulls, when uranium price is heading lower, it provides a great opportunity to add to our uranium positions or enter into new ones at better prices. Marin Katusa calls this the way of the alligator. Being patient and waiting for a good deal.

I highlighted the Sprott physical uranium trust in that article, where I mentioned that the reversal pattern known as the head and shoulders is still in play. Both the uranium spot price and this Sprott trust are showing the same pattern. This is the chart I like to use as my proxy for uranium price, and because the reversal pattern is still intact, we have more room to the downside.

The neckline I have comes in higher around the $16.35 zone. This is the zone that needs to be taken out before we can flip back to being bullish. We tested my moving average which saw sellers pile in as expected. I would watch to see how this reacts at the $14.30 zone.

The Global X Uranium ETF was one positive I mentioned for uranium bulls last week. We had a double bottom pattern with a break above the $19.60 zone. The retest is currently in play and as you can see from the chart, we are actually back below the breakout zone.

However, this is the daily chart, and at time of writing there are plenty of hours left in trading. The bulls can step in and if we get a close above $19.60, the uptrend remains intact. Otherwise we have a false breakout.

With uranium prices looking to make a leg lower, it would be prudent to look for uranium stocks which have completed their move lower, are ranging, and have the possibility of a fundamental catalyst to get things going. Or put it simply, look for cheap stocks with fundamentals.

Azincourt Energy (AAZ.V)

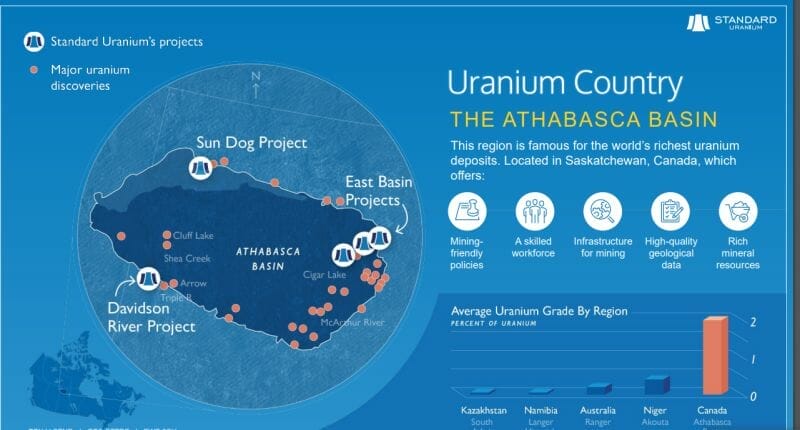

Azincourt Energy is a Canadian-based resource exploration and development company focused on the alternative fuels/alternative energy sector. Their core projects are in the clean energy space, with uranium exploration projects in the prolific Athabasca Basin, Saskatchewan, Canada, and lithium/uranium projects on the Picotani Plateau, Peru.

Recently, Azincourt announced it had completed the 2023 exploration program at the East Preston Uranium Project. For more information on this, check out this article.

The company considers the drilling results to date to be significant, as major uranium discoveries in the Athabasca Basin such as McArthur River, Key Lake, and Millennium were primarily the result of drill testing of strong alteration zones related to conductor features. Identifying and upgrading the strong alteration zones is a significant step forward in identifying the key areas along the conductor trends where more attention is required.

A total of 687 samples were collected throughout the program and sent to the Geoanalytical Laboratory at the Saskatchewan Research Council in Saskatoon, Saskatchewan for analysis. Results are expected to start arriving in May.

This is the upcoming catalyst.

The stock has recently broken down and retested previous all time lows tested in 2020 hitting $0.04. In doing so, we have broken below this support which has been holding since 2022 at $0.045. The stock is now in a range.

Bulls would want to see a strong close back above this support level ($0.045) to confirm a false breakdown. The fundamental catalyst which could see momentum carry through would be drill results expected in May 2023.

Note that my moving average is now testing the current price. A close above $0.045 would also take us above this moving average giving us two bullish confluences.

Standard Uranium (STND.V)

Standard Uranium announced that the Winter drill program at its 100% owned Sun Dog Project has been completed. The Sun Dog project boasts all the favorable characteristics to host a high-grade, Athabasca-style unconformity-related uranium deposits, and the results of the second drill program on the project have strengthened the validity of the exploration model.

Priority follow up targets are being planned as geological data from the winter 2023 program is processed and interpreted. Continuing exploration plans for the project include a supplementary bedrock mapping and sampling program in Q3 2023, leading into a possible follow up exploration drill program in fall 2023.

Some highlights from this program includes:

- Elevated radioactivity over a total of 1.5 metres up to 1,300 counts per second (cps)* intersected in drill hole SD-23-013 at the Haven discovery.

- Significant structure and alteration intersected in drill holes SD-23-011 and SD-23-012 at the Walli showing, including dravite-clay alteration halo associated with oxidized fault breccia and shear zones.

- Winter 2023 drilling intersected several characteristics of a uranium-bearing mineralized system in previously untested target areas, extending the known footprint of dravite and clay alteration associated with uranium mineralization in the Haven and Walli target areas.

Just like Azincourt Energy, Standard Uranium broke below a major support zone at $0.06, and printed new all time record lows at $0.045.

The stock is now currently ranging while uranium looks to make another leg lower. Bulls want to see a breakout of this range which would coincide with a close back above $0.06 and also coincides with a moving average cross over.

Both of the stocks mentioned have the same technicals and are just a few cents away from confirming a range breakout and a support zone recovery. The moving average catching up with the price also hints at a major technical move about to play out. Keep these stocks on your radar.