Beyond Minerals (BY.CN) engages in the acquisition, development, and exploration of mineral property assets in Canada. The company primarily has a focus on Lithium, a commodity with great fundamentals given the increasing demand for Electric Vehicles. It holds a 100% interest in the Eastchester-Fabie-Trudeau property, which comprises 37 non-contiguous mining claims located northwest of Rouyn-Noranda, Quebec.

The Property consists of 37 mineral titles in three separate blocks. . All mineral titles were acquired by map designation under the Mining Act and are recorded 100% to Beyond Minerals Inc.. The Company obtained the Property through a transfer agreement with Reyna Silver Corp. (TSXV: RSLV) whereby 100% of the Property was acquired in exchange for 1,000,000 shares of the Company and a 1.0% NSR production royalty. There are no other underlying royalties registered against the mineral titles .

A two-phase exploration program was recommended to identify, prioritize and test exploration targets on each of the three claim blocks with an emphasis on the Fabie block. Phase I of the proposed program will consist of surface work including data compilation and digitization, airborne MAG and TDEM geophysical surveys, prospecting and sampling on all three blocks, and a soil geochemical survey over the existing grid, trenching and structural mapping at the Lac Fabie Nord and Fabie NW showings on the Fabie block. Phase II will consist of drilling on the Fabie block. The proposed expenditures, including 10% for contingencies, are estimated to cost in $155,320 for the first phase of exploration and $247,500. Phase II is contingent upon positive results obtained in Phase I. Assuming both phases are fully completed, the total estimated cost is $402,820.

This is the upcoming catalyst for the stock.

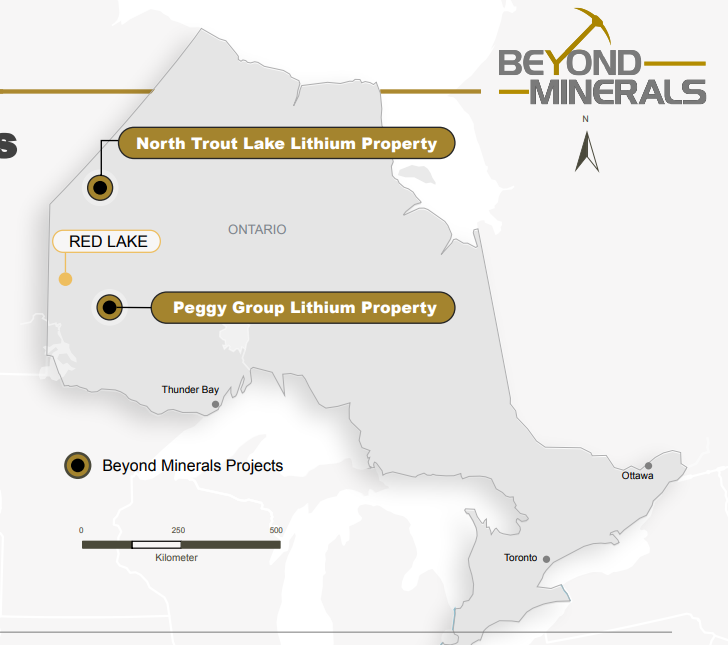

Recently, Beyond Minerals announced the acquisition of a 100% undivided interest in the 179 contiguous mining claims covering approximately 3,490 hectares (34.9 km2) comprising the North Trout Lake lithium property located approximately 30 km southwest of Sandy Lake, in the province of Ontario.

The Property is located approximately 9.5 km east of the Company’s other lithium properties (totaling 2,220 hectares) in the Borland Lake, Favourable Lake, and Gorman River areas of Northwestern Ontario, approximately 37 km north of Frontier Lithium Inc.’s PAK and Spark deposits, and approximately 15 km north of Frontier Lithium’s spodumene-bearing pegmatite at Pennock Lake.

The Pak deposit has a mineral resource of measured, indicated, and inferred categories of 9.3Mt (million tonnes), averaging 2.06% Li2O and the Spark deposit has a mineral resource estimate of 14.4Mt, averaging 1.4% Li2O.

Allan Frame, the new President and CEO of Beyond Minerals commented, “This acquisition is consistent with our disciplined approach of (i) focusing on quality assets for which extensive geological data is available, (ii) maintaining financial discipline with regards to terms and conditions of our acquisition, (iii) concentrating on Ontario assets, while being open to strategic transactions in other jurisdictions and (iv) maintaining a share structure that is favorable to value creation for our shareholders.” He added, “Beyond’s footprint in the area now totals 5,710 hectares of carefully selected land. We will shortly be putting in place a comprehensive exploration program to begin as soon as practically possible.”

Before this, Beyond Minerals announced the acquisition of a 100% undivided interest in 15 contiguous mining claims comprising the Peggy Group Lithium property located approximately 80 km north of Sioux Lookout, in the province of Ontario.

The Property is located 8 km south of the McCombe-Root Lithium project owned by Green Technology Metals (ASX: GT1), which has announced high grade lithium results from their 24,000 m drill program on the project in recent months, new spodumene bearing pegmatite dyke discoveries in the area of the project, and the commencement of baseline environmental studies, all of which highlight the importance of this emerging pegmatite field.

The stock has had an explosive 2023. From its yearly lows to yearly highs at $0.43, the stock has moved just over 140%. At the current price of $0.32, Beyond Minerals is up over 85% for the year.

Resistance comes in at $0.425, with the stock attempting to break above multiple times but with no success. A close and breakout above this level will be a major technical event. With this recent pullback, the stock is looking to retest support. We have our first support at $0.30, which was the previous highs of the stock when you look to the left. Recent green candles indicate that buyers are here.

But the major support comes in at the $0.225 zone. We have multiple touches at that zone which meets the support criteria. With prices breaking below the trendline, and with heavy volume on the big red candle on March 15th 2023, we may likely close below this support and head down to test this major support at $0.225.

Just to solidify these levels, I have drawn a fibonacci tool from all time lows to highs. Notice how the 38.2 and the 61.8 levels line up with a match at our support zones. Just adds to the confluences, and proves that other technical analysts will be watching these levels.