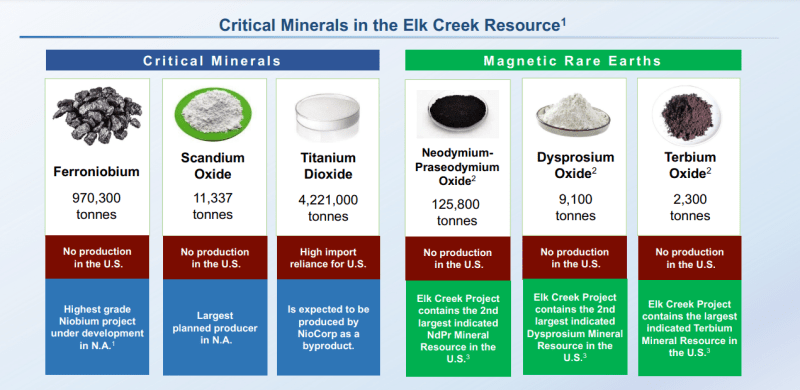

NioCorp Developments (NB.TO) is developing the Elk Creek Critical Minerals Project in Southeast Nebraska. This mine will produce strategic/critical minerals such as niobium, scandium and titanium. Several rare earths will also be produced from this mine. In fact, Elk Creek is the second largest indicated-or-better rare earth resource in the US.

A big announcement from the company today. NioCorp has announced the receipt of a Letter of Interest from the Export-Import Bank of the United States (EXIM) for potential debt financing of up to $800 million through EXIM’s “Make More in America” initiative to fund the costs of NioCorp’s Elk Creek Critical Minerals Project.

Our readers know that we have been saying that the current geopolitical set up with China, points to the US having to develop and invest in American sources of critical metals. The same energy security play with Russia, but substitutes energy with rare earths, especially since China is the major player in this market.

EXIM states on their website that in February 2021, President Joe Biden signed executive order 14017 directing an all-of-government approach to assessing vulnerabilities in – and strengthening the resilience of – the United States’ critical supply chains.

From that Executive Order, the White House released findings from its comprehensive 100-day supply chain assessments for four critical products: semiconductor manufacturing and advanced packaging; large capacity batteries, like those for electric vehicles; critical minerals and materials; and pharmaceuticals and active pharmaceutical ingredients.

The bank stated:

“We are pleased to extend this Letter of Interest in support of the proposed capital funding plan by Elk Creek Resources Corp. for the Elk Creek Project. Based on the preliminary information submitted on expected exports and jobs supported, EXIM may be able to consider potential financing of up to $800,000,000.00 of the project’s costs under EXIM’s Make More In America initiative.”

Just to be clear, this finance letter is only the preliminary step in the formal EXIM application process. The letter does not represent a financial commitment. NioCorp expects to submit an application to EXIM to begin the first phase of the underwriting process as soon as possible.

As stated in the Letter of Interest:

“Upon receipt of NioCorp’s application for financing, EXIM will conduct all requisite due diligence necessary to determine if a Final Commitment may be issued for this transaction.”

“Any final commitment will be dependent on meeting EXIM’s underwriting criteria, authorization process, and finalization and satisfaction of terms and conditions. All Final Commitments must be in compliance with EXIM policies as well as program, legal, and eligibility requirements.”

The process from submission of a Phase I application to a final commitment of financing by EXIM is expected to take approximately six to nine months and is subject to a number of risks and uncertainties.

This news comes after NioCorp announced at expansion of an existing non-revolving credit facility, the contracts for the costs for the surface facilities at Elk Creek Critical Minerals Project, and their demonstration plant continuing to show strong rare earth recovery.

Financing is key and the company will have access to a big chunk of cash once the SPAC acquisition goes through and the company is listed on the Nasdaq exchange. NioCorp would use these proceeds to advance its Elk Creek Project and move it into commercial production. Today’s news would also play a huge role in advancing the project.

The technicals are something I have covered here on Equity Guru plenty of times. I told readers that we had a false breakdown below $1.00 which is very bullish. My major resistance zone was $1.10. We have now closed above this zone triggering a double bottom reversal pattern.

This has played out and the stock has hit an important resistance zone at $1.50. The next major technical trigger would be a strong daily green candle above $1.50. This would set us up for a move to $1.75 and higher.

Catalysts going forward include more demonstration testing, financing news, and the big US SPAC acquisition which would see NioCorp traded on the Nasdaq. Meaning more eyeballs on the stock and US money being able to buy shares.