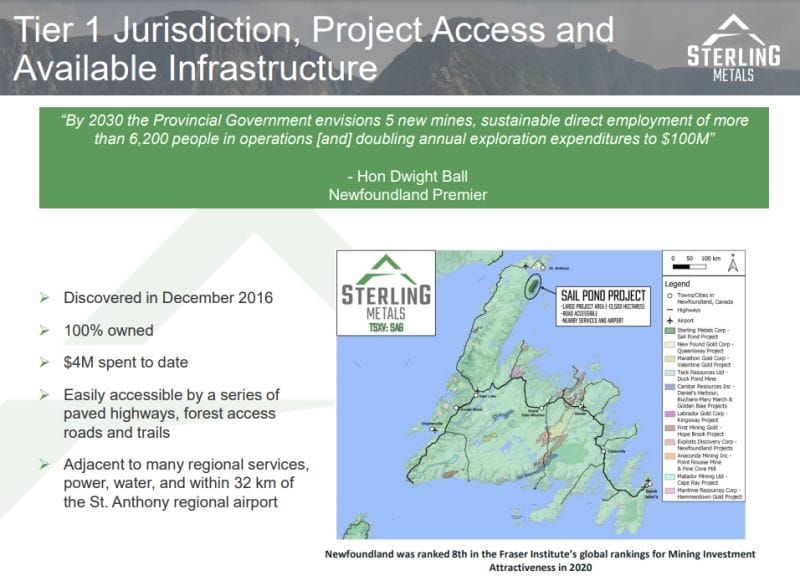

Sterling Metals (SAG.V) is a Canadian junior currently exploring for silver and base metals at the Sail Pond project in Northwestern Newfoundland. The company had an option to acquire 100% of this project, and this was recently fulfilled. Sterling Metals owns 100% of the Sail Pond Project.

Today, Sterling Metals reported results from its 2022 drilling on the Sail Pond Silver and Base Metal Project. Drilling results are from the Heimdall Zone and new zone 500m north of Heimdall.

The 34 new holes, 7500 metre drill program hit new targets, expanded mineralization at Heimdall and found a newly identified mineralized zone 500 metres to the north.

Here are significant drill results:

- 3,499.1 g/t Ag Eq over 0.35 m (1,564 g/t Ag, 8.33% Cu, 12.83% Pb, 2.74% Sb, & 3.93% Zn) within a broader interval of 294 g/t Ag Eq over 4.67m (129 g/t Ag, 0.66% Cu, 1.19% Pb, 0.22% Sb, & 0.45% Zn in hole SP-22-064 beginning at 179.23 m downhole; and

- 1,914 g/t Ag Eq over 0.28m (848 g/t Ag, 3.24% Cu, 4.27% Pb, 1.02% Sb, & 9.62% Zn) within a broader interval of 171.1 g/t Ag Eq over 6.74m (77.2 g/t Ag, 0.29% Cu, 0.69% Pb, 0.09% Sb, 0.61% Zn) in hole SP-22-053 beginning at 219.0 m downhole; and

- 1,485.3 g/t Ag Eq over 0.63m (520 g/t Ag, 1.81% Cu, 6.93% Pb, 0.57% Sb and 10.86% Zn) within a broader interval of 179.8 g/t Ag Eq over 5.58 m (63.3 g/t Ag, 0.22% Cu, 0.84% Pb, 0.07% Sb, & 1.29% Zn) in hole SP-22-047 beginning at 125.47 m downhole; and

- 530.8 g/t Ag Eq over 0.93m (162.6g/t Ag, 0.79% Cu, 1.46% Pb, 0.22% Sb, 4.71% Zn) within a broader interval of 115.4 g/t Ag Eq over 7.3m (35.9 g/t Ag, 0.17% Cu, 0.41% Pb, 0.05% Sb, & 0.95% Zn) in hole SP-22-050 beginning at 194.7 m downhole.

Mathew Wilson, CEO of Sterling Metals, commented: “It is a pleasure to finally share with the market the terrific work we have done in only our second drill campaign at Sail Pond. This drill campaign solidifies the Heimdall Zone footprint, a 400m x 200m x 150m zone of mineralization. Through boots on the ground prospecting and reinterpretation of old data, we were also able to discover a completely new zone, 500m to the north, where previous drilling had not been able to identify a mineralized structure. This resulted in one of the highest-grade intervals we have seen to date, and the highest-grade copper and antimony we have seen at the project. The company is in an enviable position with a rapidly advancing high grade polymetallic mineral system, $4m in cash and a very strong team fully focused on unlocking the potential of the Sail Pond Project.”

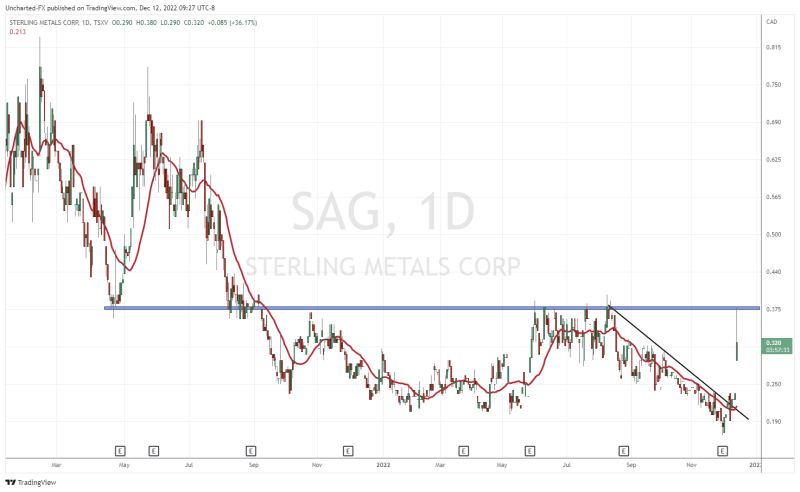

At time of writing, the stock is up 31.91% with over 1 million shares traded.

The stock is ripping, and the technicals look great. First off, we had a major downtrend line which was broken last week. For technical traders, this was a case of how technicals can predict good fundamental news. Breakouts usually mean that some sort of fundamental news is coming.

A huge gap has been created with the stock popping. This is bullish. As long as the stock price doesn’t fill the gap, meaning we get a close below $0.235, the stock can continue to make moves higher.

This gets us to the ceiling. Clearly, $0.375 is the major resistance zone. Not only did today’s pop reject this zone, but going back, you can see this zone saw major rejection from June-August 2022.

If Sterling Metals gets a break and closes above $0.375, it would be even more bullish. A break that could take the stock up to its next resistance zone around $0.56.

Pullbacks are possible as traders take profits after a big move. But remember, as long as the gap does not fill, we should expect buyers to step in on the pullbacks and eventually create a higher low swing. A swing which could see us break above our key resistance zone.

The company has good news and has the cash to develop on this catalyst. A very strong fundamental case and the technicals look prime. A great combo for continued momentum on the stock.