Goodfood Market Corp (FOOD.TO) is a leading meal solutions brand in Canada. The company delivers fresh meals and add-ons that make it easy for customers to enjoy delicious and healthy meals across Canada. Goodfood customers have access to uniquely fresh and delicious products, as well as exclusive pricing, made possible by its world class culinary team and direct-to-consumer infrastructures and technology.

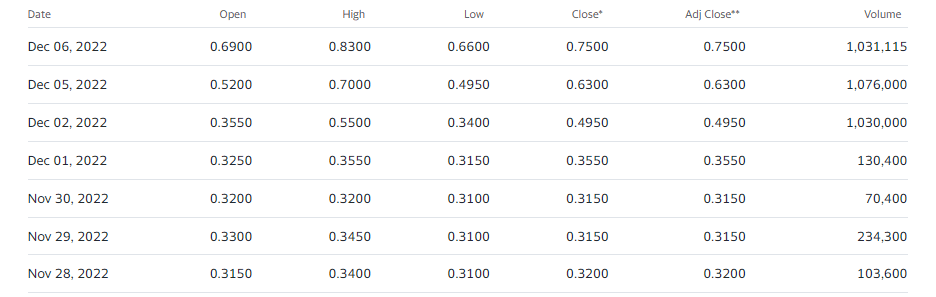

The stock has been on a tear. In three days, Goodfood has ripped 132% from the opening price to the highs of the week in just three days. The catalyst? Earnings. On Friday December 2nd 2022, Goodfood Market announced financial results for Q4 and fiscal 2022 ended September 3rd 2022.

The company announced significant gross margin expansion, improved adjusted EBITDA by 89% year-over-year and reaffirmed expectations of positive adjusted EBITDA in the first half of 2023.

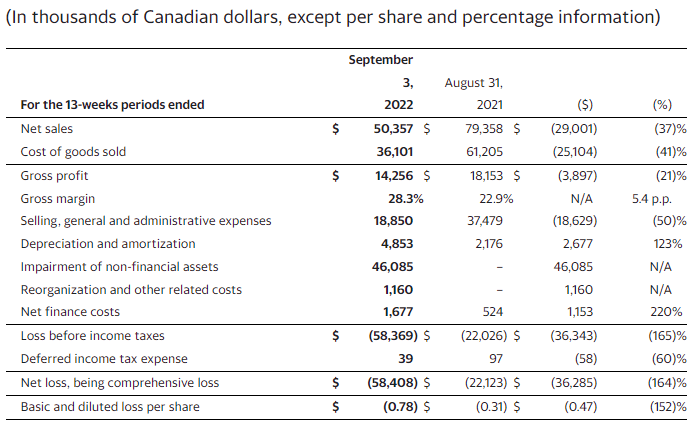

Here are highlights:

- Net sales of $50 million for the quarter, a 37% decrease compared to the same quarter last year

- Gross margin increased to 28.3% for the quarter, an improvement of 5.4% compared to the same period last year

- Adjusted gross margin1 was 30.7% for the quarter, excluding the $1.2 million charge related to the discontinuance of Goodfood On-Demand

- Net loss for the quarter was $58 million compared to $22 million in the same period in 2021, an increase of $36 million

- Net loss primarily driven by the previously announced one-time $46 million charge related to Blue Ocean initiatives and $1.2 million of discontinuance of products related to Goodfood On-Demand

- Adjusted EBITDA1 loss improved by 89% to $2 million for the quarter compared to a loss of $18 million in the same quarter of the prior year

- Reaffirming expectation to achieve positive Adjusted EBITDA1 and cash flows in the first half of Fiscal 2023, with net sales in the first quarter of Fiscal 2023 estimated in the $46-48 million range on the back of steady and growing volume and without significant contribution from On-Demand, and gross margin expected in the 32-34% range

“In our fourth quarter, we have continued to demonstrate progress on executing Project Blue Ocean and improving profitability. Our gross margin for the quarter surpassed 30% for the first time in over a year when adjusted for non-recurring inventory charges related to the closure of our On-demand service. This improvement occurred despite inflationary pressures and is the direct result of our Blue Ocean initiatives which have included footprint and supplier consolidation, ingredients and operational simplification, and price increases. Combined with rigorous discipline in reducing our selling, general and administrative costs, the gross margin improvement has reduced our Adjusted EBITDA1 loss to $2 million this quarter compared a loss of $18 million in the same quarter last year, laying our foundation for profitable future growth and positive cash flows in the near future,” said Jonathan Ferrari, Chief Executive Officer of Goodfood.

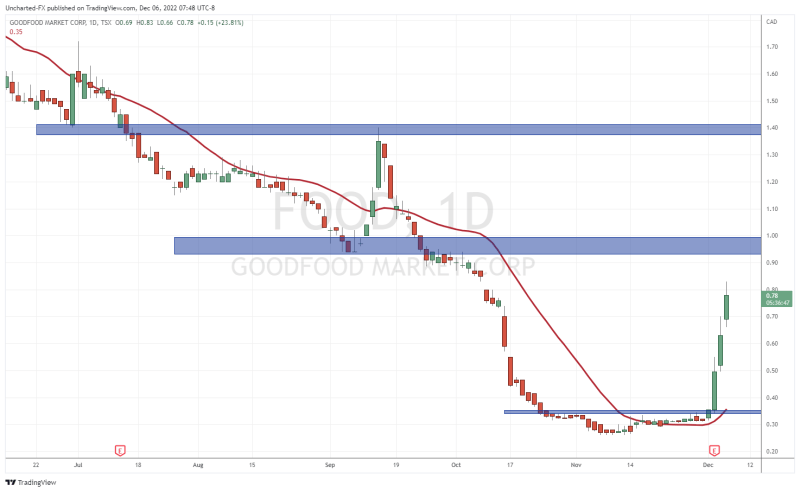

The stock is ripping with BIG volume. Since the release of earnings, the stock has seen consecutive days of volume coming in over 1 million. A breakout backed by volume is super bullish.

The chart above is just a prime example of my market structure method of reversal trading/investing. After a long downtrend, the stock began to base or range. This is a good indication of a bottom and signals the exhaustion of selling pressure. It is as simple as that. Traders tend to complicate things.

The key is to recognize that nothing ever moves down or up in a straight line. When we have an exhaustion of selling, not only do we need a breakout trigger, but this tends to occur with some fundamental catalyst. In this case, positive earnings.

The stock broke out of the range, and one can argue that the basing pattern was actually an inverse head and shoulders pattern, which just increased the probabilities of a reversal.

The next resistance zone comes in at the psychological important $1.00 zone. If we can confirm a close above $1.00, then $1.40 is resistance next. As long as the stock remains above the breakout zone of $0.35, the uptrend continues. A pullback is possible given the move in the stock and the fact that some traders will likely be taking profits.