AMPD Ventures (AMPD.CN), a Canadian company providing cutting-edge performance computing solutions for video game development, esports, film and entertainment, AI, and big data.

Today, AMPD announced the closing of the second tranche of their private placement. AMPD issued an additional 8,491,016 units at a price of CAD $0.14 for gross proceeds of CAD $1,188,742. Each unit is comprised of a common share and one common share purchase warrant, with each warrant entitling the holder to subscribe for one common share at an exercise price of CAD $0.20 per warrant share for a period of 24 months following the date of the closing of the private placement.

AMPD is closing the second tranche, but will continue to accept investments up to $2,000,000 and extend the closing date to mid December. To date, AMPD has closed $1,560,742 on these first two tranches.

Anthony Brown, CEO commented, “we are pleased to have closed over three quarters of our financing now. With many new investors, several from Europe, it has been great to see the growth of a broader global investor group participating in this round. The interest has been solid, especially when considering the markets, we are all traversing”.

AMPD intends to use the funds raised from the private placement to deploy AMPD infrastructure, increase headcount, and for general working capital purposes.

For investors, this raise can be used to initiate catalysts for the stock price.

It has been a bust few months for AMPD. At the beginning of October, AMPD announced that Tippett Studio, a leading full service animation and visual effects production company led by two-time Oscar and Emmy winner Phil Tippett, has picked AMPD Virtual Studio to help power their growth and expansion in the North American market.

AMPD announced its wholly owned subsidiary, Departure Lounge, was open for business. This facility contains the world’s largest volumetric capture stage packed with next gen technologies.

AMPD Technologies also signed an agreement with Magnolia Quality Development Corporation (MQDC). MQDC is a property development company in Thailand which is looking to AMPD’s expertise for their next generation metaverse content production initiative, which is intended to be the largest in Asia.

Deals continue to be announced as AMPD expertly leverages its virtual studio solutions as well as the world’s largest volumetric capture stage. AMPD Ventures is one of the few companies actually doing something and their metaverse/AR high-performance computing solutions are revenue generating with incredible potential for growth.

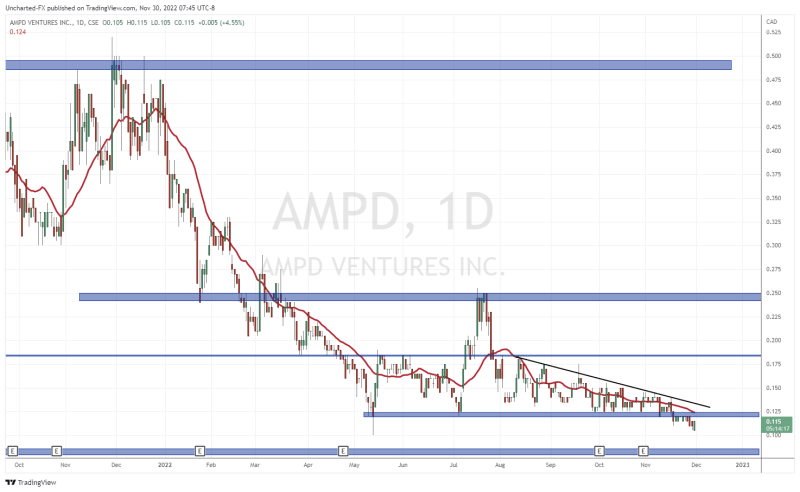

The stock itself broke below a major support level of $0.125. This is not what bulls wanted to see. Going forward, bulls would want to see the price close back above the $0.125 zone and reclaim what was once support and nullify the breakdown.

If this does not occur, AMPD has the potential to drift lower to the next support at $0.08.