NioCorp Developments (NB.TO) who owns the Elk Creek Critical Minerals Project, the second largest indicated-or-better rare earth resource in the US, announced today that it has filed a Form S-4 Registration Statement (S-4) with the US Securities and Exchange Commission (SEC) regarding the company’s proposed business combination agreement with GX Acquisition Corp II (GXII).

This filing is a key milestone in the process of the NioCorp and GXII business combination as they continue to advance the proposed deal.

The proposed transaction values the combined entity at an estimated enterprise value of $313.5 million. The business combination was announced on September 26th 2022.

NioCorp is to acquire the GXII SPAC and expects to be listed on the Nasdaq stock exchange soon after the acquisition closes. NioCorp shares will continue to also be traded on the Toronto Stock Exchange.

If there are no redemptions by GXII public shareholders, upon the closing of the deal, the combined entity could have access to as much as $285 million in net cash (after paying transaction expenses) from the GXII trust account. These funds could be used to advance the Elk Creek Critical Minerals Project into production.

The deal is expected to close in the first quarter of 2023, subject to effectiveness of the registration statement on Form S-4 that NioCorp filed today, the satisfaction of customary closing conditions, including certain governmental approvals, the approval of the TSX, and the approval of certain elements of the proposed Transaction by a majority of shareholders of GXII and a majority of NioCorp shareholders voting to approve such elements.

The S-4 includes detailed information including the following:

- The specific proposals that will be put before NioCorp shareholders for a vote at a Special Meeting of Shareholders that is expected to be scheduled following the SEC’s determination of effectiveness of the S-4.

- The specific proposals that will be put before GX shareholders following the SEC’s determination of effectiveness of the S-4.

- Questions and answers about the Transactions.

- Questions and answers about the NioCorp Special Meeting of Shareholders.

- NioCorp’s Reasons for the Transactions and the NioCorp’s Board’s Recommendations

- A third-party opinion, conducted by GenCap Mining Advisory Ltd., as to the fairness, from a financial point of view, of the Transaction, including the Exchange Ratio, to NioCorp shareholders.

- A third-party opinion, conducted by Scalar, as to the fairness, from a financial point of view, of the Transaction, to GX shareholders.

For more information, each portion of the S-4 listed above can be seen on NioCorp’s website here. The full Form S-4 can be seen here.

At time of writing, the stock is currently up 0.88% with over 48,000 shares traded.

The big move on this stock occurred when it came out that NioCorp was to acquire the GXII SPAC in order to be listed on the Nasdaq. The stock pumped on September 26th 2022, but the bigger pump came on September 30th 2022 when it was announced that NioCorp CEO Mark Smith would appear on “The Claman Countdown” on Fox Business. With the stock to be listed on the Nasdaq in 2023, NioCorp is taking steps to let the American investor know about the opportunity and the project NioCorp owns.

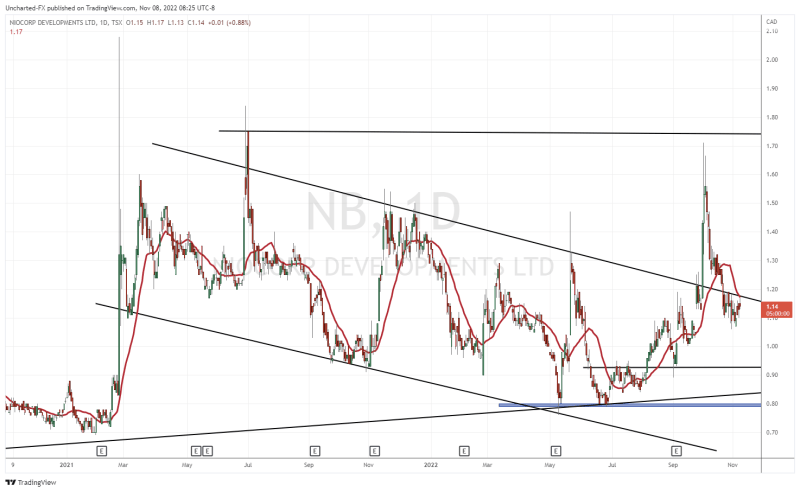

The breakout of my trendline (a flag pattern) took us near our resistance target at $1.75. Since then, the stock has been pulling back which is to be expected as traders take their profits after a rip roaring move.

However, just recently, NioCorp closed back below the broken trendline. This is important because a retest of the trendline was supposed to act as support for the stock. We expected to see buyers jump in. This did not happen. Instead, we closed back below the trendline which means said trendline is now resistance. You can see this clearly. Every time the stock bounced, it would sell off right at the trendline.

For NioCorp to get back on the uptrend, we need to see a close above this trendline, or $1.20. With the overall markets rising, perhaps this could help NioCorp climb over $1.20. If not, then the $1.00 zone becomes the next support level.