All of these analyst calls of peak inflation, peak interest rates, peak dollar… whoopsie. A lot of whoopsie.

Markets expected Powell to flip dovish and talk about the Fed taking a pause from raising interest rates. The Fed hiked by 75 basis points as expected, and the financial world waited for the Fed press release. It came out and things initially looked great.

This line in the FOMC statement got people excited:

In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

The Fed basically says that they acknowledge they have taken interest rates quite high, close to their 2023 median rate of 4.6% (which is now higher!). Markets saw this as a good sign that interest rates would be peaking soon.

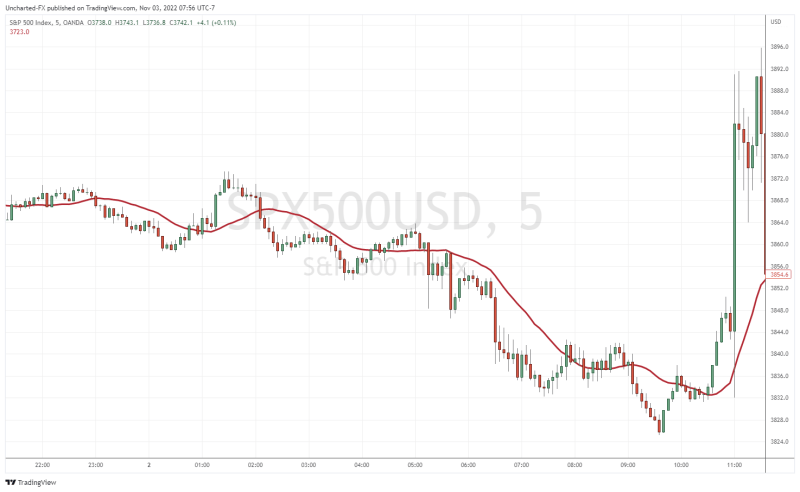

This is how the stock markets reacted in the initial minutes post FOMC release:

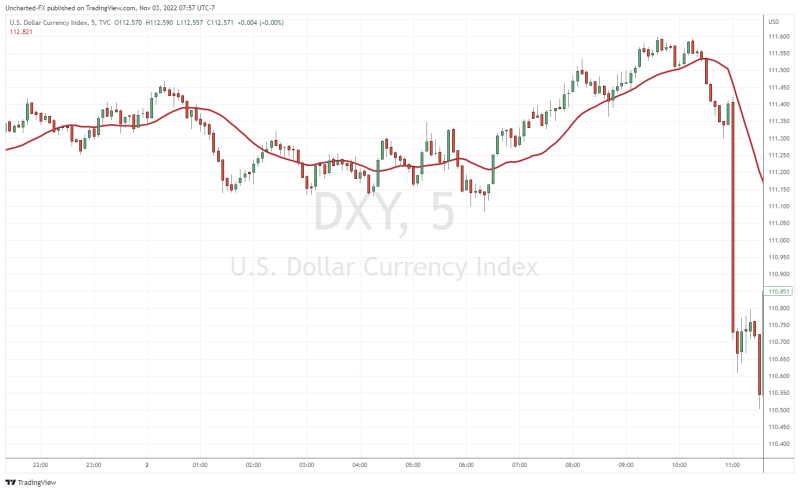

This is how the dollar reacted:

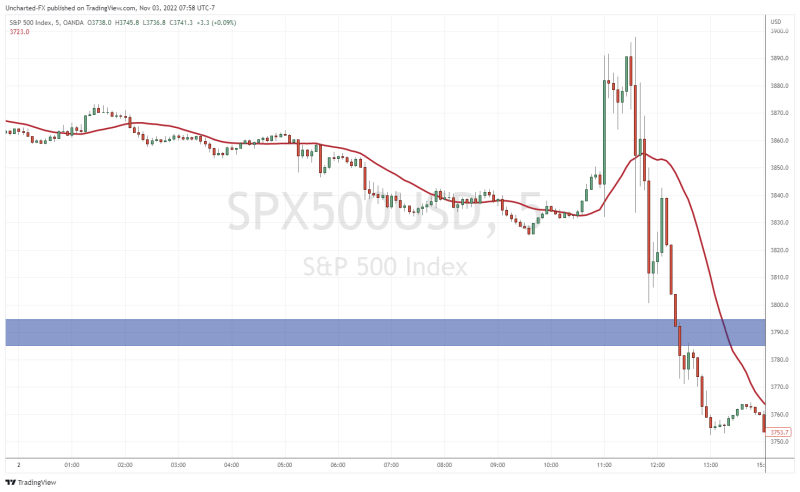

However, by the time Fed Powell gave his press conference, this is how stock markets ended:

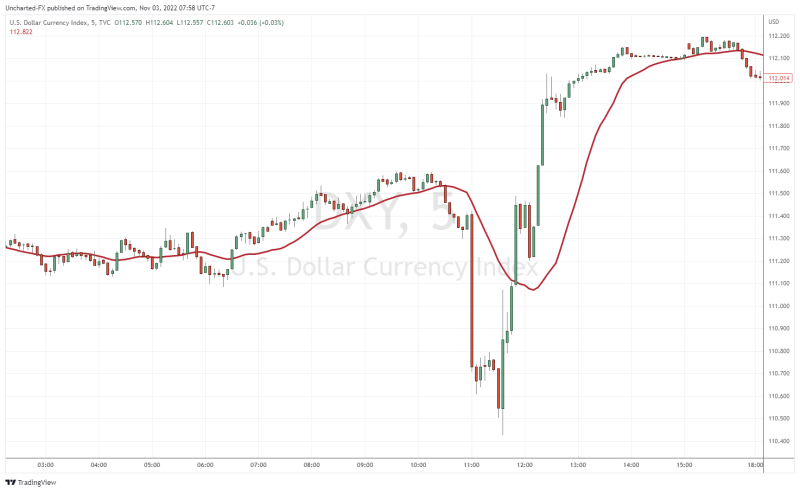

And the dollar:

If you have not watched Powell’s press conference, I would suggest you do so. It was a painful one to watch. Reporters kept asking questions regarding a Fed taper or if interest rates are going to pause or slow down. Powell answered these diplomatically and said that the fight against inflation is not over.

The good news? Powell did say that the Fed could slow down rate hikes come December or January.

“As we come closer to that level and move further into restrictive territory, the question of speed becomes less important. … And that’s why I’ve said at the last two press conferences that at some point it will be important to slow the pace of increases. So that time is coming, and it may come as soon as the next meeting or the one after that. No decision has been made,” Powell said.

But no pause.

“It is very premature to be thinking about pausing. People when they hear ‘lags’ think about a pause. It is very premature, in my view, to think about or be talking about pausing our rate hikes. We have a ways to go,” Powell said.

Powell in past meetings has said that the labour market is robust and is showing strength. He continues to see this in the data. A real case of softening cannot be made. This is why US Non-Farm Payrolls (NFP) or employment numbers have become very significant data points. And we have NFP data this week on Friday November 4th.

Essentially, the markets were expecting a dovish Fed, and it appeared that way when reading the FOMC report. But this changed at the Powell press conference. Markets were not expecting a steadfast hawkish tone.

Now, markets are expecting the Fed to raise funds to a high of 5.05% before stopping its current rate hiking cycle.

In my humble opinion, there was no dovishness in the Powell conference. Rates are going to continue higher. Powell even defended this by saying if the Fed accidently overtightens, they have the ability to bring rates down to adjust.

When I was tuning into the press conference, Powell said something about interest rates lagging the rate of inflation. Most people know that whenever inflation was over 5%, there has been no time in monetary history where inflation was brought down with an interest rate lower than the rate of inflation. This means that rates have a long way to go, if inflation remains entrenched.

This then opens the debate on inflation: whether it is due to printing excess money, supply chains etc. If it is supply chains then raising rates can’t really do much. This is why I focus on inflation being a monetary phenomenon, and unfortunately, I see more inflation coming as governments continue to spend big.

The hope is that inflation numbers will drop hard and the Fed will then have an interest rate higher than the rate of inflation. But I see inflation driving off like a Ferrari, and the Fed and other central banks are chasing it down in a golf cart.

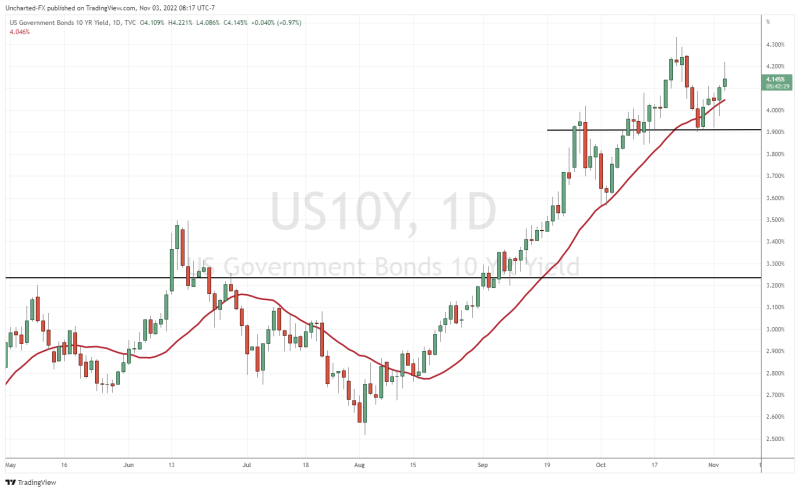

My readers know the drill. One chart that I have been watching is the 10 year yield:

It continues to remain above 4% and had quite the pop today putting pressure on stock markets. When this begins to drop, we can expect stock markets to rise.

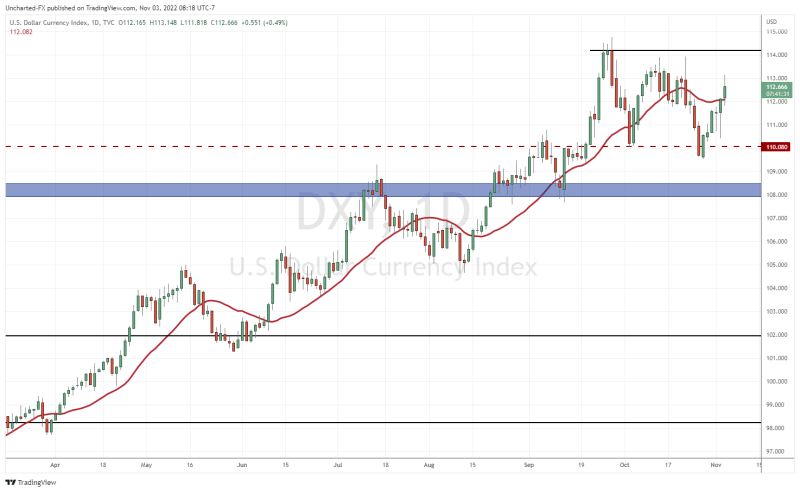

The dollar also continues to hold on to its uptrend. Readers know I expect the US dollar to be the best performing fiat currency. It will continue to do so adding inflationary pressures to all other nations around the world as their purchasing power decreases. This will put even more stress on central banks and their abilities to actually do something about inflation.

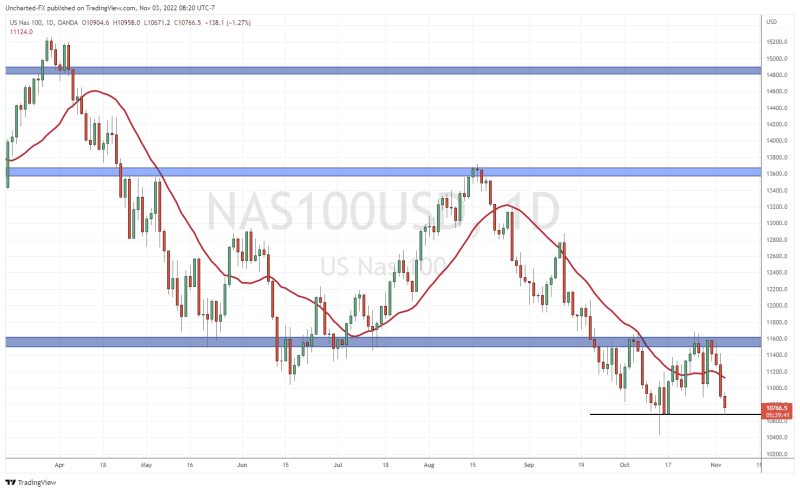

US stock markets dropped hard and have taken out their previous breakout levels signaling the end of momentum. Now we see if markets breakdown lower. The Nasdaq is in danger of breaking below recent lows and continuing its downtrend. Or, it can bounce and range here, or bounce and break back above 11,600 down the road.

Tech stocks feel more pressure from rising interest rates because most of them are not making revenues. They are borrowing money. The debt gets more expensive as interest rates rise which eats away their financial statements.

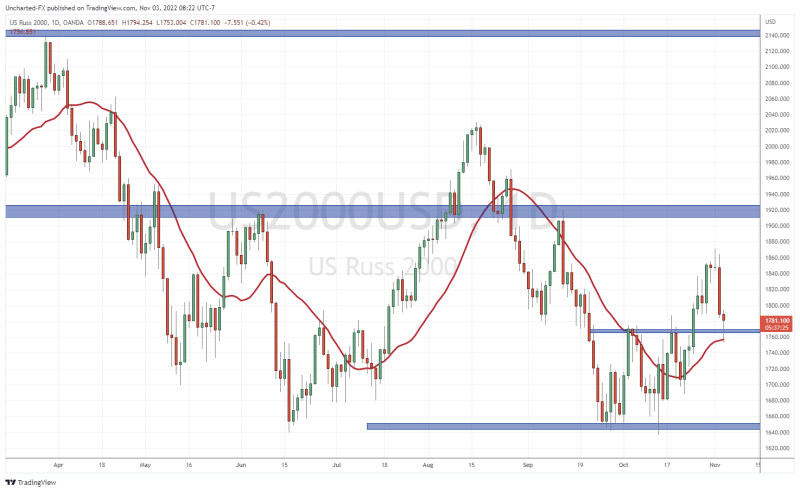

But let me leave you with some hope. The US small cap index, the Russell 2000, is what I use as a leading indicator for the three major US indices (S&P 500, Nasdaq and the Dow Jones). From a technical perspective, the Russell is just retesting the breakout zone at 1760. The uptrend remains intact as long as the Russell holds above this.

If the Russell does lead, then this is a good sign for a stock market recovery. This, along with the US 10 year yield, will be the chart I will be most watching.

So in summary, a Fed pivot is still on hold. Interest rates are expected to go higher albeit at a slower pace perhaps. If inflation data shows months of decline, that would be a good sign that the Fed and other central banks are winning the battle. But as of now, we do not see this and we could be waiting for quite some time.