Asia is making headlines. Asian currencies are taking a hit including both the Japanese Yen and the Chinese Yuan.

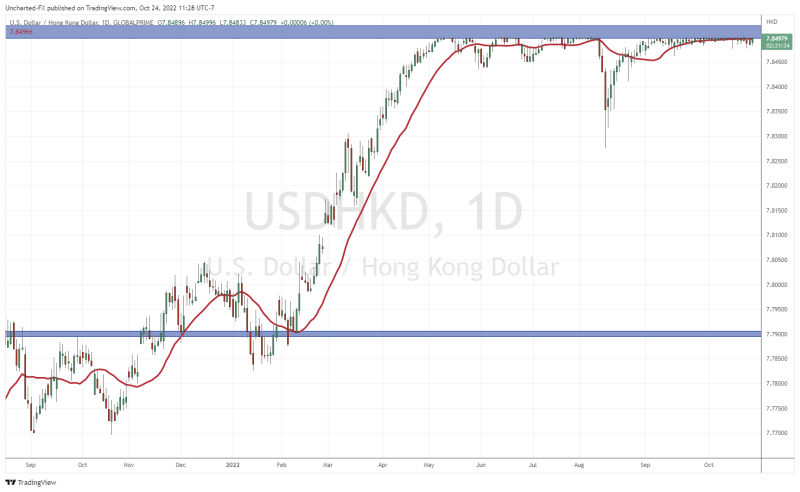

Hong Kong has been on my radar for sometime, but especially in recent months given the likelihood of the US Dollar Milkshake Theory playing out.

The Hong Kong dollar is run by a currency board. Recently, the Hong Kong Dollar has been battling at resistance on the peg. This means the currency board needs to sell US Dollars to maintain this peg at this level. Dollars that the currency board may be running out of. Hong Kong used to attract a lot of dollars and investment in Asia. However, the same amount of investment is not coming in. Hong Kong’s IPOs have fallen the most in two decades.

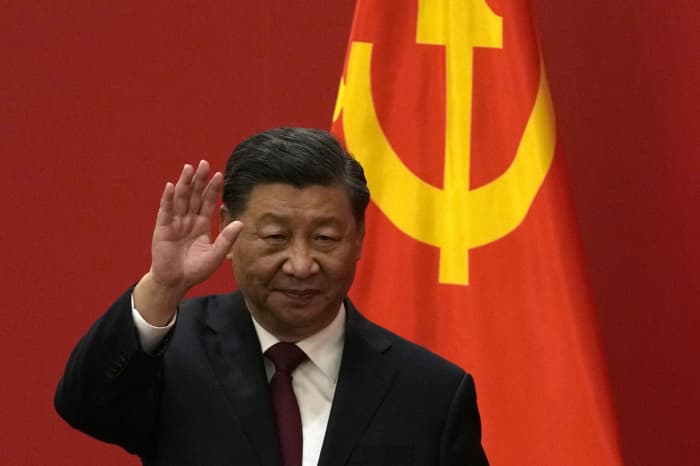

Geopolitics and issues with mainland China are not helping. With the CCP imposing their rule in Hong Kong, it is not being seen as ‘safe’ as once before.

There are many who are betting on this peg breaking, especially with the US dollar getting stronger. This list includes Kyle Bass and even the man behind the Dollar Milkshake Theory himself, Brent Johnson.

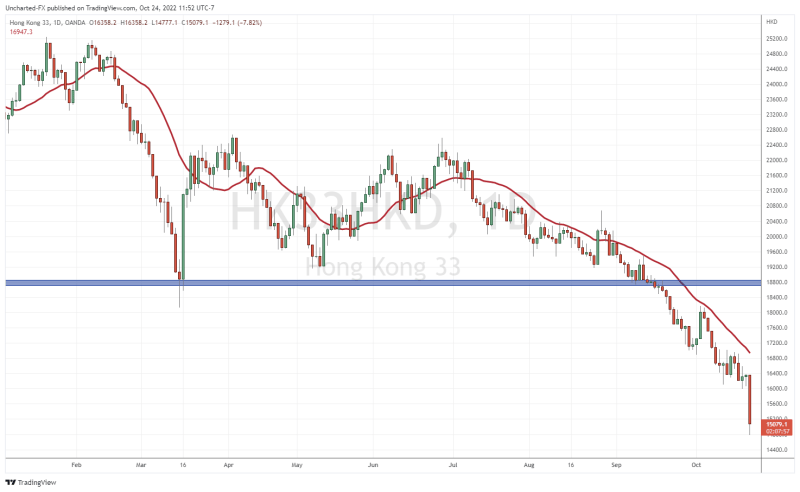

As global markets recover, one market that is not joining the party is the Hang Seng.

The Hang Seng is in a firm downtrend. Today, the Hang Seng saw its worst single day rout since 2008 with the market falling over 6%.

The reason? This:

The Hang Seng is falling as Chinese Leader Xi tightens his grip on power and was granted an unprecedented third term by the party at the CCP National Congress. This congress also saw the forced removal of previous Chinese Leader Hu Jintao, which is getting a lot of attention by Western media.

The Hang Seng is reacting because this National Congress was more about personnel changes rather than addressing the issues impacting the Chinese economy. Investors expected policy measures to be announced. Low growth concerns are hitting the Hang Seng.

“Since the meeting is mostly about personnel changes, the economic recovery might not come as soon as we have hoped,” said Tai Hui, from JPMorgan Asset Management’s APAC chief market strategist.

The Japanese Nikkei closed slightly green for the day, Singapore, Malaysia and India’s markets are closed for a holiday. The major event out of Asia will be this week’s Bank of Japan policy meeting as the Yen continues to weaken even with Japanese currency intervention. For more details on this, check out my recent article. Yensanity!

I am keeping tabs on Hong Kong, both through the Hang Seng and the Hong Kong Dollar against the US dollar. The peg is definitely going to come under pressure with the stronger US dollar. Hong Kong just isn’t what it once was with mainland encroachment and one of the most expensive real estate markets on the planet.