In January, 2011 Northern Dynasty (NDM.T) (NAK.NYSE) was trading at USD $18.

A dozen years later, the share price is at a 98% discount – USD 25 cents.

With a market cap of CAD $175 million, NDM is valued about the same as a Nevada exploration company doing trench-sampling on the outskirts of the Carlin trend.

That’s remarkable because Northern Dynasty’s Alaska, USA Pebble Deposit is believed to contain 57 billion pounds copper and 71 million ounces gold.

At today’s spot prices Northern Dynasty’s metal-in-the-ground is worth $280 billion.

What happened to Northern Dynasty – under its previous management – is a cautionary tale.

The Pebble deposit was originally discovered in 1988 by Cominco Alaska. According to NDM, it is “one of the greatest stores of mineral wealth ever discovered, and the world’s largest undeveloped copper and gold resource”.

The Pebble deposit was built into a monster, step by step, but one embarrassing blunder eclipsed all the progress.

Two years ago, The New York Times published a story about a successful sting operation launched against Northern Dynasty, revealing the Pebble Video Tapes, which had been recorded secretly by the Environmental Investigation Agency (EIA).

Posing as foreign investors, EIA operatives captured video calls showing Northern Dynasty’s then CEO, bragging that the proposed small mine was just a strategy to get a permit. He planned to mine the entire ore body over many decades. He also bragged about inappropriately cozy relationships with state politicians and regulators.

It was garden-grade promotional bluster, but the optics were horrendous – and it led directly to the termination of the loose-lipped CEO – killing the forward momentum of the project.

To be fair, the development of the Pebble Deposit was never going to be easy.

The asset sits in the Bristol Bay watershed, which produces half the world’s Pacific salmon, generating more than a billion dollars in economic benefits to Alaska. The locals are understandably skittish about a massive tailings pond in their back yard.

But there is so much money at stake – so much metal in the ground – the Pebble project will continue to rumble until, one day, it becomes a mine. When that happens, NDM better make sure, not a thimble of toxic material leaks into the water shed.

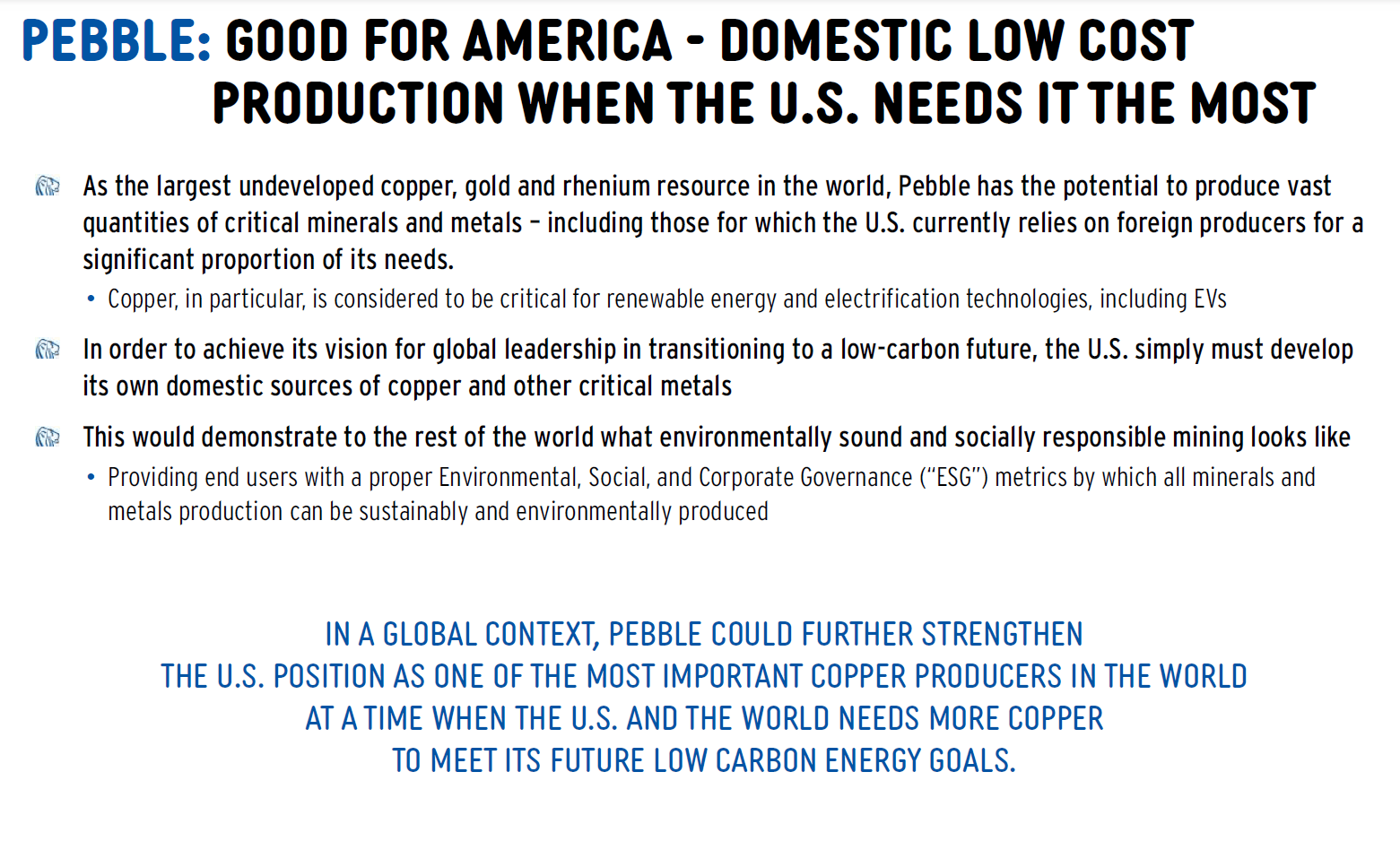

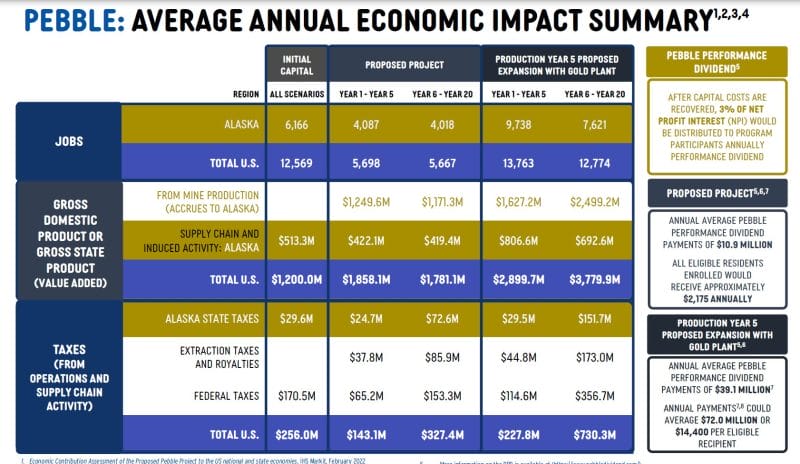

An Economic Contribution Assessment Study for Alaska’s pebble project demonstrated that project could support thousands of jobs and billions of dollars of economic impact annually while reducing the need for the U.S. to import copper to meet its green energy goals,” stated NDM on February 28, 2022.

“We believe that the Pebble Project would have a significant impact on the economic prosperity of Alaska, resulting from direct high paying jobs, significant purchases of equipment and supplies, and substantial government revenues and supply and service contracts,” stated the new CEO Ron Thiessen, “The Pebble Project could help the U.S. reduce its dependence on imports of copper metal as demand surges during the transition from an oil-based economy to electricity.”

“It’s also important to remember that the benefits of the Pebble Project are in addition to the fishing, sport fishing and tourism industries already operating in this part of Alaska,” Thiessen added. “We have always recognized the importance of the environment at Pebble and the importance of the Bristol Bay subsistence and commercial fishery. We accordingly have designed our project carefully with a number of innovative approaches to protect the environment and to ensure the project can coexist with the fishery, as was shown in the Final Environmental Impact Statement of 2020.”

As expanded capacity and the gold plant come online, the total taxes generated by the Production Year 5 Potential Expansion with Gold Plant rise to $469.0 million versus $225.6 million for the Proposed Project,” stated NDM, “The state and local taxes could average $135.3 million and $277.0 million per year”.

There are approximately 5,000 residents of the Bristol Bay communities that would qualify to receive a profit-sharing dividend.

From the start of mine construction, to the point at which capital costs have been recovered, a minimum of $3 million would be distributed annually among qualified local residents. After capital costs are recovered, 3% of net profits would be distributed to program participants, annually.

As Northern Dynasty does back flips trying to reduce environment risk, and share economic benefits with the locals, some investment groups have bought into the idea that Northern Dynasty will eventually prevail.

On July 27, 2022 NDM announced that it has entered into an agreement with an unnamed investor (the “Royalty Holder”) to receive up to $60 million over the next two years, in return for the right to receive a portion of the future gold and silver production from the Pebble Project for the life of the mine.

Remember that copper is the primary target, not gold or silver.

Northern Dynasty already received an initial payment of USD $12 million from the Royalty Holder.

“It has become clear to us that to develop a world-class mineral deposit like Pebble requires time, patience and sufficient liquidity to successfully navigate the established legal process and continue ongoing efforts to work with the people in the region,” stated Ron Thiessen, Northern Dynasty President and CEO. “This financing, when completed, also gives us the financial wherewithal to keep fighting against what we consider to be unfounded interference by U.S. Federal Government agencies in an otherwise well-established, legal permitting process, as well as to deal with challenges from well-funded parties from outside the area that lack scientific or other factual studies to support their opposition.”

Deal Terms:

After making the initial payment of $12 million, Royalty Holder has the right to receive 2% of the payable gold production and 6% of the payable silver production from the Pebble Project, in each case after accounting for a notional payment by the Royalty Holder of $1,500 per ounce of gold and $10 per ounce of silver, respectively, for the life of the mine.

If, in the future, spot prices exceed $4,000 per ounce of gold or $50 per ounce of silver, then the Company will share in 20% of the excess price for either metal.

Additionally, Northern Dynasty will retain a portion of the metal produced for recovery rates in excess of 60% for gold and 65% for silver, and so is incentivized to continually improve operations over the life of the mine.

The Royalty Holder has the right to invest additional funds, in $12 million increments, to an aggregate total of $60 million, within two years of the date of the Agreement, in return for the right to receive up to 10% of the payable gold and up to 30% of the payable silver (in each case, in the aggregate) on the same terms as the first tranche.

“It was important to us that we improve our liquidity without issuing equity at what we consider depressed prices,” stated VP of Corporate Development Adam Chodos, “We are pleased to reach an agreement that can raise significant capital over the next two years in return for the right to buy a small portion of future, non-core gold and silver production from the Proposed Project, while keeping 100% of the copper production.”

“As I have said many times before, a large amount of copper is critical for the generation and transmission of electricity, and we believe the world needs to develop the few world-class copper assets that have been discovered in order to have any chance of meeting its green energy goals,” said Mr. Thiessen. “We are also convinced that the Pebble Project has been designed – and can be built and operated – safely, without harming the environment or the fishery, as clearly outlined in the Final Environmental Impact Statement of July 2020.

“The Pebble Project represents an enormous amount of value, both to Alaskans and to the rest of the U.S,” added Thiessen, “And we believe that value should increase significantly as the expected supply/demand imbalance leads to future copper price increases.”

Because of missteps by previous management, Northern Dynasty’s headwinds have reached hurricane status.

The company is laser-focused on winning back the trust of regulatory bodies, environmental groups and local stakeholders.

One unnamed royalty company just made a $12 million bet that NDM can ride this storm.

Full Disclosure: Northern Dynasty is an Equity Guru marketing client