Northern Dynasty Minerals (NDM.TO, NAK) has a special place in my junior mining journey. I still recall being in my 20s and attending the Vancouver Resource Investment Conference for the very first time. Back then, there were not many young people attending those shows. I was just beginning to get a taste of junior mining.

I recall Marin Katusa and other speakers talking about a company that potentially could have the largest untapped reserve in the world. A reserve so good that this mine would have to go into production.

I then witnessed this stock jump from around $0.30 (the price I could have jumped into the stock) to hitting a peak of $4.25 a year later. This company was Northern Dynasty Minerals.

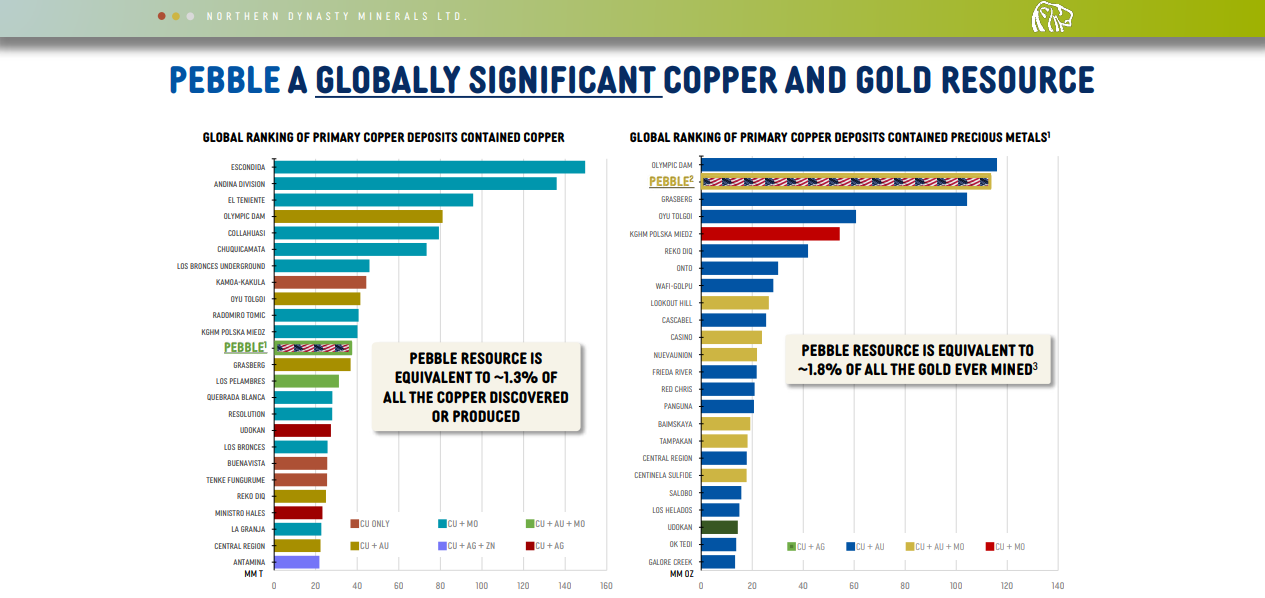

Northern Dynasty is advancing the Pebble Project in Alaska, the most significant undeveloped copper and gold resource in the world.

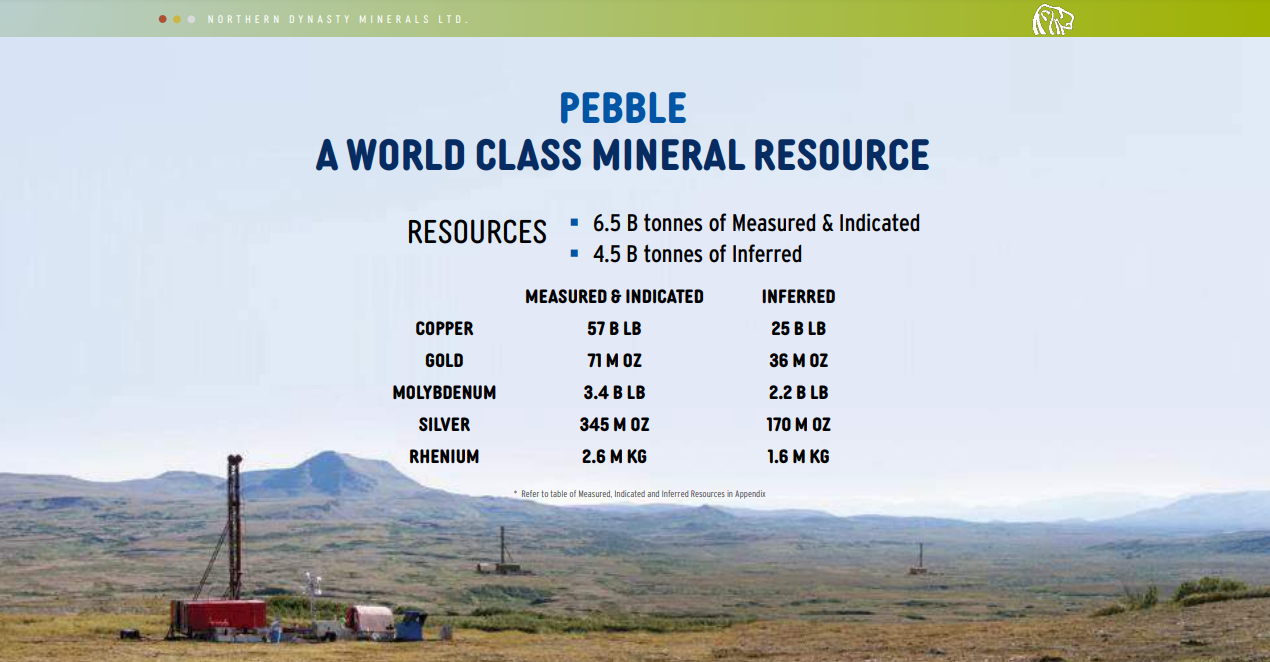

Take a look at some of these numbers. 6.5 billion tonnes measured and indicated.

Some of you who have not followed the mining industry may not appreciate the resource numbers. The above image will put their resource in perspective. This is a world-class deposit.

This mine will literally be a strategic asset for the US government, and by itself would significantly impact US GDP.

So why hasn’t this mine gone ahead? Environmental reasons. An ongoing saga between the US corps of Engineers, the government (Donald Trump Jr mentioned this project!), and the locals in

For a mine this large, there are concerns from the locals in Alaska that the mine would impact fisheries and the salmon population. It is now up to Northern Dynasty to prove that this mine will be safe for the environment. They need to convince locals in Alaska.

A recent press release highlights the safety design features of the tailings storage facility (TSF) for the Pebble project and how it could coexist with a local fishery. CEO Ron Thiessen had this to say:

“The failure of a tailings storage facility around the world is rare. When one does occur, however, failure is often caused by the accumulation of too much water,” said Ron Thiessen, President and CEO of Northern Dynasty. “The tailings storage and management plan for Pebble includes an investment of approximately $500 million in modern water treatment facilities to allow the water to be treated and safely released into the environment, meeting all required standards, instead of accumulated. Because of this and other design features, such as constructing the embankments on bedrock and with flatter slopes than is typical in the industry, the Army Corps of Engineers (“USACE”) in the 2020 Environmental Impact Statement said that they could not conceive of how a failure could occur. The fact is that Alaska has a very rigorous dam permitting process which will ensure that the facility will be safe before it is built.”

“The reality is that there just aren’t many salmon near to the proposed mine site. We know this because of extensive salmon population studies we have conducted over many years. Why are these populations so small? It may be because of the poor quality habitat, lack of surface water in the streams, or the hills that exist between the Pebble site and the ocean, which is 120 miles away, making it a challenge for the salmon to get that far inland, or there may be other reasons. The lack of fish living near the proposed mine site does not, however, diminish our commitment to designing and operating a safe mine that can coexist with the Bristol Bay fishery,” said Mr. Thiessen.

So will this project ever go into production? Just under two months ago, a royalty company made a bet that this project is too big to fail. Northern Dynasty entered an agreement with an investor (Royalty Holder) to receive up to US $60 million over the next two years, in return for the right to receive a portion of the future gold and silver production from the Pebble project for the life of the mine. Northern Dynasty received an initial US $12 million from the Royalty Holder with the execution of the agreement.

“It has become clear to us that to develop a world-class mineral deposit like Pebble requires time, patience and sufficient liquidity to successfully navigate the established legal process and continue ongoing efforts to work with the people in the region,” said Ron Thiessen, Northern Dynasty President and CEO. “This financing, when completed, also gives us the financial wherewithal to keep fighting against what we consider to be unfounded interference by U.S. Federal Government agencies in an otherwise well-established, legal permitting process, as well as to deal with challenges from well-funded parties from outside the area that lack scientific or other factual studies to support their opposition.”

I first want to highlight the weekly chart of Northern Dynasty going back to 2014. Pay attention to the pops we have had in the past. But what I want investors and traders to focus on is the price floor area that we are currently in. Looking back on the weekly chart, you can see this price floor is a zone where Northern Dynasty has historically seen buyers. And has historically been the platform from which a bounce has initiated. Further downside from here would take us into new record lows.

History may not repeat itself, but it sure does rhyme when it comes to the charts.

If we zoom into the recent price action on the daily chart, you can see that Northern Dynasty has slowly drifted downwards. We had a major pop on July 27th 2022, which was the reaction to the Royalty news. However, we sold off at $0.43 and could not break above it even with a second attempt at the beginning of August. Going forward, $0.43 is a major resistance zone for the stock.

But I want to focus on where we are currently. For those looking for bottoming plays, we may have something to work with on Northern Dynasty. The stock is at a major support zone. We have held this support and have seen buyers jump in when we tested this zone back in June and July of 2022. Can we bounce a third time?

On the day I am writing this, we are just one more day away from a major high risk event. The Federal Reserve will be speaking, or has spoken already, by the time you have read this article. The Fed may cause markets to drop if they present a hawkish tone towards interest rates. This will impact the US Dollar, which will then impact gold. Gold heading lower will impact many of the miners, and this in itself could cause Northern Dynasty to break below this support. If this happens, the stock would test $0.28, which is the previous lows for Northern Dynasty. Further weakness would cause new record lows. Factoring in the fundamentals including the US and the world requiring more copper projects to come online, the stock would look very attractive.

But maybe the market likes what the Fed says and the opposite happens. Gold pops and miners follow. If so, this would be a great level for Northern Dynasty to begin a new leg higher.

Notice I have drawn a downtrend line. The slope is a good indication of the prevailing trend. It would be very bullish if Northern Dynasty could take this trendline out with a close on the other side above $0.35. For those who want to play the stock safe, that would be the technical signal to wait for.