It is one day before the highly anticipated US CPI for August comes out. Yes readers, we are ending off summer with a macro bang. US CPI followed by the Federal Reserve interest rate decision next week, means that there will be plenty of volatility. Volatility and major moves.

Just looking at the charts as we begin the week and I am already seeing major macro moves. Of course all of this can change as we continue the trading day, but the markets seem to be pricing in something.

Currently, we are seeing a major risk on move. Stocks and cryptos are popping.

US markets are having their fourth green day in a row. Over in Europe, most European market indices are having their third green day in a row. And we are talking about big green days.

It seems that the markets are once again shifting away from the inflation narrative. I mean it still is there, but the markets and traders seem to be pricing in peak inflation once again.

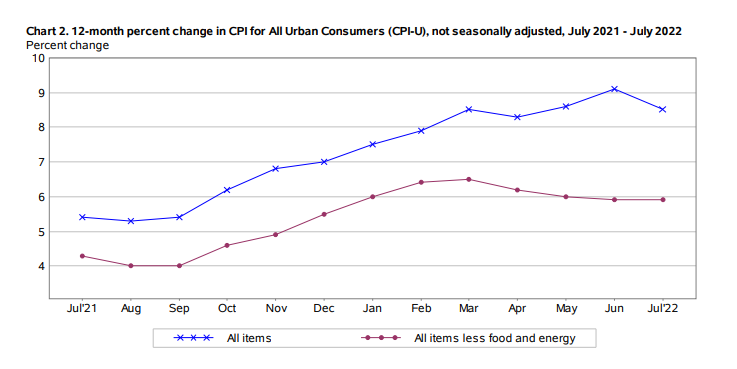

We are one day away from the US CPI print for August, and the markets are acting as if this data will come in lower. Lower relative to previous data prints. Yes, inflation at 7% or 8% is still high, but the markets care about peak inflation.

July’s CPI print was super important. It came in lower than June’s. To the markets, that June print was the peak because July’s CPI came in lower. But we cannot just call peak inflation just after one data print. We require more. This is why August’s CPI print will be pivotal for the markets. We want it to come in lower than 8%. It would boost claims that inflation has peaked and is on the downturn as you can see from the chart above.

Now of course, declining energy prices (oil) played a big part in July’s CPI coming in lower. Keep in mind that food and shelter costs remained elevated. It is likely those costs remain elevated for sometime.

Oil prices were lower into August and will reflect how much consumers were paying at the pump. With lower energy prices, the markets are expecting a lower CPI print tomorrow.

For the future, OPEC+ announced that they will be decreasing production starting in October. This could once again elevate oil prices depending on how strong the global economy is. If demand remains high, then oil prices will move higher. If we begin to see signs of economic slowdown then demand will fall.

When we talk about inflation expectations, then the US 10 year yield must be in the conversation. Regular readers know we have used this chart to call stock market moves. When the 10 year rips higher, markets sell off. When the 10 year declines or ranges, markets react positively.

Currently, the US 10 year yield is ranging around 3.30%. This is after the 10 year yield was on a strong uptrend. Ranges after a long uptrend or downtrend typically means exhaustion of the current trend.

What I am interpreting from this chart is that the Fed will raise rates by 75 basis points in September but then be more pragmatic rather than hawkish. Markets expect the Fed to take into account the two declining CPI prints (that is if August CPI does come in lower!) and the rhetoric to change. Because inflation is turning, larger rate hikes will not be required, thus the Fed could do a smaller 25 basis rate hike before the year ends.

The US Dollar is also hinting at a more pragmatic Federal Reserve. The DXY hit 110 and has begun to reverse… or pullback. The Dollar dropping is also positive for risk on assets such as stocks and cryptos. Precious metal bulls will also be happy from this Dollar drop.

One reason for this Dollar reversal is that the markets are thinking there will be less Fed rate hikes. Basically expecting that CPI to come in lower tomorrow.

This is what traders are seeing. But remember, they could be wrong. If we see August CPI surprise and come in higher, expect equity markets to tumble, and the 10 year yield to react. If Jerome Powell continues to be hawkish and aggressive with this rate hike rhetoric the following week, we will get the same reactions.