NioCorp has announced that it has filed a technical report summary (TRS) based on its 2022 feasibility study for the Elk Creek Critical Mineral Project, the second largest rare earth resource in the US, with the US Securities and Exchange Commission (SEC).

The TRS was filed with the SEC to comply with Item 601(b)(96) and subpart 1300 of Regulation S-K promulgated by the SEC (“S-K 1300”), which regulates disclosure of Mineral Resources and Mineral Reserves.

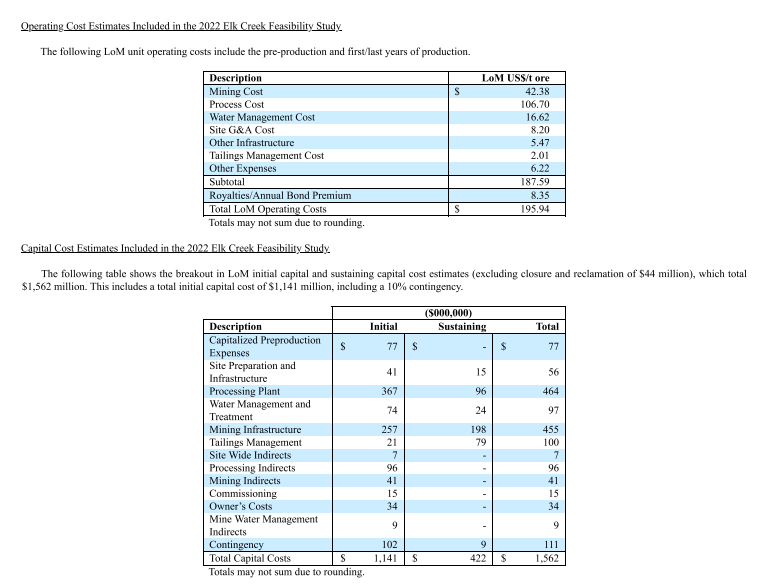

A technical report was filed by NioCorp on SEDAR on June 28th 2022. The technical data and economic conclusions of these reports are substantively identical and the minor differences between reports result only from the respective disclosure requirements of S-K 1300 and NI 43-101.

The full report can be seen here.

It has been a bust few weeks for NioCorp. The Inflation Reduction Act of 2022 created an advanced manufacturing tax credit which includes domestic critical minerals production. Should NioCorp find it economic to produce the magnetic rare earths neodymium, praseodymium, dysprosium, and terbium, and once the Project is financed and placed into commercial production, the 10% tax credit would also apply to the cost of producing these products.

More US States are likely to follow California’s lead in banning the future sale of internal combustion engine vehicles as a means of accelerating demand for electric vehicles to address climate change. This type of government action will likely increase the demand for critical minerals needed by EVs and other cleantech applications.

Finally, the company also announced that its demonstration-scale processing plant in Quebec, Canada is now processing ore samples from its Elk Creek Critical Minerals Project. The demonstration plant project is intended to demonstrate that the Company can extract and separate rare earth elements from ore that NioCorp expects to mine from the Project site.

We have recently featured NioCorp on Equity Guru. The fundamentals and the geopolitics which are pushing the stock higher can be read about here and here.

The stock has played out just as I have outlined to readers. The stock found buyers at the retest of the breakout at $0.93 and has taken out recent highs confirming a higher low. The stock was up over 10% at one time today on the news. The selling is coming as the stock nears our trendline which is the next resistance level for bulls. A daily close above $1.10 will go a long way in determining sustained momentum. A close above $1.20 is the next major technical breakout for bulls.