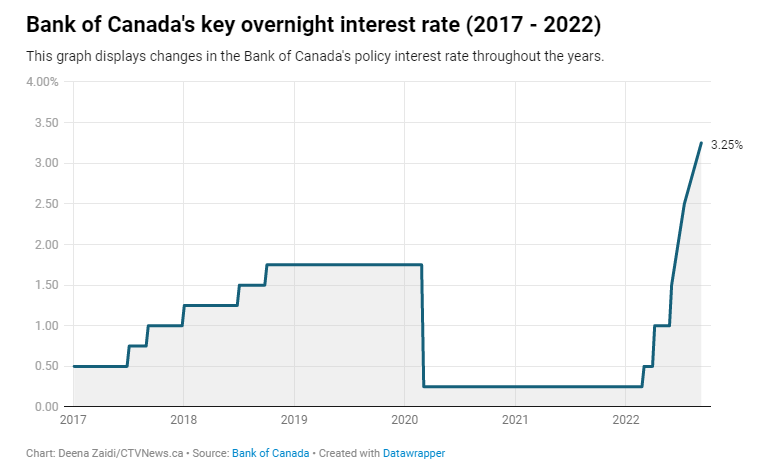

The Bank of Canada raised its key interest rate by 0.75 percent (three quarters of a percentage point) bringing the central bank’s key rate to 3.25%. This rate hike matches up with market and economist expectations. No surprise.

Since March 2022, the Bank of Canada has increased rates by 300 basis points, the fastest pace since the mid 90s.

But what’s on everyone’s mind is what comes next? More interest rate hikes are to come in order to bring inflation back to its mandated 2% target.

The Bank of Canada says global inflation remains high while the Canadian economy continues to operate in “excess demand“. The central bank attributes this to the war in Ukraine, COVID-19 lockdowns in China and volatile commodity prices.

Inflation rose by 7.6 per cent in July, down from its peak of 8.1 per cent in June. The drop was mainly due to a decrease in gas prices, but the price of food and services remained high. Even with inflation showing signs of peaking from the data, the Bank of Canada said the core measure of inflation continues to rise which prompts a greater risk that rising prices become entrenched. Therefore, more rate hikes will be needed.

“They have set the stage for further rate hikes,” says Kevin Page, president and CEO of the Institute of Fiscal Studies and Democracy at the University of Ottawa. “They have to probably get their policy rate to 4 per cent.”

The Loonie is down by 0.25% as USDCAD looks to break above 1.32.

The Canadian TSX is slightly up on the day. There is a global market rally relief occurring so I would not attribute this pop on the Bank of Canada rate hike.

News

Markets now expect the Federal Reserve to hike by 0.75% later on this month (September 21st).

Apple is set to unveil new iPhones and Apple Watches at a press event in Cupertino, California today at 1 pm ET.

Mortgage demand drops further as interest rates shoot back to June highs in the US. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to 5.94% last week from 5.80% the previous week.

The British Pound falls to its weakest level against the US Dollar since 1985.

Bitcoin has dropped and hit its lowest level since June. The cryptocurrency market drops below $1 trillion as stock markets fall globally and the US Dollar strength continues.

Canadian Market News

Sparta Capital (SAY.V) announced its e-waste recycling division has signed a deal to recycle electronics from General Motors Canada massive 5.1 million square foot manufacturing facility in Oshawa, Ontario. The stock is currently up 80% with over 2,800,000 shares traded.

Love Pharma (LUV.CN) has made a strategic investment in Starton Therapeutics, a New Jersey based clinical stage biotechnology company focused on transforming standard care therapies in oncology. The stock is currently up 50% with over 1 million shares traded.

Reyna Gold (REYG.V) announced drill results from its La Gloria property in Sonora, Mexico. Highlights include 59m of 1.45 grams per tonne Gold from 1.2m to 60.2m at newly discovered La Republicana target. There was also a drill of 5.5m of 935 g/t Silver. The stock is currently up 15% with over 236,000 shares traded.

Cymat Technologies (CYM.V) announced it has received a purchase order for military under-belly blast protection kits from an Asian military vehicle manufacturer for use by the Singaporean military. The final value of the purchase orders is anticipated to be between $5 and $7 million. The stock is currently up 24% with over 135,000 shares traded.

Palladium One (PDM.V) has discovered a new high grade nickel sulphide zone at the Tyko Project in Ontario, Canada. The stock is up 24% with over 1.1 million shares traded.

Imagine Lithium (ILI.V) has reported high grade Li2O in grab samples taken from newly identified trend of Lithium-bearing pegmatites. The stock is up 20% with over 866,000 shares traded.

Chart of the Day

A lot of European charts will be making the “chart of the day” in the coming weeks and months. GBPUSD is currently one of them. The currency pair is at a major support zone but did drop briefly below creating lows in the British Pound which has not been seen since 1985!

Are more lows possible? Absolutely as long as the US Dollar uptrend continues. The UK will have major problems come Winter, and there is a real chance that the British Pound hits parity.