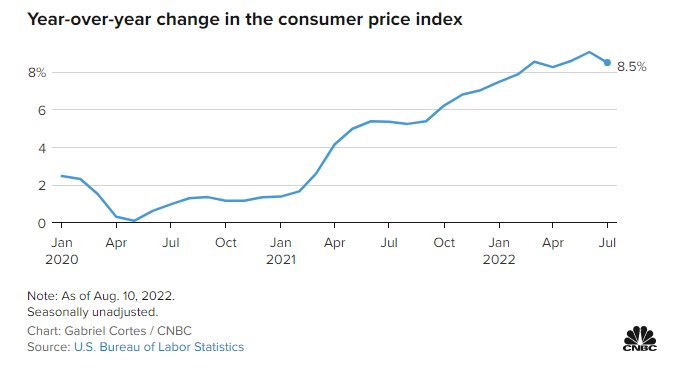

Did we just hit peak inflation? Investors are cheering today’s lighter than expected inflation numbers.

The US consumer price index (CPI) rose 8.5% in July from a year ago, coming in below expectations of 8.7%. This is indicating a slowing pace of inflation which is due largely to a drop in gasoline prices.

On a monthly basis, prices were flat as energy prices broadly declined 4.6% and gasoline fell 7.7%. That offset a 1.1% monthly gain in food prices and a 0.5% increase in shelter costs.

If we exclude food and energy prices, core CPI rose 5.9% annually and 0.3% monthly compared to estimates of 6.1% and 0.5%.

However, inflation pressures remain mixed. Food saw the most. We got a huge jump in the food index putting the 12 month increase to 10.9%, the fastest pace since 1979. Butter is up 26.4% over the past year, eggs have surged 38%, and coffee is up more than 20%.

Electricity prices rose 1.6% and were up 15.2% from a year ago.

But the markets are reacting positively to this data point.

“Things are moving in the right direction,” said Aneta Markowska, chief economist at Jefferies. “This is the most encouraging report we’ve had in quite some time.”

You can tell the markets like this data by looking at the charts. The main resistance zone that we have been warning our readers about in recent weeks is breaking. Markets found sellers here and couldn’t make any breakout for 7 full trading days. This seems to be changing. All US equity indices are taking out this resistance zone. However this breakout will only be confirmed with a daily close. Still a lot of trading left for August 10th, and anything can happen from now until the end of the trading day.

But this is very positive. If we close like this and sustain in the next few days, this is a very bullish indicator technically.

Why would markets be moving higher?

Markets are thinking that the Fed will not be raising interest rates as much as previously thought due to inflation slowing down. The 10 year yield is still holding on above 2.7%, but if we continue lower, it would be a good sign for the stock market.

Now of course one CPI print won’t cut it. I want to see the next few reports to also indicate that inflation is indeed falling to the downside. There is also the matter of PPI data to keep in mind.

Inflation came softer due to lower energy prices. Oil prices have fallen and recently, confirmed a big support breakdown. From a technical perspective, there is a good chance we get another leg down. On fundamentals, oil prices are dropping lower due to fears of a recession. A recession or economic slowdown is seen as demand killing which will help tame inflation numbers.

Finally, the US Dollar is dropping hard and looks to be confirming another lower leg. This is big because a weaker dollar means investor’s are pricing in a less hawkish Fed. If CPI data came out higher than 8.7%, we would have seen the Dollar pop as the market priced in a large rate hike in September.

In summary, the market is thinking the Fed will hike less given the fact inflation numbers are peaking. Watch to see if stock markets can close above their weekly resistance levels by Friday. I would also want to see a drop in the 10 year yield. Finally, we would also want to see oil and the US Dollar continue their new downtrend.