This week we’ve been chatting with gold exploration CEOs who are grumpy about the spot price of Au.

But at least most investors know what gold looks like, feels like and what the demand drivers are.

Not so, with the critical mineral Niobium.

Without context, you might assume it was the name of the next super-villain in Matrix 5.

“I didn’t know what niobium was, and I had been in the minerals industry for 20 years,” admitted the Chairman of one resource company.

“I had to actually open up the periodic table just to double-check that it was an element,” he added, “It definitely is a boutique space.”

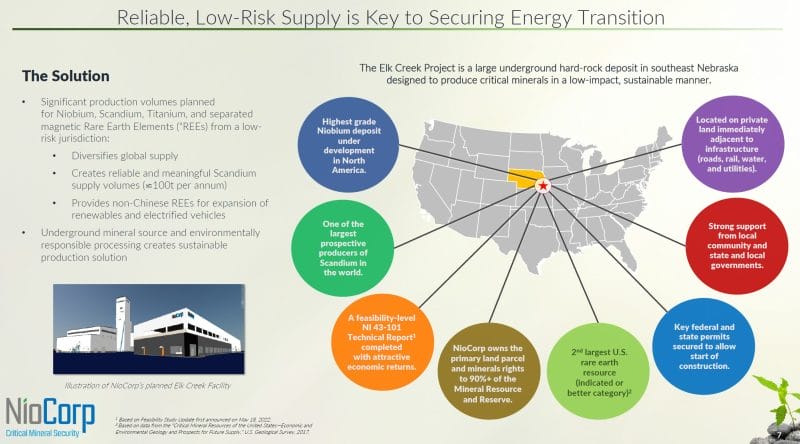

NioCorp (NB.T) is a $227 million company developing a critical minerals mine in Southeast Nebraska that will produce niobium, scandium, and titanium.

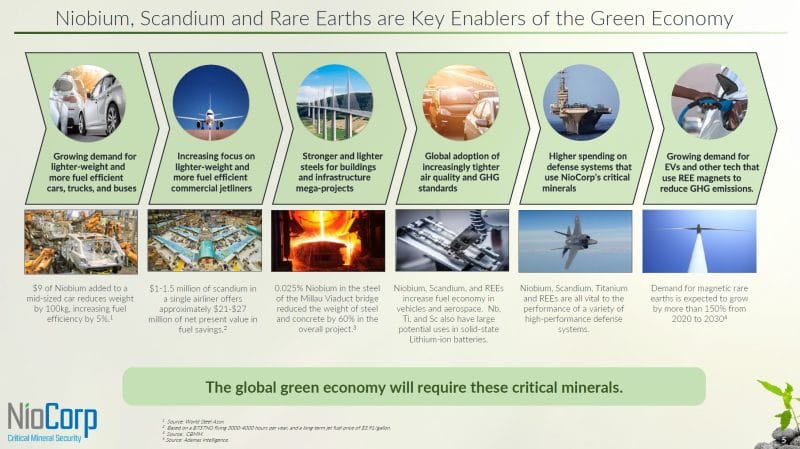

Niobium is used to produce specialty alloys as well as High Strength, Low Alloy steel used in automotive, structural, and pipeline applications.

Scandium is a specialty metal that makes Aluminum corrosion resistant, also used in solid oxide fuel cells.

Titanium is used in various lightweight alloys and is a key component of pigments used in paper, paint and plastics and is also used for aerospace applications, armor, and medical implants.

Magnetic rare earths, such as neodymium, praseodymium, terbium, and dysprosium are critical to the making of Neodymium-Iron-Boron (NdFeB) magnets, which are used across a wide variety of defense and civilian applications.

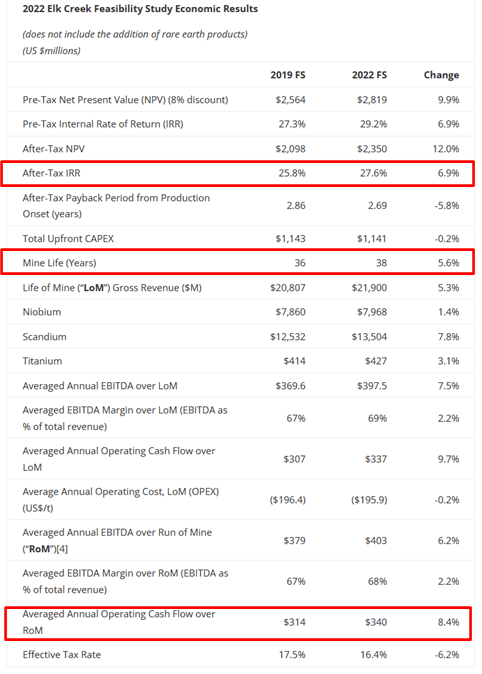

On June 29, 2022 NioCorp filed a 43-101 Technical Report regarding its Feasibility Study completed for the Company’s Elk Creek Critical Minerals Project.

The entire 659-page report is available here.

It took 11 minutes to read the first 4 pages.

Extrapolating, we estimate the total read time to be 30 hours.

For the same time-investment you could hike the Grouse Grind 13 times, take a train from Fort Lauderdale to NYC or learn to play the piccolo flute.

Your call.

This Equity Guru article will summarise the 659-page report.

According to the 2022 Feasibility study, in addition to niobium, scandium, and titanium, the Elk Creek Mineral Resource “contains various amounts of all rare earth elements (REEs).”

“There is potential for NioCorp’s REEs to be mined, crushed, and placed into solution as part of the process NioCorp plans to use to produce its primary niobium, scandium, and titanium products, once Project financing is secured,” states NB.

NioCorp is building a demonstration plant in Quebec to perform metallurgical testing on REE recovery rates from Elk Creek ore. In the future, NioCorp could produce separated rare earths as a by-product, making it more economically efficient than other rare earth projects.

“If our testing continues to show the positive results we have seen to date, and we decide to add magnetic rare earths to our potential product line, the Elk Creek Project will represent a unique critical minerals project after project financing is obtained and the Project is put into commercial operation,” stated Mark A. Smith, CEO and Executive Chairman of NioCorp.

“We believe the minerals we intend to produce in America’s heartland are essential to the world’s accelerating energy transition and to the many technologies that will make it possible, including those in electrified transportation, renewable energy, infrastructure projects, and many others,” added Smith.

The 2022 FS shows that the Elk Creek Project contains an estimated 632.9 kilotonnes (“kt”) of contained total rare earth oxides (TREO) in the indicated mineral resource category.

According to U.S. Geological Survey data, this places the Elk Creek Mineral Resource behind MP Materials’ Mountain Pass deposit but ahead of all other current rare earth projects in the U.S. in terms of contained TREO from a NI 43-101 rare earth resource of indicated or higher classification.

The Elk Creek Indicated Mineral Resource includes the following tonnages of contained metals, using a ≥US$180/tonne NSR cut-off that was calculated using solely the contained niobium, scandium, and titanium in the Mineral Resource:

- 632.9 kt of TREO, including these individual rare earth oxides:

- 26.9 kt of praseodymium

- 98.9 kt of neodymium

- 2.3 kt of terbium

- 9.1 kt of dysprosium

- 970.3 kt of niobium oxide

- 11,337 tonnes (“t”) of scandium oxide

- 4,221 kt of titanium oxide

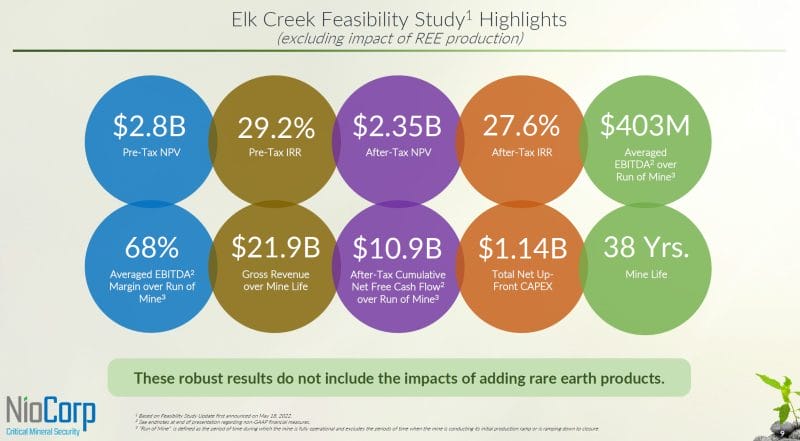

The expected Pre-Tax and After-Tax Net Present Value (NPV) of the Project both increased, the mine’s expected life has been extended from 36 to 38 years, and expected Life of Mine (LOM) gross revenue for all three currently planned products (niobium, scandium, and titanium) have increased.

Earlier this year, NioCorp Executive Chairman Mark A. Smith and Chief Operating Officer Scott Honan discuss the importance of the Elk Creek Superalloy Materials Project in southeast Nebraska.

“There are three production facilities for niobium in the world today,” explained Smith, “two of those are located in Brazil, which produces well over 90% of the world’s niobium supply. So you have a very constrained to geographic supply of these minerals.”

“One of the easiest things to do to mitigate risk in your business is to have diversity of supply. By opening up the Elk Creek project in Nebraska, we can diversify the supply chain for niobium.”

“Niobium is now being used in combination with lithium-ion batteries. When you put those elements together, you end up with a battery that provides much greater distance for driving so much greater range for the automobile to drive on a battery charge,” added Smith, “These batteries required less time to charge. Reports are coming out that it may take as little as six minutes to charge that battery, when you get longer rages in shorter charging times – that’s the holy grail in the electric vehicle battery sector.”

On June 20, 2022 NioCorp closed a non-brokered private placement – issuing 4.9 million units at .96, for total gross proceeds of $4.8 million.

There are only three primary Niobium mines in the world today. But growing demand has created a global market value of more than $5 billion.

Niobium is considered so critical by the U.S. that it is one of a small handful of metals that the National Defense Stockpile purchases, according to DoD Strategic and Critical Materials reports.

“Getting the permits that we need to construct the operation has been a focus since I started working on this project in 2014,” stated Scott Honan, COO of NB, “I don’t think it’s any secret that permitting can be a big schedule drag on projects if it’s not properly prioritized.”

“We’ve taken the time and the effort and spent the money on making sure we’re well positioned to start construction,” added Honan, “We’ve got the three key permits that we need to get this project off the ground.”

Full Disclosure: NioCorp is an Equity Guru marketing client.