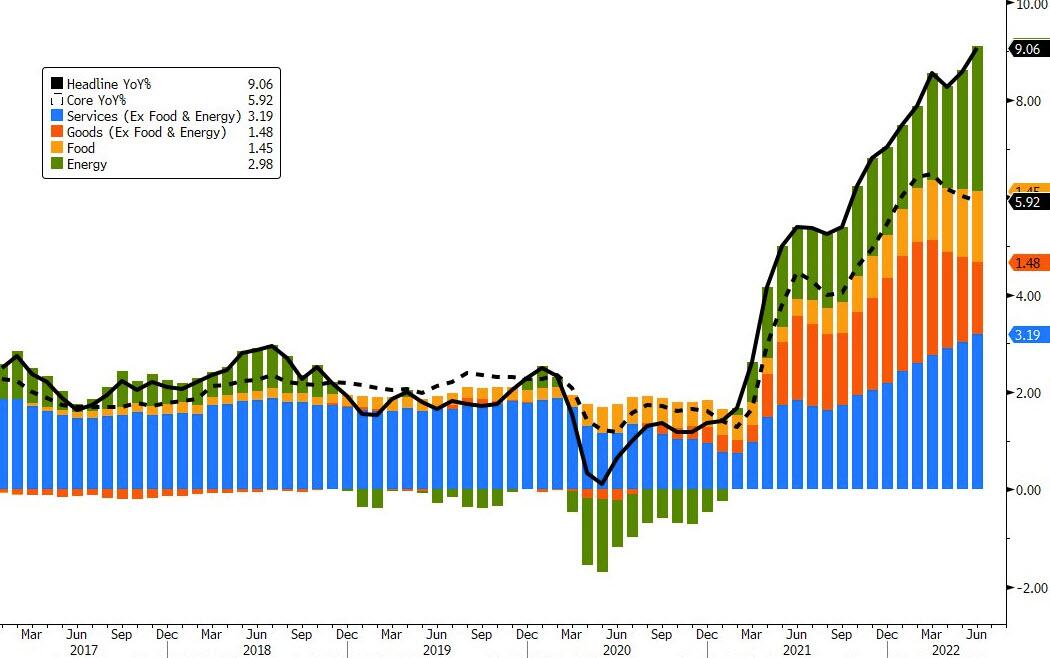

US CPI beat market expectations. Estimates were pegged at June inflation coming in at 8.8%. Instead, inflation came in sizzling at 9.1% from a year ago.

Excluding food and energy, core CPI came in higher at 5.9%, beating estimates of 5.7%.

Not too surprising to some, but many in the markets were hoping for signs of peak inflation. There still is hope though! With oil prices and the prices of other commodities dropping, July’s inflation numbers which will come out in August could show signs of peaking.

But that has not happened just yet. Rather, we continue to print records with this inflation number marking the fastest pace for inflation going back to December 1981.

So what does this all mean? Interest rates still have room to move higher, and the Fed may have to be even more aggressive. The hope was with signs of a recession and inflation peaking, the Fed might be close to the end of this rate cycle. This CPI print says otherwise but many analysts are saying don’t worry this will be the worst given the drop in commodity prices in July.

Prices are up across the board but there are a few things I was looking for: shelter costs, services inflation vs goods inflation, and the average hourly earnings.

Rent was actually one of the top increases alongside gasoline, groceries and dental care. Rental costs rose 0.8% in June, the largest monthly increase since April 1986, according to the BLS. Shelter inflation itself is up 5.61%, the highest since 1992.

When it comes to services inflation vs goods inflation, goods inflation is slowing but service costs are rising at their fastest pace since 1991.

When it comes to earnings, it probably comes to no surprise that workers wages are not keeping up with inflation. Real wages fell for the 15th month in a row. Inflation adjusted incomes based on average hourly earnings fell 1% for the month of June and were down 3.6% from a year ago. Simple translation: the worker is getting hit in the wallet.

Not only are they getting hit by inflation, but also borrowing costs as central banks raise interest rates making borrowing costs rise. The Fed may need to get even more aggressive with raising rates if they want to tame inflation. Sort of what the Bank of Canada did today.

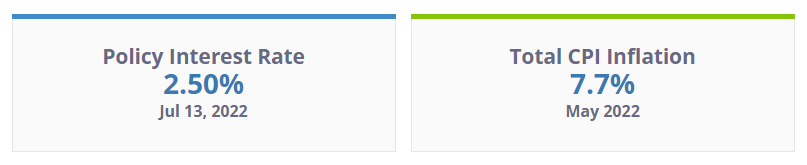

Analysts were expecting the Bank of Canada to raise interest rates by 75 basis points. Instead we got a surprise. The Bank of Canada raised interest rates by a full percentage point! A full 1% taking the policy interest rate from 1.5% to 2.5%.

For Canadians it could get worse. Either the number on the left (the interest rate) has to go higher, or we need some sort of demand killing event to bring down the number on the right (inflation). We shall see if the Bank of Canada’s aggressive rate hike will do anything to taper inflation in the coming months.

What makes all of this even more dramatic is the possibility of a recession. The US Q2 GDP number comes out on July 28th and that will confirm whether the US is in recession or not. If a recession is confirmed, then the markets may begin to start pricing in the end of the rate cycle. Generally in a recession, central banks cut interest rates to spur the economy. If a recession is not confirmed…then expect more rate hikes. But to be honest, we may need to expect more hikes regardless. We will need to see whether inflation drops as we head into recession. If it doesn’t, we are heading into stagflation, an environment with high inflation and low economic growth.

US stock markets initially fell on the CPI report numbers but are turning around. The Nasdaq is the first to flip positive at time of writing. The S&P 500 and the Dow are confirming intraday breakouts hinting at a flip to the green.