Counting Sheep

For me, sleeping is both a blessing and a curse. While I love nothing more than laying in bed after a long day, I hate waking up. That sounded pretty cryptic so let me clarify. When I wake up, my mouth is as dry as the Sahara and my throat feels like sandpaper. To begin with, I am not a morning person, so if you cross my path before I have had my coffee, don’t take it personally.

The morning symptoms I have been experiencing are commonly associated with xerostomia. For context, xerostomia refers to a condition where the salivary glands in the mouth do not make enough saliva, which causes “dry mouth.” However, xerostomia is more common in people with obstructive sleep apnea (OSA) who snore or breathe through their mouth by habit.

As a filthy mouth breather myself, I am especially prone to dry mouth. According to a study published in the Journal of Sleep Research, more than 30% of participants with OSA experienced morning dry mouth. If you’re reading this and have experienced similar symptoms, you may have sleep apnea. In North America, the estimated prevalence of OSA is 15-30% in males and 10-15% in females.

Based on a total of 11.6 million nights of data, the global prevalence of OSA sits at approximately 22.6%. In the United States (US), sleep apnea affects around 20% of adults, yet 90% of these cases are undiagnosed. Keep in mind that most of the official statistics referenced thus far do not take into account undiagnosed cases. Now, what if I told you there may soon be hope for those of us who remain undiagnosed?

ResApp Health Limited

- $111.761M Market Capitalization

ResApp Health Limited (RAP.AX) develops digital healthcare solutions aimed at assisting medical professionals and their patients. In particular, the Company’s solutions are intended to assist in the diagnosis and management of respiratory diseases. ResApp’s digital diagnostics tools only require a smartphone and are designed for seamless integration into existing telehealth solutions.

ResApp is developing products for acute disease diagnosis, chronic disease management, and sleep apnea. Overall, ResApp is using machine learning to create highly-accurate algorithms capable of diagnosing diseases based on cough and respiratory sounds. The Company’s machine learning algorithms have also shown potential in detecting exacerbations in patients with asthma or COPD.

Latest News

On April 11, 2022, ResApp announced that it had entered into a binding scheme implementation deed with Pfizer Australia Holdings Pty Limited. As you probably could have guessed by the name, Pfizer Australia represents Pfizer Inc.’s (PFE.NYSE) wholly-owned Australian subsidiary. According to the terms of the agreement, Pfizer is set to acquire 100% of ResApp for a total of A$100 million.

“The proposed acquisition recognizes the years of dedicated work by the ResApp team to build ResApp into a leader in the audio-based analysis of respiratory health. We believe that the material premium and certainty of an all-cash consideration is an attractive outcome for our shareholders,” said Tony Keating, CEO and Managing Director of ResApp.

In addition to the proposed acquisition, ResApp has entered into a Research and Development License Agreement with Pfizer, whereby the two companies will collaborate to research and develop products related to COVID-19. This agreement is effective for a six-month term with the option of two extensions for three months each.

Now, let’s get back to the “hope” I mentioned earlier with regard to sleep apnea. More recently, on July 6, 2022, ResApp announced that its SleepCheckRx has received 510(k) clearance as a prescription-only software-as-a-medical device from the US Food and Drug Administration (FDA). Having acquired clearance, the Company is now permitted to commercially market SleepCheckRx in the US.

“We are delighted to have secured FDA clearance for SleepCheckRx…By using SleepCheckRx, physicians will have the opportunity to screen their patients conveniently and quickly for sleep apnoea, helping their patients take the first step to getting treatment,” commented Tony Keating.

SleepCheckRx is an at-home sleep test capable of screening adults for moderate to severe OSA. Using ResApp’s machine learning algorithms, SleepCheckRx analyzes breathing and snoring sounds recorded on an Apple iPhone. Don’t get too upset Android lovers! The Company is shooting for 510(k) clearance for Android devices at some point in the future.

Unfortunately, SleepCheckRx isn’t openly available to the public. The application is only available to patients via prescription from their healthcare provider. Using a special code, patients are then able to download SleepCheckRx from the App Store. Results from the application are then uploaded to a healthcare provider portal. If you hate going to the doctor like me then you are SOL.

In terms of efficacy, an at-home clinical trial of 220 patients revealed that SleepCheckRx was able to accurately identify 89.3% of patients with OSA, and achieved a specificity of 77.6%. To put things into perspective, studies suggest that between 20-60% of people with OSA may be misdiagnosed. With this in mind, SleepCheckRx appears to at least be on par with polysomnography.

For context, ResApp’s clinical study evaluated SleepCheckRx in comparison to polysomnography, which is currently the standard for sleep apnea diagnosis. While SleepCheckRx records and analyzes sounds, a polysomnography test records brain waves, oxygen levels in the blood, heart rate, and movement. That being said, this method of diagnosis is substantially more expensive.

ResApp’s share price opened at $0.135 on June 7, 2022, up from a previous close of $0.13. The Company’s shares were trading at $0.13 as of 4:10 PM AEST on June 7, 2022.

Ocugen Inc.

- $590.914M Market Capitalization

Ocugen Inc. (OCGN.Q) is a biotechnology company focused on the discovery, development, and commercialization of novel gene therapies, biologicals, and vaccines. Ocugen completed its initial public offering for gross proceeds of $65,000 on December 8, 2014. However, the Company began trading on the NASDAQ on December 3, 2014.

Regarding Ocugen’s vaccines, the Company has developed its COVID-19 vaccine candidate BBV152, also known as COVAXIN™ outside of the US. BBV152 has demonstrated a vaccine efficacy in mild, moderate, and severe COVID-19 cases of 77.8% with efficacy against severe COVID-19 cases of 93.4%. BBV152 has also been granted Emergency Use Listing by the WHO.

Latest News

On June 21, 2022, Ocugen announced the publication of positive results from its pediatric Phase II/III study in children aged 2-18 for the Company’s COVAXIN. As previously mentioned, COVAXIN is Ocugen’s COVID-19 vaccine candidate. One of COVAXIN’s biggest selling points is its unique formulation enabling the same dosage administered to adults to be used for children as well.

“This is encouraging development in the effort to contain this pandemic, which needs a greater variety of vaccine options to combat the multiple COVID-19 variants. We believe the distinct features of COVAXIN offer benefits that could help improve public health,” said Dr. Shankar Musunuri, Chairman, CEO, and Co-Founder of Ocugen.

Ocugen’s latest positive results are encouraging primarily due to the fact that COVAXIN is currently under clinical investigation in the US for use in adults aged 18 or older. The Company’s vaccine candidate was developed and manufactured by its partner Bharat Biotech International Limited, which is based in India. With this in mind, Ocugen has commercial rights for COVAXIN in North America.

Furthermore, Ocugen possesses emergency use authorization in Mexico for adults, however, the Company is exploring pediatric emergency use authorization as well. The Phase II/III study was conducted in six hospitals in India and included 526 children. These children were administered COVAXIN 28 days apart in three groups according to their age. Results were then compared to a previous Phase II study.

To summarize, the study had no serious or adverse events, deaths, or withdrawals due to an adverse event. With these results now published in the Lancet Infectious Diseases journal, Ocugen is now conducting follow-up studies to assess pediatric effectiveness, however, the Company is expecting similar efficacy among pediatric participants.

It should be noted that the FDA had previously placed a clinical hold on its Phase II/III study for COVAXIN. The FDA’s decision came shortly after the World Health Organization (WHO) suspended the supply of COVAXIN on April 2, 2022, following an inspection of Bharat’s manufacturing facilities.

During inspections, WHO identified deficiencies in Bharat’s Good Manufacturing Practices (GMP). However, it didn’t take long before the FDA announced that it had lifted the clinical hold on May 23, 2022.

In addition to its vaccine candidate, Ocugen has made progress toward the prevention and treatment of ocular diseases and disorders associated with retinal degenerative disease. On June 13, 2022, the Company announced that it had received a patent from the US Patent and Trademark Office (USPTO), which covers the use of a nuclear hormone receptor gene to treat and prevent retinal degenerative diseases.

“We are pleased to have been granted this new U.S. patent through our exclusive license agreement with The Schepens Eye Research Institute, an affiliate of Harvard Medical School. We believe this patent significantly validates our modifier gene therapy platform,” commented Dr. Shankar Musunuri.

To date, Ocugen has three product candidates related to the treatment and prevention of various retinal degenerative diseases, including OCU400, OCU410, and OCU200. With this in mind, Ocugen’s latest Patent No. 11,351,225 is comprised of 18 claims pertaining to the use of a nuclear receptor gene to treat retinitis pigmentosa, age-related macular degeneration, and inherited retinal degenerative diseases.

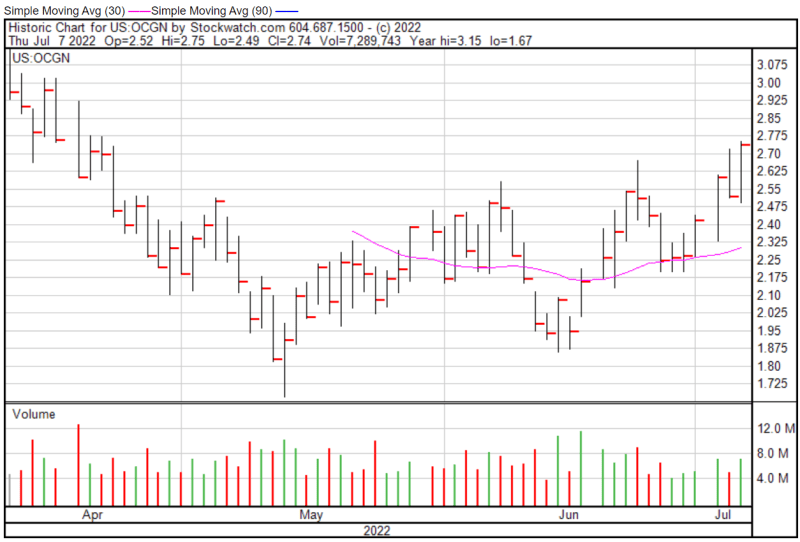

Ocugen’s share price opened at $2.52 on July 7, 2022, compared to a previous close of $2.52. The Company’s shares were up 8.73% and were trading at $2.74 as of 4:00 PM EDT.

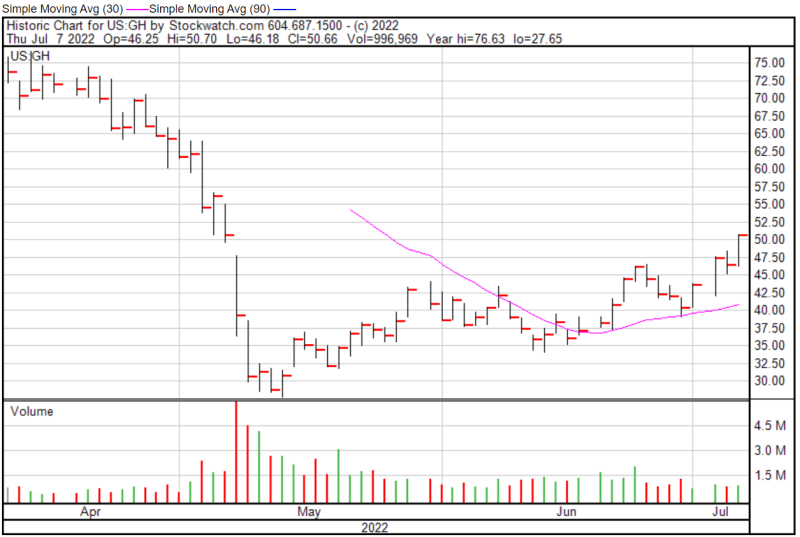

Guardant Health Inc.

- $5.163B Market Capitalization

Guardant Health Inc. (GH.Q) is a leading precision oncology company focused on conquering cancer through its proprietary tests, data sets, and analytics. The Company’s platform leverages capabilities to drive commercial adoption, improve patient outcomes, and lower healthcare costs across all stages of cancer treatment. Included in Guardant’s commercial portfolio is Guardant360.

The aforementioned tests are intended for advanced-stage cancer patients, however, the Company has also developed Guardant Reveal for early-stage cancer patients. Guardant is also committed to screening for cancer. The Company’s portfolio of screening tests includes Guardant Shield, which aims to address the needs of individuals eligible for cancer screening, including CRC screening.

Latest News

On July 6, 2022, Guardant announced a strategic partnership with Adicon Holdings Ltd. To provide some context, Adicon is an independent clinical laboratory company based in China. Through this partnership, Guardant will offer its genomic profiling (CGP) tests to biopharmaceutical companies conducting clinical trials in China.

“Our partnership with Adicon marks another important milestone for Guardant Health, and we are excited to bring our comprehensive genomic profiling tests and services to researchers in China,” said Helmy Eltoukhy, Guardant Health co-CEO.

More specifically, Guardant will license Guardant360, GuardantOMNI, and Guardant360 TissueNext tissue-based biopsy tests. Additionally, Guardant Reveal will be offered to biopharmaceutical companies to assist in early-stage cancer research and development. Cumulatively, Guardant’s latest partnership is expected to assist researchers in streamlining patient screening and enrollment, among other benefits.

Last month, on June 13, 2022, Guardant announced that it had purchased the remaining shares of Guardant Health AMEA Inc (GHA). Previously, GHA was held by SoftBank and its affiliates, however, having purchased the remaining shares of the company, Guardant now has complete control over operations throughout the regions of Asia, the Middle East, and Africa (AMEA).

“By acquiring the remaining shares of Guardant Health AMEA, we can focus on creating a unified and centralized global organization that delivers on our promise to help conquer cancer and improve patient outcomes,” said Helmy Eltoukhy.

To clear up any confusion, GHA was initially created as a Joint Venture (JV) between Guardant and SoftBank in May 2018. The JV was intended to expand the commercialization of Guardant’s technology. The Company has now paid approximately $177.8 million to acquire the remaining equity interest held by SoftBank and its affiliates.

Having acquired 100% of GHA, Guardant plans to prioritize bringing blood-based testing to healthcare providers and patients with advanced cancer in Japan. Keep in mind that the Japanese Ministry of Health has already granted regulatory approval for Guardant360 CDx as of March 14, 2022.

Guardant’s share price opened at $46.25 on July 7, 2022, down from a previous close of $46.52. The Company’s shares were up 8.90% and were trading at $50.66 as of 4:00 PM EDT.