If you check your stock screeners, you will see one stock standing out in the “top gainers” category. That stock is Ocean Bio-Chem Inc with a nice 117% plus gainer at time of writing today.

Rippy rippy! The stock closed at $5.92 yesterday only to open at $12.80 on June 22nd 2022.

Ocean Bio-Chem, Inc. manufactures, markets, and distributes a broad line of appearance and maintenance products for the marine, automotive, power sports, recreational vehicle, and outdoor power equipment markets under the Star brite®, Star Tron®, Odor Star® and other brand names within the United States of America and Canada.

The Company manufactures, markets, and distributes a line of disinfectant, sanitizing and deodorizing products under the Performacide® and Star brite® brand names. In addition, the Company produces private label formulations of many of its products for various customers and provides custom blending and packaging services for these and other products.

The company is now being acquired by OneWater Marine Inc. The acquisition will be for $13.08 per share in an all-cash transaction valued at approximately $125 million. Ocean Bio-Chem’s board of directors has unanimously approved the transaction. As part of the transaction, OneWater will also acquire OBCI’s affiliate, Star Brite Europe, Inc. Upon closing of the transaction, both OBCI and Star Brite Europe, Inc. will be integrated into T-H Marine Supplies, LLC, OneWater’s subsidiary and strategic growth platform for parts and accessories businesses.

“Ocean Bio-Chem brings aboard a suite of iconic brands and consumable products to the OneWater portfolio, and we are thrilled that OBCI’s experienced and highly regarded team will be joining us,” said Austin Singleton, Chief Executive Officer for OneWater. “OneWater has made great strides in establishing a parts and accessories business, utilizing our acquisition platform to further enhance our higher-margin businesses, helping to insulate us from the industry cyclicality of new boat sales. With a demonstrated track record of growth, OBCI’s shared values and consistent performance make it a tremendous addition to the OneWater family.”

“We are excited to be joining a team as passionate about their business as we are. With OneWater’s support and resources, we can implement promising new product lines. At the same time, we can also each leverage sales relationships across a combined portfolio to continue our histories of profitable growth,” said Peter Dornau, Chief Executive Officer and President of Ocean Bio-Chem.

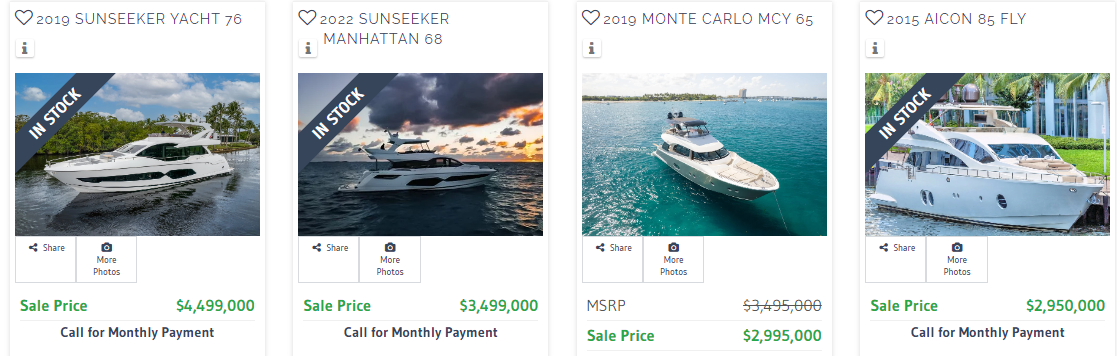

A little bit on OneWater Inc…because the chart really caught my attention! Oh and seriously check out their inventory here. If you have a few million to spare, there are some really nice boats!

OneWater Marine Inc. is one of the largest and fastest-growing premium marine retailers in the United States. OneWater operates a total of 96 retail locations, 10 distribution centers/warehouses and multiple online marketplaces in 20 different states, several of which are in the top twenty states for marine retail expenditures.

OneWater offers a broad range of products and services and has diversified revenue streams, which include the sale of new and pre-owned boats, finance and insurance products, parts and accessories, maintenance, repair and other services.

In terms of resources used for the acquisition, OneWater will finance the transaction with an extension of its term loan facility and has received a commitment letter to be executed following the transaction closing. The transaction is expected to close during the Company’s fiscal fourth quarter 2022, which ends September 30, 2022.

OneWater currently has a market cap of $518 million.

When it comes to the technicals, OneWater Marine has a chart set up that I cannot ignore. This is going into the watchlist.

2022 has been rough for the stock. We broke down below $46 support, and hit lows of just under $30.00 per share. But when it comes to market structure, pay attention to the recent price action.

OneWater Marine has ranged for months! We are holding the range with lows at $30 and highs at $37.25. We even held onto this range as broader stock markets sold off hard! To me, this is a positive sign. It is telling me that the selling pressure has been exhausted. We are building a strong base which will act as the platform for the new uptrend move.

How to play this? Well one can enter the lows of the range at around $30. You would nestle your stop loss below the support just in case we break down. The safest and prudent way to play the range is wait for the breakout above $37.25. First of all, this triggers the range. Second of all, the trigger ensures your money is not tied up for months as the stock continues to range. Sure you might miss on some of the move, but the breakout initiates the new uptrend. Our job is to ride that uptrend as we attempt to reclaim $46.

The technicals look good, and OneWater has fundamental news with the acquisition of Ocean Bio-Chem. A winning combination for sustained momentum once we get the technical breakout!