Well, the highly anticipated Federal Reserve Interest Rate Decision has come to pass. The Fed raised interest rates by 0.50% as expected. This is the biggest rate increase since 2000. May 2000 to be exact.

The markets loved it. We had big green candles with the Dow even gaining 800 points. But we will get to the charts in just a bit. At time of writing, US markets have already given up most of the gains from the Fed rally.

The hiked rates and gave an update on the tapering of the Fed balance sheet. The good news? It won’t be to the tune of $95 Billion per month.

I took down some notes from the Powell press conference because there were 3 things I was looking for.

First, if the Fed could surprise and hike more than 50 basis points in the next meeting. Powell put this to rest by saying, “So a 75-basis-point increase is not something that committee is actively considering,” Powell said. “I think expectations are that we’ll start to see inflation, you know, flattening out.”

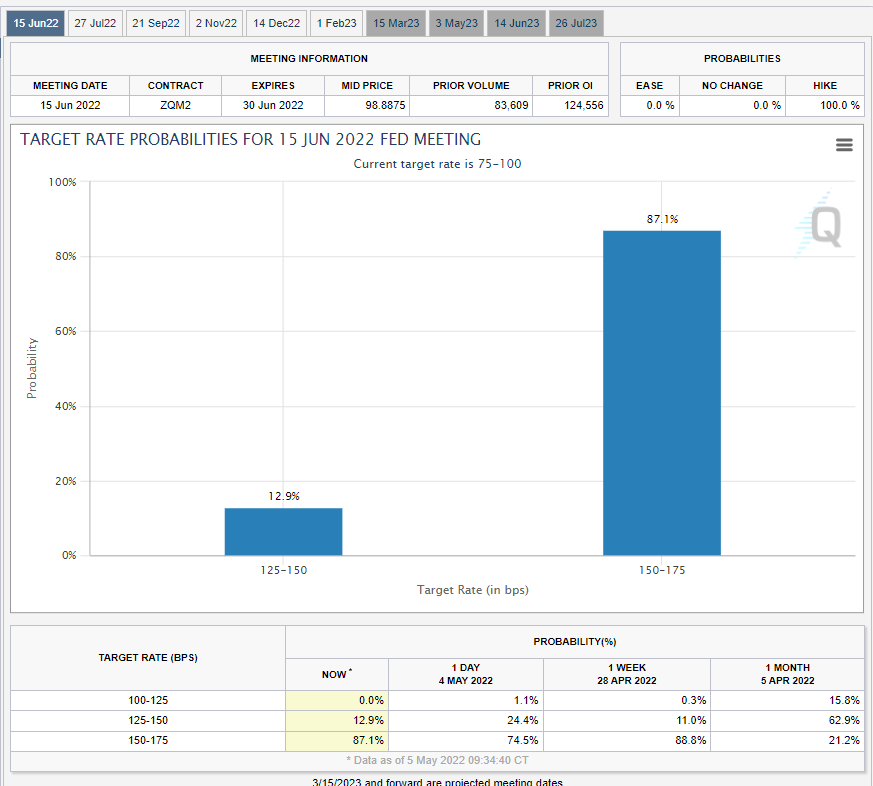

Powell did say that more 50 basis point hikes could be coming in the next FOMC meetings. Going forward, keep your eyes on the CME FedWatch tool for rate hike expectations. The market is expecting another 50 basis point hike in June.

On the balance sheet reduction, the Fed is taking a slower approach. Balance sheet reduction will begin in June. Starting June 1st, the plan will see $30 billion of Treasurys and $17.5 billion on mortgage-backed securities roll off. After three months, the cap for Treasurys will increase to $60 billion and $35 billion for mortgages.

Some have even gone to say that the Fed is ‘dovish’ on the balance sheet.

Finally, when it came to inflation expectations and economic uncertainty, China has been included to the list:

The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain. The invasion and related events are creating additional upward pressure on inflation and are likely to weigh on economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. The Committee is highly attentive to inflation risks.

I think this is going under the radar, but to me, it just adds more to the economic uncertainty. And to non-monetary inflationary pressures.

Going forward, we should expect the Fed to continue to rate hike. But recall what I said before on the current market sell off. Inflation is likely to be the ‘permanent’ kind rather than ‘temporary’. The Fed has to either tame inflation or keep assets propped.

Let’s not forget that the US is one quarter away from a recession. CNBC breaking headlines from yesterday read as follows: Dow rallies 900 points as investors bet the Fed can slow inflation without causing a recession. I’m not too sure about that.

The ten year yield is now rising above 3%. Bond markets are expecting higher interest rates. The 10 year yield is important because it may drive money out of the stock market and into bonds for yields like this. However, in real terms, these bonds are still yielding negative if inflation is coming in higher than 8%.

This is the chart that you need to pay attention to. The US Dollar broke down below a range post Fed. It looked like the Dollar would pull back. Instead, we shot back. The Dollar is now likely to confirm a false breakdown. I say likely because the daily candle could still theoretically sell off and close back below 103. Crazier things have happened.

But the Dollar could breakout to the upside instead, pointing to a hawkish Fed… or for those who follow my work, I do expect the Dollar to be the best performing currency as the rest of the world goes to sh*t. Dollar Milkshake Theory anyone? This Dollar rise has me worried that we are there.

US markets are giving back their gains from the post Fed rally. Not really the price action you want to see the day after a massive rally. I posted an article titled, “Is the Fed about to crash the stock markets?“. Take a look at the weekly reversal pattern charts I have highlighted in that article and for our members on Equity Guru’s discord channel. Unless we can close above the 4150 neckline on the weekly chart, the downtrend for equity markets still stands. The technicals are super important folks.

For the bulls, there could be some positives. Instead of breaking below recent lows, the US markets might just range here. If so, then the bulls have a chance of winning this battle. We then just need the breakout above 4300 to trigger the next upside move. Perhaps when the markets realize that a recession is likely to happen which means the Fed would need to pause or reverse policy. Contrary to the CNBC headline, it’s about how much more can the Fed hike rates before something breaks or they cause a recession?