A Genetic Link

I recently started watching Netflix’s Archive 81 with my girlfriend. Although we have only watched the first episode, there is a clear focus on mental health. It is referenced multiple times in the first episode, specifically in relation to the protagonist’s ‘mental breakdown,’ which supposedly happened at some point in his past. Following his breakdown, the protagonist was institutionalized.

While the show appears to be based on cults and demons, I can see the narrative taking a complete 180° similar to Shutter Island. In the first episode, a character named Jess seems to see something in the background and begins to convulse, as if having a seizure. Needless to say, Archive 81 really got me thinking about mental health. In particular, I am curious to see how schizophrenia is represented in the show, if at all.

In general, schizophrenia is a bastard of a mental illness, affecting approximately 24 million people, or 1 in 300 people. With this in mind, schizophrenia is not as common as other mental illnesses, however, people living with schizophrenia are two to three times more likely to die early compared to the general population.

So, what causes schizophrenia? According to research, it is thought that interaction between genes and a range of environmental factors may cause this mental illness. That being said, no single cause has been identified, however, new research from arguably the largest genome-wide association study has identified genetic mutations and changes in neuron function as potential causes of schizophrenia.

The study was conducted by researchers across 45 countries to analyze the DNA of more than 320,000 people, nearly a quarter of which had schizophrenia. In summary, the study found genetic links to schizophrenia in more than 280 different regions in the genome, with genetic risks most concentrated in the neurons.

Furthermore, 10 rare mutations were identified that disrupt proteins and can increase a person’s risk of schizophrenia, with one mutation increasing the risk 20-fold. With this in mind, there are therapies for schizophrenia in development, fueling the Schizophrenia Drug Market, which is expected to reach USD$9.3 billion by 2026. Let’s talk about a company with one such therapy in the pipeline.

Karuna Therapeutics Inc.

- $4.01B Market Capitalization

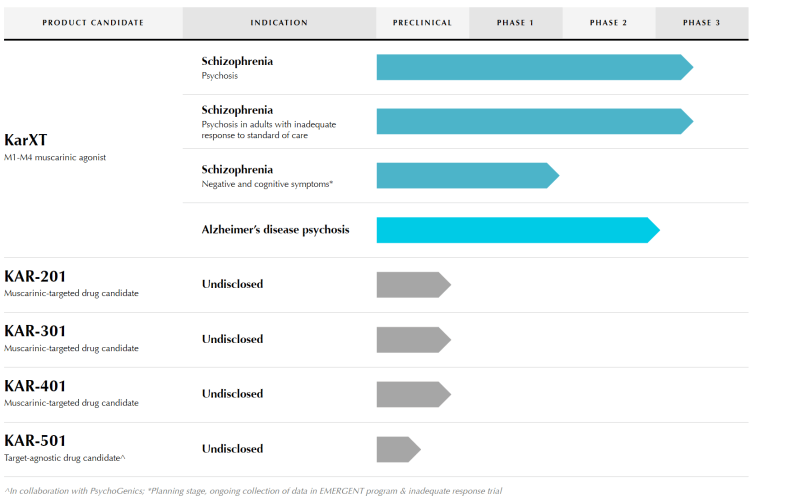

Karuna Therapeutics Inc. (KRTX.Q) is a clinical-stage biopharmaceutical company focused on the development of transformative medicines for people living with psychiatric and neurological conditions, such as schizophrenia. Speaking of which, the Company’s lead candidate KarXT is currently under development as an investigational treatment for schizophrenia and dementia-related psychosis (DRP).

KarXT is an oral modular of muscarinic receptors that are located both in the central nervous system (CNS) and various peripheral tissues. KarXT combines xanomeline, a novel muscarinic agonist, with trospium, an approved muscarinic antagonist, to stimulate muscarinic receptors in the CNS. In doing so, KarXT is intended to provide therapeutic benefits for mental illnesses including schizophrenia.

Latest News

On February 24, 2022, Karuna announced its financial results for Q4 2021 and FY2021, as well as provided a general business update. While I won’t be focusing too much on the financials, I will provide a quick overview of the Company’s FY2021 results. In total, as of December 31, 2021, Karuna ended the year with $494 million in cash and cash equivalents, up from $322.3 million on December 31, 2020.

“Looking ahead, we are dedicated to expanding and diversifying our development efforts and capabilities…as evidenced by our strategic collaboration with Zai Lab in Greater China and the growth of our commercial organization in preparation for a potential launch in the US,” said Steve Paul, M.D., CEO, President, and Chairman of Karuna.

For the year ended 2021, the Company reported a net loss of $143.8 million compared to $68.6 million for the year prior. Karuna attributes its increased net loss to higher operating expenses, which totaled $180.8 million compared to $71.8 million in 2020. However, the Company’s operating expenses were partially offset by an increase in revenue of $37 million.

This increase in revenue is directly related to Karuna’s exclusive licensing agreement with Zai Labs on November 9, 2021. According to the terms of the agreement, Zai Labs will fund substantially all development, regulatory, and commercialization activities in Greater China, including mainland China, Hong Kong, Macau, and Taiwan.

Looking forward, Karuna intends to initiate a Phase 3 program evaluating KarXT for the treatment of psychosis in Alzheimer’s disease. Moreover, the Company expects to release topline data from its Phase 3 EMERGENT-2 trial and EMERGENT-3 trial. Study results for EMERGENT-2 and EMERGENT-3 are expected for mid-2022 and 2H 2022, respectively.

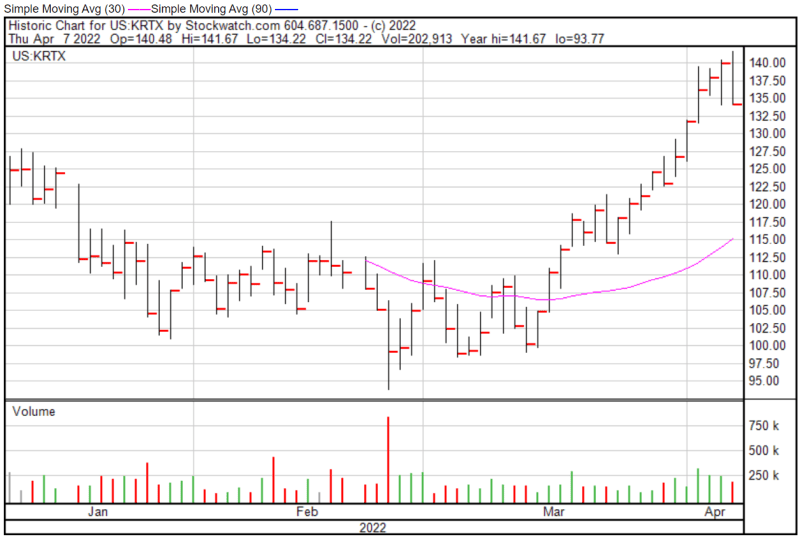

Karuna’s share price opened at $140.50 today, up from a previous close of $140.02. The Company’s shares were down -4.04% and were trading at $134.36 as of 1:29 PM EST.

Sunshine Biopharma Inc.

- $60.247M Market Capitalization

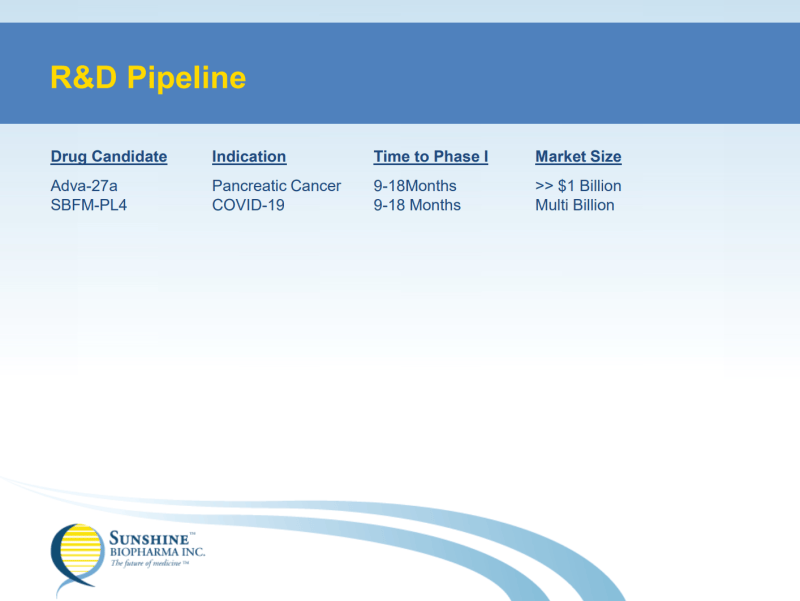

Sunshine Biopharma Inc. (SBFM.Q) is a biopharmaceutical company focused on the development of Adva-27a, a small molecule that has been shown to be exceptionally effective at destroying Multidrug-Resistant (MDR) Cancer Cells. This includes pancreatic cancer cells, small-cell lung cancer cells, breast cancer cells, and uterine sarcoma cells. It is worth noting that Adva-27a is the only known compound capable of destroying MDR cancer cells.

With this in mind, Sunshine Biopharma is the direct owner of all worldwide patents covering Adva-27a, including all issued and pending patents. In addition to Adva-27a, the Company is working on the development of a treatment for COVID-19 and has completed synthesis for four potential inhibitors. However, if you have been keeping up with Sunshine Biopharma, you’d know that’s not all.

Latest News

On April 5, 2022, the Company announced that two of its newly designed mRNA molecules are effective at destroying cancer cells grown in culture. Cytotoxicity tests were performed on a variety of cancer cells, including MDR breast cancer cells, ovarian adenocarcinoma cells, and pancreatic cells. Toxicity studies using normal human cells showed that the Company’s mRNA molecules had little or no cytotoxic effects.

We are delighted by these findings in connection with our ongoing mRNA-as-therapeutic-agents research…The potential use of mRNA to treat cancer opens the door to many possibilities for patients including convenience, reduced toxicity, and enhanced efficacy,” said Dr. Steve Slilaty, CEO of Sunshine Biopharma.

To provide some background, cytotoxicity tests are traditionally used to evaluate the general toxicity of medical devices and materials, in this case, Sunshine Biopharma’s new mRNAs. According to Nelson Labs, a medical device or material will fail if cytotoxic reactivity is higher than what is permitted by the ANSI/AAMI/ISO 10993-5 standard, which encompasses a variety of cytotoxicity test methods.

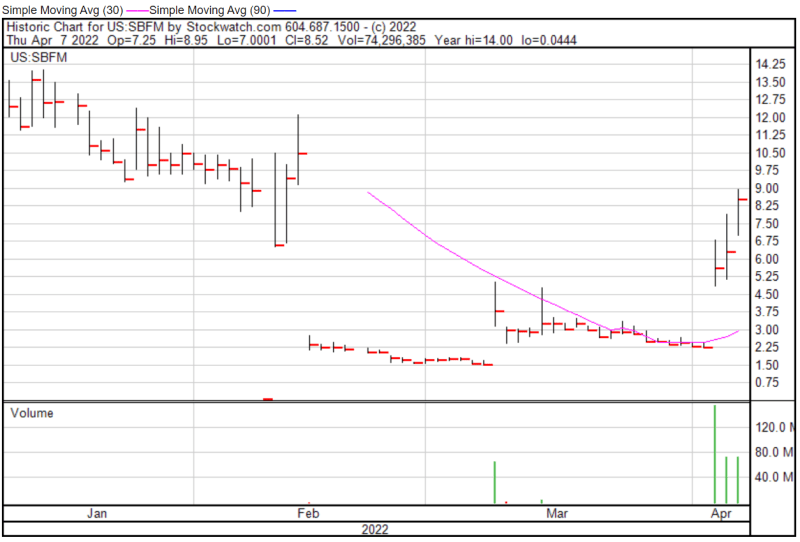

With this in mind, seeing as Sunshine Biopharma’s mRNAs had ‘little to no effect,” on normal human cells, I think it’s safe to say that the Company has made quite a breakthrough. That would explain why the Company’s shares skyrocketed 130% following the news. Speaking of which, if you’d like to know more about the technicals surrounding Sunshine Biopharma’s latest news, check out this article!

Like a cherry on top, it should be noted that the Company’s new mRNAs are readily adaptable for delivery in patients using the mRNA vaccine technology. Upcoming, Sunshine Biopharma anticipates filing a patent application in connection with these positive results.

Sunshine Biopharma’s share price opened at $7.25 today, up from a previous close of $6.29. The Company’s shares were up 32% and were trading at $8.30 as of 1:43 PM EST.

Tetra Bio-Pharma

- $29.031M Market Capitalization

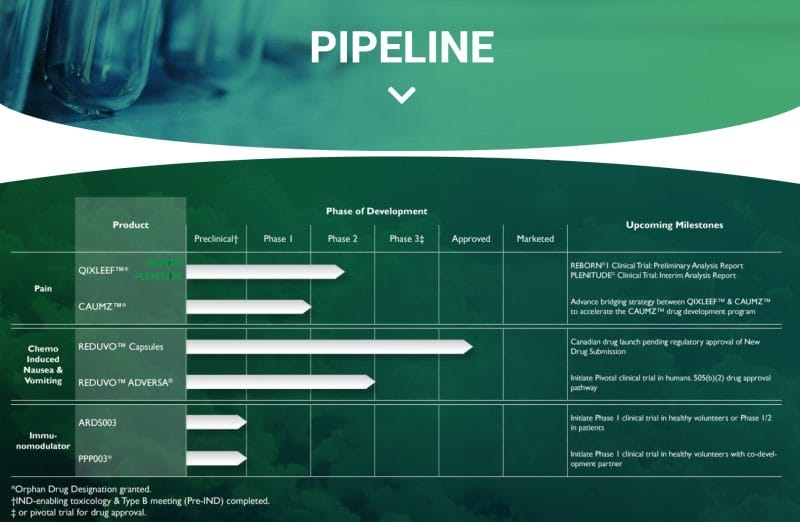

Tetra Bio-Pharma Inc. (TBP.T) is a biopharmaceutical company focused on cannabinoid-derived drug discovery and development. The Company has an FDA and Health Canada cleared clinical program intended to bring novel prescription drugs and treatment to patients and their healthcare providers. Tetra is specialized in combining the traditional methods of medicinal cannabis with supporting scientific validation and safety data.

Furthermore, Tetra’s evidence-based scientific approach has enabled the Company to develop an extensive pipeline of drug products for a range of medical conditions, including pain, inflammation, and oncology. Tetra’s current product pipeline includes QIXLEEF and CAUMZ for pain, REDUVO and REDUVO ADVERSA for chemo-induced nausea, and ARDS003 and PPP003 as immunomodulators.

Latest News

On March 17, 2022, Tetra announced that it has received a response letter for a Type C meeting with the FDA for QIXLEEF, the Company’s inhaled cannabinoid-based product. To be more specific, QIXLEEF is a botanical therapy with a fixed dosage of THC and CBD inhaled using a medical vaporizer. QIXLEEF is intended to serve as an alternative to morphine sulfate immediate release (MSIR) for the treatment of breakthrough pain.

“The FDA guidance will pave the way for marketing approval and allow the Company to elaborate a cost-effective strategy as part of the drug development program. To date, our data shows that QIXLEEF™ might become an alternative analgesic to reduce the use of opioids in patients with severe or chronic pain. An alternative to opioids is long overdue” said Guy Chamberland, CEO and CRO of Tetra Bio-Pharma Inc.

During the Type C meeting, the FDA provided guidance on Tetra’s nonclinical safety program, which is required to submit a marketing application. To summarize, the FDA expressed previous concerns related to the disproportionate amount of CBD metabolite, 7-COOH-CBD, that was found in humans treated with Epidiolex™, the first FDA-approved CBD oral solution, compared to animals.

Keep in mind that the high amount of 7-COOH-CBD was correlated to hepatotoxicity raising a safety concern regarding CBD usage in humans. With this in mind, the FDA has defined drug metabolite testing in animals as a prerequisite. An additional study published in Science Direct compared an inhaled CBD formulation with Epidiolex.

Results demonstrated that the maximum concentration of CBD for the inhaled powder was 71-fold higher than Epidiolex while administering 24-fold less CBD. With this in mind, inhaled CBD indicated a more rapid onset and increased bioavailability than oral CBD.

However, unlike Epidiolex, Tetra was able to demonstrate that 7-COOH-CBD is only 2.5 times higher in subjects inhaling QIXLEEF compared to 40 times higher in CBD oral administration, further supporting the Company’s inhaled solution. Additionally, the FDA requires a more exhaustive assessment of brain histopathology, seeing as the inhalation route of administration facilitates QIXLEEF delivery to the brain.

A carcinogenicity assessment is also required as QIXLEEF is intended to be administered on a chronic basis for long-term usage in patients living with pain. Accordingly, the Company will provide the FDA with a bridging strategy to ensure that the risks to patients who are pregnant, are at risk of becoming pregnant, or are breastfeeding are adequately characterized.

Tetra’s share price opened at $0.075 today, up from a previous close of $0.070. The Company’s shares were trading at $0.07 at closing.

Perimeter Medical Imaging AI Inc.

- $180.32M Market Capitalization

Perimeter Medical Imaging AI Inc. (PINK.V) is a medical technology company transforming cancer surgery with ultra-high resolution, real-time, advanced imaging tools to address unmet medical needs. With this in mind, Perimeter’s S-Series Optical Coherence Tomography (OCT) platform is capable of delivering 2mm subsurface imaging of excised tissue margins, allowing surgeons to make informed decisions in real-time during an operation.

Ultimately, Perimeter’s technology is intended to reduce the prevalence of positive margins during breast-conserving surgery (BCS). Positive margin refers to when a pathologist finds cancer cells at the edge of the tissue, suggesting that the cancerous legion has not been removed during BCS. That being said, breast cancer recurrence risk doubles when positive margins are not excised, with 48% complication rates for re-operations. For a closer look at Perimeter, check out this article.

Latest News

On April 1, 2022, Perimeter announced that it will be participating in the Lythan Partners Spring 2022 Investor Conference taking place virtually from April 4 to April 7, 2022. Here, the Company will conduct one-on-one meetings with investors and participate in a panel discussion.

Additionally, Perimeter has been selected to present at NobleCon18 taking place from April 19 to April 20, 2022. Perimeter will also conduct one-on-one meetings with investors and host a Company presentation at the 2022 Bloom Burton & Co. Healthcare Investor Conference on May 2, 2022.

On March 10, 2022, Perimeter announced that it will be participating in numerous industry events and conferences. This includes the Society of Surgical Oncology’s International Conference on Surgical Cancer Care (SSO 2022), the National Consortium of Breast Centers’ 31st Interdisciplinary Breast Center Conference (NCoBC 2022), and the 23rd Annual Meeting of the American Society of Breast Surgeons (ASBrS 2022).

At the time of writing this article, the SSO 2022 and NCoBC conferences have already passed, however, the ASBrS 2022 conference will take place in Las Vegas, Nevada from April 6-10, 2022. It is worth noting that this date is subject to change. If you are interested, details related to Perimeter’s presentations and webcasts can be found on the Company’s website. I get it, this news isn’t the most exciting or relevant.

If you’re looking for something with a little more substance, check out this article for a deeper look at Perimeter and some of the Company’s biggest news. This includes the expansion of Perimeter’s ongoing pivotal study assessing the Company’s Perimeter B-Series OCT imaging platform combined with ImgAssist AI. The study will examine this combination’s impact on positive margin rates during BCS.

Perimeter’s share price opened at $2.82 today, down from a previous close of $2.87. The Company’s shares were up 2.09% and were trading at 2:56 PM EST.