The commodity super rally continues. Nickel is making all the headlines. Don’t worry my Gold and Silver bugs. I will have you covered tomorrow. As someone who has been saying buy commodities for the inflation trade (not for war-fueled supply chain disruptions because you know…I don’t have a crystal ball), we have been having a great few weeks here.

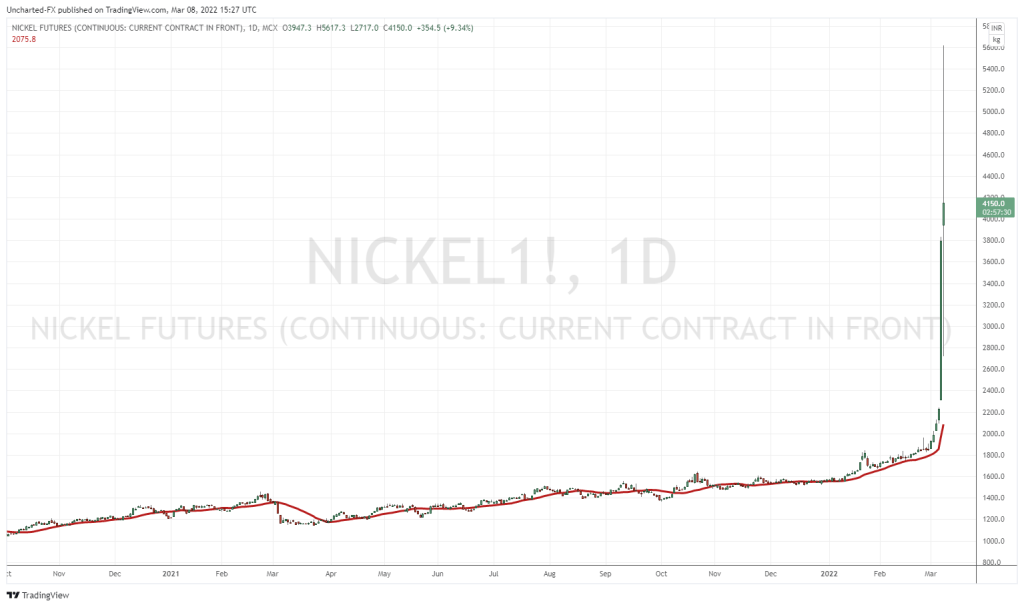

Nickel Prices took off yesterday. And they keep on making amazing moves today.

Nickel has moved as much as 250% in just two days! It got so out of hand earlier on that the London Metal Exchange (LME) suspended trading in Nickel after an unprecedented spike above $100,000 per ton. Too many brokers were struggling to pay margin calls against unprofitable short positions. Classic short squeeze.

“This market is absolutely insane,” said ING Senior Commodities Strategist Wenyu Yao. “The fundamentals alone won’t be able to explain these prices.”

“There is little else to say about a market squeeze which has resulted in these unprecedented price moves. A short unable to deliver the necessary physical against their position apparently,” said Al Munro at brokerage Marex.

A major Chinese bank is also in the mix. A Chinese tycoon who built a massive short position in the nickel market is facing billions of dollars in mark-to-market losses as a result of the surge in prices, according to people familiar with the matter.

Chinese entrepreneur Xiang Guangda — known as “Big Shot” — has for months held a large short position on the LME through his company Tsingshan Holding Group Co., which is the world’s largest nickel and stainless steel producer, according to people familiar with the matter. In recent days, Tsingshan has been under growing pressure from its brokers to meet margin calls on that position — a market dynamic which has helped to drive prices ever higher, the people said. Tsingshan bought large amounts of nickel to reduce those short bets and its exposure to costly margin calls

Why Nickel?

The crazy thing is, with the rise in Nickel prices, the Nickel content in a Nickel 5 cent coin is now worth double!

I am sure most of us think of our 5 cent coins when it comes to Nickel. But let’s look at some fundamentals about this commodity.

Nickel is a ferrous metal, meaning it belongs to the iron group of metals. It is an industrial metal used as an alloy with metals such as Iron and Copper. Nickel is sought after because of its ductility, malleability, and corrosion resistance.

The major use for Nickel is in creating stainless steel. When steel is alloyed with Nickel, its resistance to corrosion increases dramatically. Stainless Steel is necessary for modern life. Take a look at your fridge and other appliances. The creation of Stainless Steel is by far Nickel’s largest primary application. The demand for this alloy fundamentally ensures a strong demand for Nickel. Other usages of Nickel come in the form of Nonferrous alloys, Ferrous alloys and Electroplating.

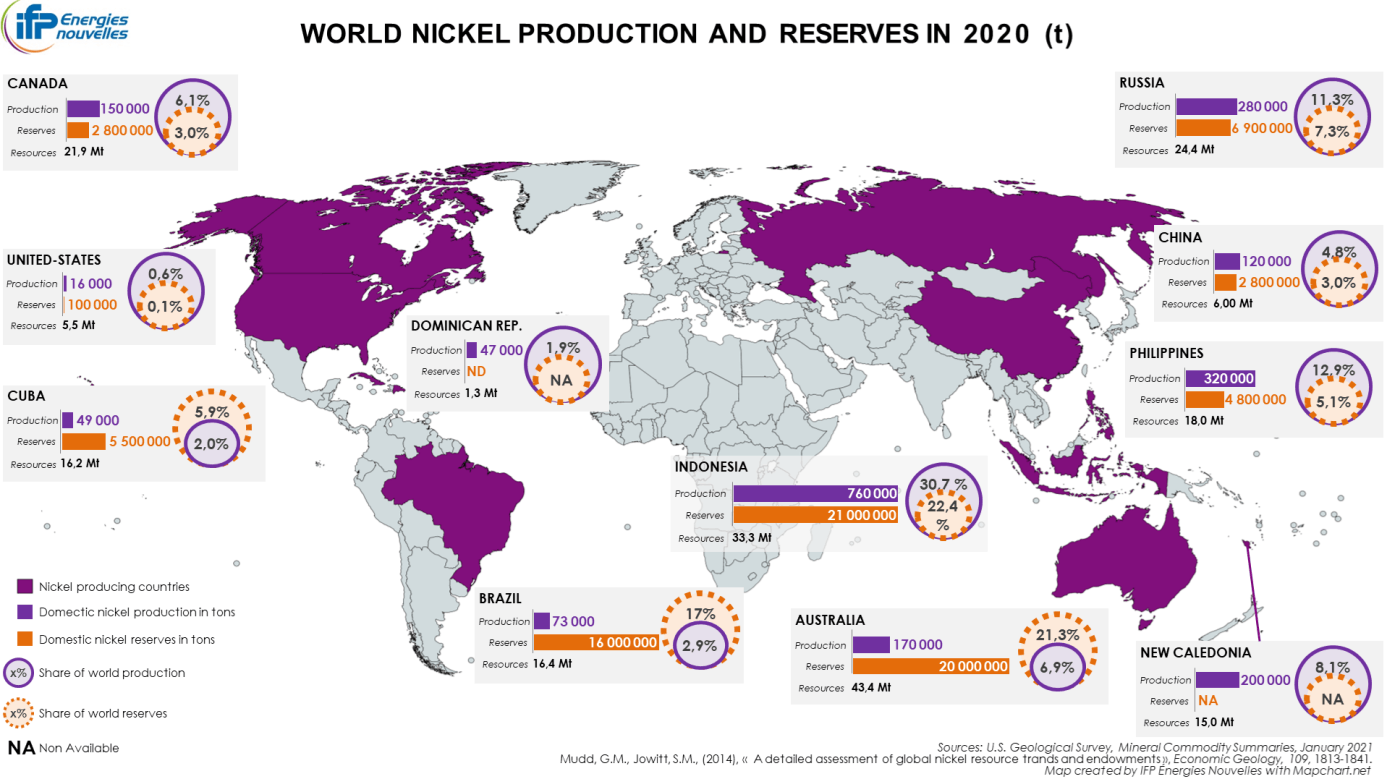

In terms of reserves, Indonesia and Australia are at the top of the list. Both nations are close to the rapidly growing nations of India and China so they have a strategic advantage.

But of course we need to talk about Russia. Russia supplies the world with about 10% of its nickel needs.

A major player in the Nickel market is Russian company Norlisk Nickel, who are one of the largest producers of Nickel in the world. The owner is the wealthiest man in Russia, Vladimir Potanin.

The stock recently got clapped due to US and other Western funds pulling out of Russian stocks. But I will be honest folks, China and India and many other Asian nations (also those part of BRICS and the SCO) will be stepping in to take Russian energy and commodity exports. When things cool down, I might even pick up some of these beaten down Russian stocks.

Perhaps the best sympathy play would be Carnegie’s famous United States Steel Corporation. With the ticker X.

Technically, it hasn’t just taken off yet. Instead, we have broken out and are pulling back to retest the breakout zone. I would watch to see if buyers step in here. So far, judging by the current daily candle, and its large wick, buyers are stepping in.

War fueled supply chain disruptions and low inventories in most metals have made markets vulnerable to volatility. I still like to throw in the inflation trade, which favors holding hard assets and commodities. Traders obviously have the current Russia-Ukraine situation at the forefront, but let’s not forget about inflation being a monetary phenomenon! I remain bullish on most commodities going further, with a bit of a bias leaning towards the precious metals.

When things cool down, I might even pick up some of these beaten down Russian stocks.

So that you said, do an article on the top ten best Russian stocks to buy before this is all over. Would be very interesting to throw a few bucks into the hat on that.

Good article but you should have made a small list of Canadian Nickle stocks.

Thanks! Good idea on the Russian Stocks!

I will be watching for a follow up soon