Truck Troubles

How about them truckers? While I won’t be talking about Ottawa’s trucking crisis, I will be talking about the freight transportation market as a whole. In particular, freight trucking comes with various advantages, including low packing needs and fuel costs. In 2020, the Global Freight Trucking Market was estimated at USD$2.1 trillion. By 2026, this market is expected to grow substantially, reaching USD$2.7 trillion and expanding at a compound annual growth rate (CAGR) of 4.7%.

Furthermore, the trucking industry has created a veritable wellspring of jobs in North America. In fact, the trucking companies, warehouses, and private sector in the United States employ an estimated 8.9 million people, 3.5 million of which are truck drivers. In comparison, Canada has in excess of 250,000 truck drivers. To put things into perspective, the United States economy depends on trucks to deliver almost 70% of all freight transported annually across the nation.

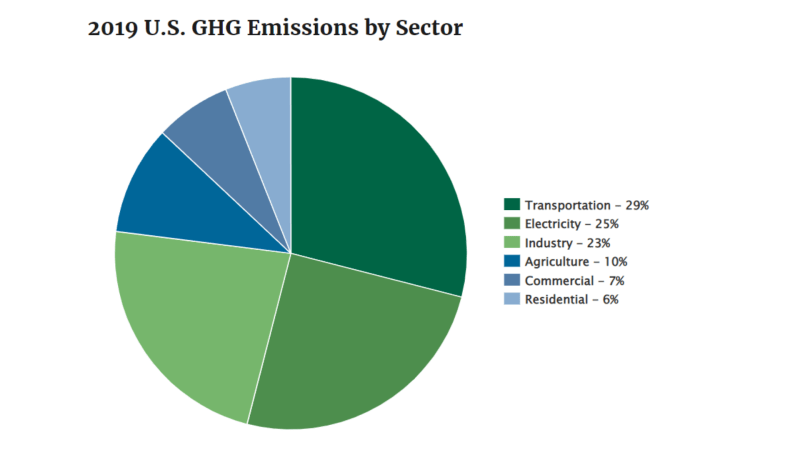

However, it’s not all sunshine and rainbows. The transportation sector is one of the largest contributors to US greenhouse gas (GHG) emissions, including carbon dioxide, methane, and nitrous oxide. According to the Inventory of US Greenhouse Gas Emissions and Sinks 1990-2019, transportation accounted for 29% of total US GHG emissions in 2019. At the time, this made the transportation sector the largest contributor to GHG emissions in the US.

According to data from Commercial Fleet, a trucking consulting group based in the United Kingdom, the carbon footprint from one truck is comparable to the carbon footprint of 14 people over the span of a year, or approximately 223 tons of carbon dioxide emissions. What’s the solution? Well, for starters, the trucking industry can adopt alternative fuel vehicles powered by batteries, hydrogen fuel cells, or biofuels. That being said, let’s take a look at a company offering a wide variety of alternative fuel vehicle solutions.

Vicinity Motor Corp.

- $144.457M Market Capitalization

Vicinity Motor Corp. (VMC.V) is a leading supplier of electric, Compressed Natural Gas (CNG), and clean-diesel buses for both public and commercial enterprise use in the US and Canada. The Company is recognized for its flagship line of Vicinity™ buses, which maintain a dominant market share in Canada. These buses are produced by Vicinity’s world-class manufacturing partners or at the Company’s Buy America Act compliant assembly facility in Washington state.

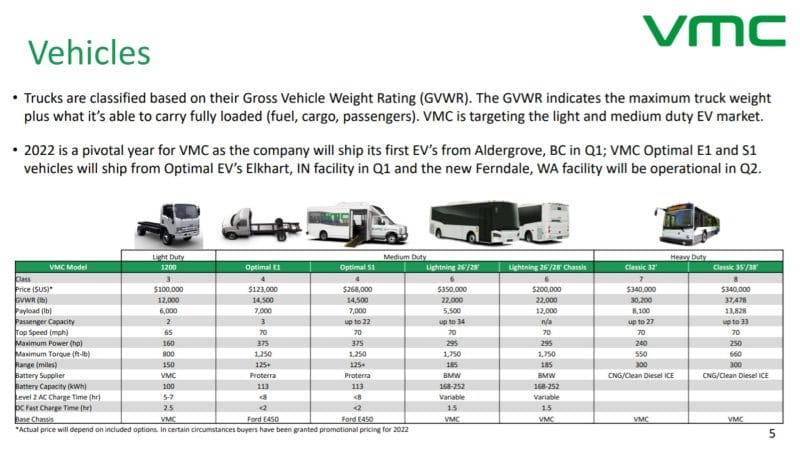

Aside from busses, Vicinity also offers green truck solutions, including the Company’s VMC 1200 and VMC Optimal E1. Vicinity’s VMC 1200 is a fully electric, Class 3 truck powered by lithium-ion battery technology, a type of rechargeable battery. The VMC 1200 is capable of providing up to 150 kWh of power and can travel up to 150 miles on a single charge. Ultimately, Vicinity designed VMC 1200 with the intention of reducing the costs and carbon emissions associated with the transportation industry.

Latest News

Speaking of Vicinity’s VMC 1200, the Company recently announced on February 1, 2022, that it has signed a sales and marketing agreement with Skydome Auto and Truck Centre Inc. For context, Skydome is an automotive dealer and service center in the Greater Toronto Area (GTA) of Ontario, Canada. According to the terms of the agreement, Vicinity will fulfill an initial order for 50 VMC 1200 electric trucks. Furthermore, Skydome has been appointed to act as Vicinity’s exclusive dealer in Brampton, Ontario.

“We are excited to begin offering the VMC 1200 in the Toronto market alongside our new sales partner, Skydome…Skydome has decades of experience serving and maintaining fleets in the region across a wide variety of vehicle types, and we believe the VMC 1200, as well as our expanding line of all-electric vehicles, will be of strong interest to their large base of customers,” said William Trainer, Founder and CEO of Vicinity Motor Corp.

Adding to Mr. Trainer’s commentary, the Skydome family of companies operates from three locations in Brampton. The dealership’s fleet center offers a variety of services for trucks, buses, ambulances, and commercial vehicles. Services include glass replacement, refinishing, metal fabrications, and rust damage restoration, to name just a few. With this in mind, Vicinity’s VMC deliveries are expected to begin with the delivery of five vehicles in Q2 2022.

Keep in mind, Toronto is putting in the work to promote the adoption and presence of electric vehicles (EV) in the GTA. For example, the city’s first Electric Vehicle Strategy was approved by City Council in January 2020. The strategy identifies actions the city can pursue to support the transition to electric light-duty vehicles such as cars, vans, trucks, and SUVs, for personal and shared use.

In order to promote this transition, Toronto is currently in the midst of developing a robust public EV charging network. Furthermore, the city is also transitioning its own fleet and transit vehicles to EVs in order to meet the city’s net-zero GHG emissions target. With this in mind, Toronto’s goal is to have 100% of transportation use low-carbon energy sources by 2050.

In addition to EV purchase incentives, Toronto’s Electric Vehicle Strategy outlines targets for the provision of publicly-accessible EV charging infrastructure. By 2025, the city hopes to have 3,000 Level 2 ports and 220 Level 3 (DCFC) chargers. What’s the difference? Put simply, one can charge an EV faster than the other. There are three variations of charging ports, namely Level 1, Level 2, and Level 3, with Level 3 being the fastest.

That being said, by 2030, Toronto intends to have an impressive 10,000 Level 2 ports and 650 Level 3 ports installed. As a denizen of the GTA, that seems awfully generous for the big city. After all, Toronto can’t seem to fix a pothole to save its life. Google “pothole” and you’ll understand just how bad it is. Either way, Toronto’s Electric Vehicle Strategy is the real deal, making Toronto prime real estate for a company like Vicinity Motor Corp. looking to sell its wares.

Financials

According to Vicinity’s Q3 2021 Financial Results, the Company’s cash and cash equivalents increased to CAD$4,956,000 on September 30, 2021, compared to CAD$1,283,000 on December 31, 2020. As of September 30, 2021, the Company’s total assets and total liabilities were CAD$38,812,000 and CAD$8,610,000, respectively. With this in mind, Vicinity’s total assets and total liabilities both decreased from CAD$47,036,000 and CAD$24,670,000, respectively.

Vicinity’s revenue decreased a substantial 67% to $2,900,000 for the three months ended September 30, 2021, compared to $8,900,000 during the same period in the previous year. The Company attributes this decrease to the delivery of just six buses in the quarter, as compared to 20 buses in Q3 2020, as a result of the pandemic and the global supply chain dilemma. This can be observed when we look at Vicinity’s results for the nine months ended September 30, 2021.

For the nine months ended September 30, 2021, the Company’s revenue grew 128% to $49,300,000 compared to $21,600,000 for the nine months ended September 30, 2020. In total, Vicinity delivered 119 buses for the nine months ended September 30, 2021, compared to 49 buses during the same period in the previous year.

Vicinity’s net loss for Q3 2021 was $4,800,000 compared to a net loss of $1,300,000 in Q3 2020. Comparatively, the Company’s net loss for the nine months ended September 30, 2021, was $3,100,00 compared to a net loss of $3,800,000 for the nine months ended September 30, 2020. Upcoming, 8,333 stock options of Vicinity at an exercise price of $7.50 will expire on March 14, 2022.

Personally, I think Vicinity is in a great position to capitalize on the EV Market, which is expected to reach USD$725.14 billion by 2026, expanding at an impressive CAGR of 27.19%. While the Company did experience notable losses following the onset of the pandemic, Vicinity’s results for the nine months ended September 30, 2021, indicate steady growth nonetheless.

With a strengthened cash position and additional EV orders underway, I would say Vicinity is doing quite well for itself. Looking forward, Vicinity expects to deliver 95 Vicinity Classic buses, 75 Vicinity Lightning™ buses and chassis, 200 VMC 1200 EV trucks, and 300 VMC Optical EVs to drive revenues of CAD$140,000,000. Currently, the Company’s 2022 firm orders total CAD$90,000,000. Pair this with a rapidly expanding EV market and I would say you have a recipe for success.

Vicinity’s share price opened at $4.00 today, up from a previous close of $3.93. The Company’s shares are up 5.34% and were trading at $4.14 as of 12:36 AM EST.