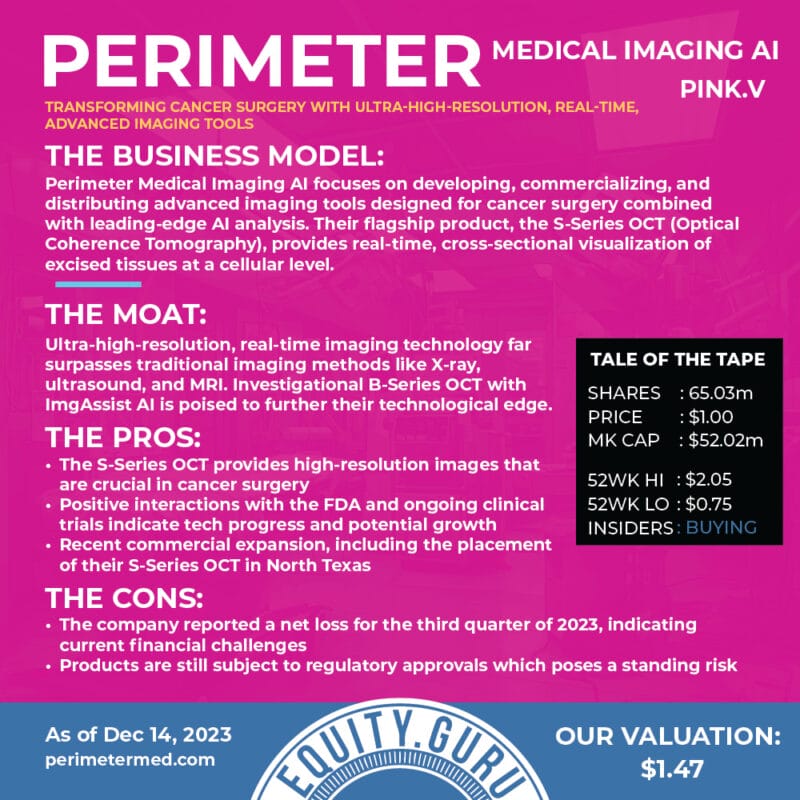

What an end to 2021 for Perimeter Medical Imaging (PINK.V). The company is a medical technology company that is driven to transform cancer surgery with ultra-high-resolution, real-time, advanced imaging tools to address areas of high unmet medical need. Now they have huge backing. The stock and the company has been a favorite of ours here at Equity Guru. I think it is safe to say that PINK was our biggest winner of 2021.

The big news which came out in mid December 2021 was the $43.4 Million CAD investment by Social Capital.

Jeremy Sobotta, Perimeter’s CEO had this to say:

“We believe Social Capital’s investment marks a transformative, pivotal event for Perimeter that will help accelerate our growth. This strategic partnering comes at a time when we are ramping up our Perimeter S-Series market development activities and commercialization efforts across the U.S., while also supporting the ongoing clinical development of our next-gen AI technologies. This financing provides us with the backing to execute upon our long-term vision to transform cancer surgery.”

Chamath Palihapitaya, the SPAC king and head of Social Capital, made these comments about Perimeter:

“Perimeter’s advanced imaging technology has the opportunity to materially improve cancer surgery outcomes. Today’s methods rely on contemporary imaging techniques, which often result in the need for additional surgery, increasing payer costs and potentially delaying subsequent treatment plans. This investment will support the commercial launch of Perimeter’s initial imaging device for breast cancer, but equally as important, we believe it can accelerate their path to become the standard of care for many other surgical applications in the future.”

The Guru himself, Chris Parry, has been very bullish on Perimeter. In fact, if you listen to our Investor Roundtable from early November 2021, you would think Chamath himself watched our analysis. His long term bullish case is similar to Chris’ take.

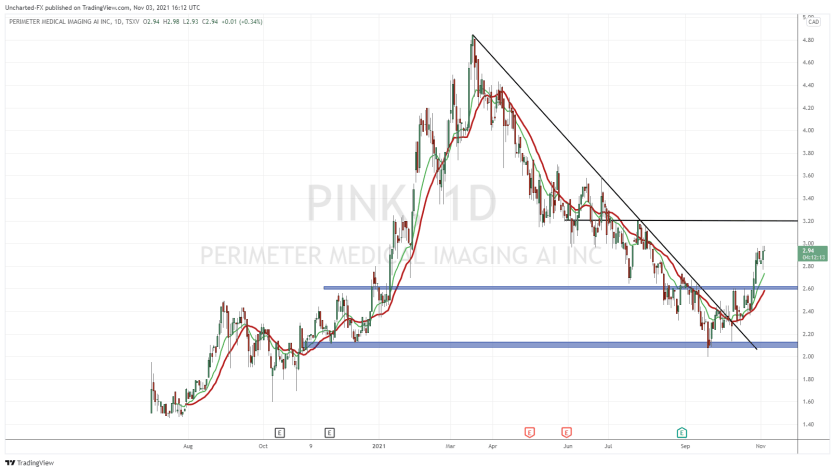

For you technical analysts out there, in early November 2021, I declared that Perimeter Medical had confirmed a new uptrend. We bounced from a major support zone, and also close above a downtrend line. Not only that, but Perimeter triggered a breakout with a reversal pattern.

Above is the chart from that article. The daily candle close above $2.60 confirmed our breakout. That was the signal to go long the stock. In the same article, I talk about how we should expect more moves higher because an uptrend is composed of higher lows and higher highs. Just pure market structure.

The reason I, and many others, love technical analysis is because firstly, nothing moves up or down in a straight line. Everything moves in cycles or waves which we call uptrends or downtrends. As a trader, I am never going to call a bottom or a top. That isn’t my job. My job is to take trades based on good probabilities. I call myself an early trend reversal trader. That’s my niche. I look for plenty of signs indicating a reversal is taking place, and then I take the trade. Perimeter met all my criteria. Here is where things might seem like magic and sorcery: I have found that many times, the technicals can indicate some sort of news or event coming down the pipeline. There has to be a reason for the trend shift, and it tends to be people in the know picking up positions front running some news. Not only can this be used on stocks, but I have found technicals work well with forex pairs whenever a high even risk is coming. You can predict the data before the release just by looking at the technicals. This is why the charts are powerful and I recommend you include them in your investing arsenal.

I covered the Social Capital news and the price action when the news was released. I will highlight the major parts, but you can read my full article here.

Here are the details regarding Social Capitals Investment:

Social Capital has agreed to subscribe, on a non-brokered private placement basis for C$43.4 million in units of Perimeter at a price of C$3.00 per unit, with each Unit consisting of one common share and a total of one warrant to purchase an additional Common Share . 80% of the Warrants issued in the Private Placement will have a strike price of C$3.99 and 20% of the Warrants in the Private Placement will have a strike price of C$4.50. Half of the Warrants at each strike price will be subject to accelerated expiry if the 60-day volume weighted average trading price of Perimeter’s Common Shares is greater than the strike price during the applicable period. The other half of the Warrants will not be subject to accelerated expiry, and instead they may be exercised for cash or exercised using a cashless exercise feature at any time prior to expiry. Subject to the accelerated expiry clause described above, all Warrants will expire five years following the closing of the Private Placement.

Two key price levels for when we look at the chart: $3.00 and the strike price of some warrants at $3.99 and $4.50.

Here is the current daily chart of Perimeter Medical, and you can see we took out my resistance zone at $3.20 mentioned back in November 2021. Price tested it and couldn’t break through, but the Social Capital news led to a nice 70% plus pop on December 15th 2021.

With the current sell off after making all time record highs at $5.20, I can’t help but think some warrants above $4.50 and $3.99 were exercised for some profit.

Going forward, I would love picking up shares closer to $3.00, where Social Capital got in. I would be a buyer on these dips. Currently, price is ranging between $3.90-$4.20. Dips would be great, but alternatively, if we get a daily close above $4.20, I would grab some shares because the pullback looks less likely. A higher low with another higher high into new record territory becomes more probable with the latter case.

The technicals and the fundamentals are lining up nicely with Perimeter. On the fundamental side of things, the company has announced its first commercial installation S-series OCT in North Texas and plans ongoing market activity in North America. Expect positive news like this going forward now that Perimeter has a nice cash position, but more importantly, a strong backing by Chamath and Social Capital.