This outlook can be summarized with one word: bullish. For those that do not think fiat money is going down when central banks are stuck, and cannot raise interest rates above 1% because of the amount of debt, I suggest you read Ray Dalio’s new book. Dalio warned about the predicament the current Keynesian system is in before the pandemic with his ‘cash is trash’ comment. He also suggested an increased allocation in the best currency, Gold. A few other billionaires suggested the same thing. Dalio’s new book came out just a few weeks ago, but he makes a good argument on why you want to hold non fiat assets, particularly Gold (but Silver is okay too), to preserve your wealth when the long term debt cycle ends.

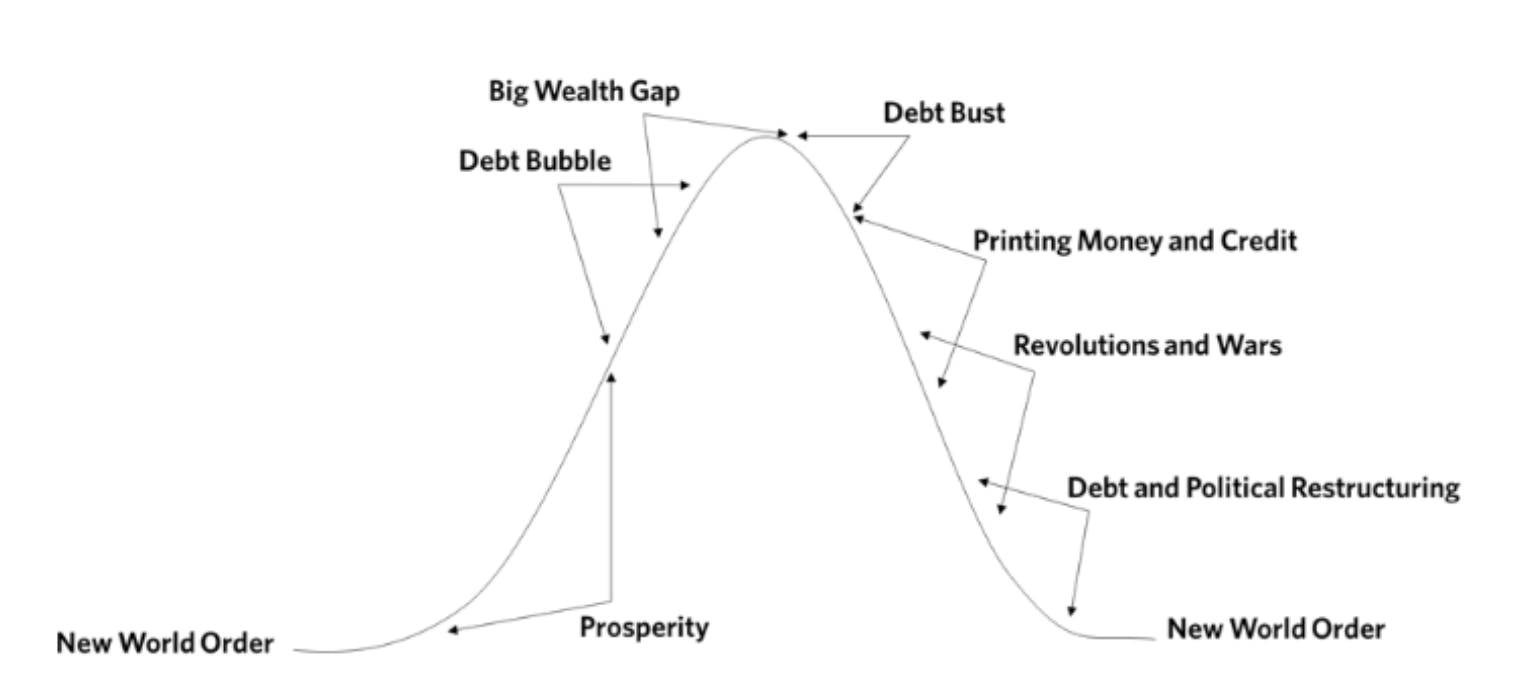

We are at the “printing money and credit” stage. It really seems like it is money printing and cheap money keeping this entire system propped up. As I am writing this, we have seen new restrictions, and in some cases, full lockdowns, in countries due to Omicron. This is actually bullish because it means the cheap money is likely to continue.

The ending of a long term debt cycle happens once every 80-100 years. With central banks stuck, government and consumer debt at high loads which prevents any major rate hike, division in society…it looks like we are near the end of the cycle. Long time readers know that I refer to this term as the confidence crisis. When people begin losing faith, or confidence, in the government, the central bank and the fiat currency. When I look around the western world, we are pretty much at the beginning of this confidence crisis. And yes folks, I am not going to lie, it will be a shaky ride.

I have been personally acquiring much more non-fiat assets lately. I do consider Bitcoin and crypto’s as non fiat assets. There may be some more issues with it when it comes to the government and regulations, but I think it is worth holding some. Gold and Silver are my preferred assets. Physical to bet against the debt, and then one can trade paper contracts to make a nice profit…which can then be used to purchase non-fiat assets.

It is not a surprise to my readers that I expect precious metals to have a great 2022. In fact, Q1 2022 might start off with a bang given where the charts are right now.

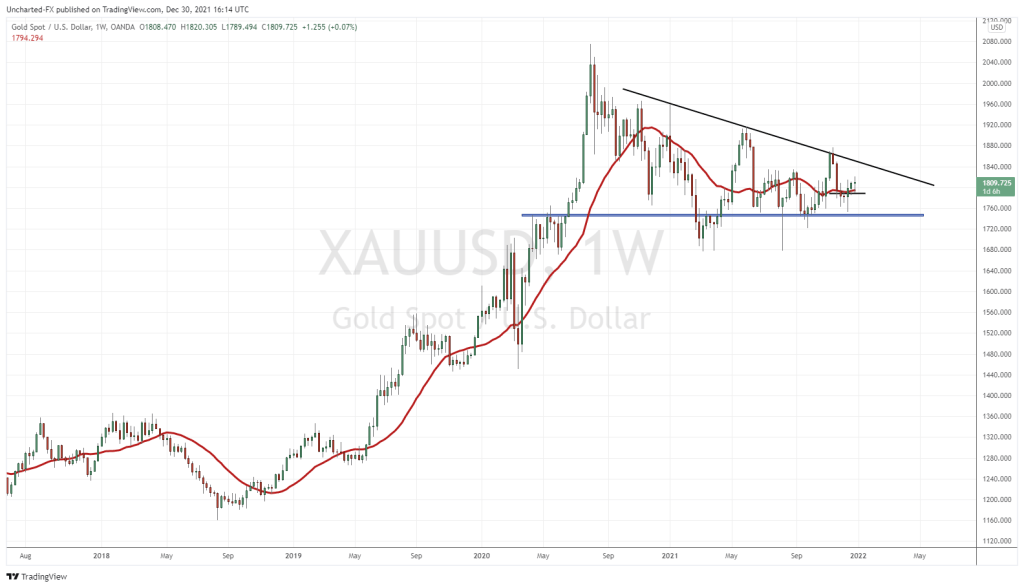

Gold on the weekly is still in a triangle pattern. Once we get a break above the trendline, a new leg higher begins. The weekly support at $1750 becomes key for Gold bulls in 2022. If we remain above this level, the breakout remains possible.

For those who are a part of Equity Guru’s Discord Investing/Trading channel, I have highlighted the daily chart of Gold as something we can all act on. $1750 saw buyers, evident by the large wick candle. We then had a breakout after ranging for three trading weeks. Yesterday, we saw price retest the breakout zone with buyers jumping in. It’s looking real good folks. A higher low is setting up, indicating more upside. Will this momentum higher be enough to give us our trendline breakout? We will have to wait and see. And it could occur as soon as Q1 2022.

For my Silver bulls, a huge support zone at $21.50 was tested recently. I gave the heads up on Discord, and wrote a piece here under Market Moment. Bulls have held, and technically, I expect price to pop higher here just like it did the four other times we tested this support in September 2020, December 2020, August 2021, and October 2021. So far the December 2021 retest is looking great. I took a long on the breakout above $$22.50. Another higher low is being formed on the retest which is hinting at another leg higher. Silver might start off 2022 with a bang.

A lot of Silver bulls quote the Gold/Silver ratio. The Gold/Silver ratio is simply the amount of silver it takes to purchase one ounce of gold. Currently it is sitting at 78, meaning it takes 78 ounces of silver to buy 1 ounce of gold. Quite high, and historically, the number has been closer to 15-20. With Silver’s industrial uses, more of it was mined to meet those demands rather than being money. Although, when looking at the correlation between Silver and Gold, the monetary metal, and between Silver and Copper, the base/industrial metal, Silver correlates with the monetary metal better. I am not saying we will ever get back to the 15-20:1 ratio, but darn, it would be awesome for us Silver bulls.

Not a precious metal, but Copper is worth taking a look at. Mind you, I think all metals and commodities will perform well on the rising inflation trade as money runs into hard assets. Copper will be no exception. However, Copper does have another major bullish factor. The green/clean movement to electrify the economy and go green. Copper is the green metal. It is likely that governments will attempt to rebuild the economy by initiating large infrastructure projects. Green infrastructure is the number 1 contender for this. In fact, we are already seeing the beginning of it with the Biden “Green New Deal”.

Copper had a fantastic 2021. After hitting highs in May 2021, Copper just ranged between $4.80 and $4.00 for the rest of the year. The range still holds as we end 2021. 2022 will see this range break. Copper prices are looking to close above $4.50 currently. If this can happen, we set up another run up to $4.80 and a possible breakout.

Platinum looks very attractive after bouncing from major support at $900. Similar technical set up to Silver. We got out breakout, saw buyers hop in on the retest, and we now expect another leg higher. In terms of resistance levels, I think we can see $1100 by the end of Q2 2022.

Last but not least, Palladium. I mentioned the huge support retest at $1600. Things escalated quickly. We are now back above $2000 an ounce. The most priciest of the metals. Might surprise people when they find out Palladium hit highs of $3000 this year. For 2022, I will be watching resistance at $2200. To be honest, as long as we hold above the $1875 zone, $2200 can be reached in the first quarter of 2022.

In summary, all the metals look bullish here. Technically, they have all just bounced at major support, and traders should expect multiple legs higher in this new uptrend. Fundamentally, the environment couldn’t be better. We expect more easy money policy, and inflation to persist. Bullish for metals and commodities as a whole. To me, this is the space you want to be in if you are betting against the debt.

I like the all things EV/green as a longer term trend play and precious metals both long and short term. Enjoy your analysis. Cheers to 2022

Thank you! Let’s hope for a great year for both precious and base metals this year!