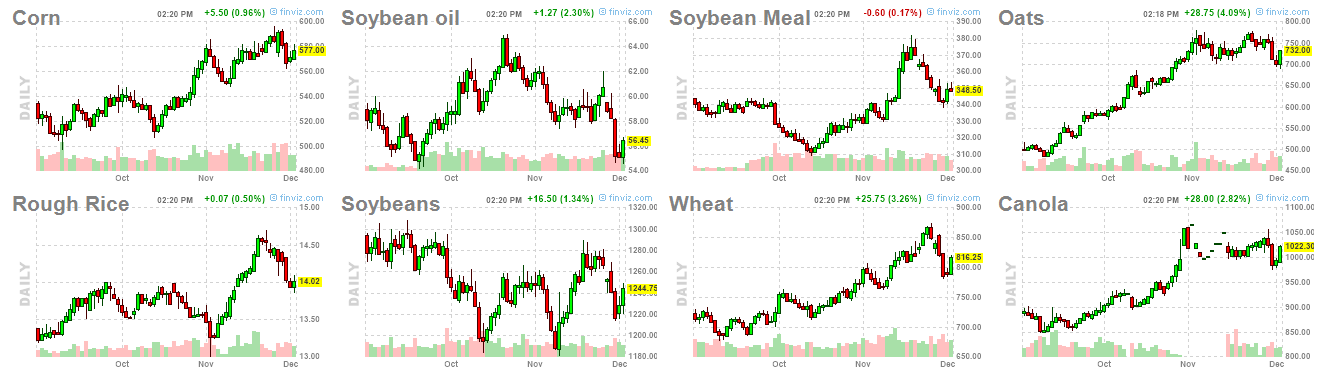

It’s all about Omicron, and the new variant out of South Africa is putting pressure on Stock Markets. At time of writing, we are rebounding after Wednesday’s rout. Yes folks, Agriculture stocks got hit too. In fact, the commodities did as well. Everything from Soybeans, Wheat, Corn, Sugar and more took a hit as we witnessed an everything sell off. Money leaving risk on assets to move to risk off assets. The positive? More traders now are expecting the Fed to perhaps hold off on a strong taper. A wait and see approach. More brrrr? Positive for the stock markets, and we can now look for some good deals in Agriculture after this dip.

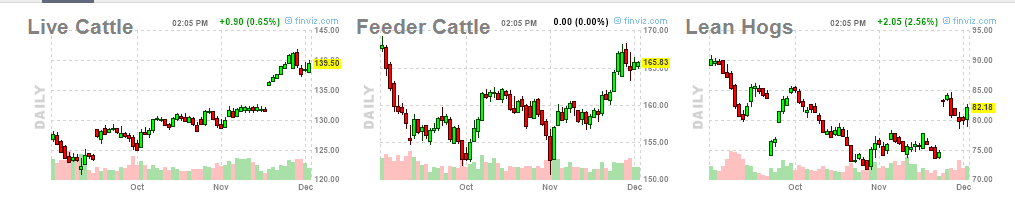

On the meat side of things, things are looking pretty good. A slight pullback, but not as bad as other markets I follow. Take a look at Lean Hogs. I like what I am seeing in the market structure. A nice bottoming range, and the breakout occurred with a gap up. Bullish. It seems like another higher low is coming up meaning a break above $85 is in the cards.

On the grain side of things, plenty of charts I will be watching. Rough Rice has pulled back to a major support zone. I would expect to see buyers jump in here. The same can be said about Oats, Soybean Meal. Both are pulling back to major support zones. Soybean Oil stands out too as it is at a major support zone. Not from a breakout retest, but from a drop. A zone where shorts would take some profits.

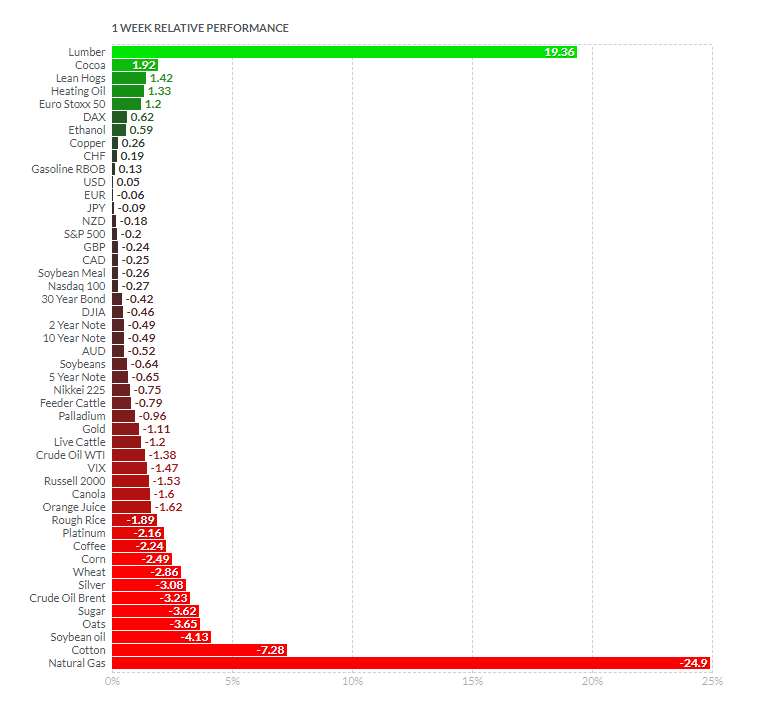

Quite a skewed weekly performance chart. Lumber and Natural Gas stand out, other than that, just meh. There was more red on this earlier this week. A lot of things under Lumber are staging a recovery after the market drop.

Let’s take a look at some charts and press releases.

Potash Companies

I just want to highlight last week’s Potash Agriculture sector round up. Lot of those company charts are holding up due to another piece of news this week. The US is placing sanctions on a Belorussian Potash exporter. This company accounts for 16% of global production. The company is Belarus Potash Company (BPC) which is the exporting arm of Belorussian state potash producer Belaruskali and is Minsk’s main foreign currency earner. BPC ships potash mainly to China, India and Brazil. With 12.5 million tonnes potash to be produced in 2021, Belaruskali is the world’s second largest producer of the crop nutrient after Nutrien Ltd (NTR.TO). This news will support the elevated prices of Potash, and North American Potash producers such as Nutrien and Mosaic Co stand to benefit. Their shares are up over 3% on Thursday at time of writing.

CubicFarm Systems (CUB.TO)

A lot of today’s coverage will be like this:

Since we have a market sell off, many stocks are finding a base at support. CubicFarms gapped down last week when they announced a $20 million bought deal public offering of common shares. It means shareholders get diluted, but the company raises cash which will be used to initiate a catalyst. CubicFarms right now is at a major support zone. This $1.15 zone has been support and resistance multiple times in the past. What I like to call a flip zone. These are very powerful areas which attract price like a magnet. We now have had multiple daily candles basing here. A battle between the bulls and the bears. I like what I am seeing here, and a candle break above $1.25 gets us going. Yes, there is a large gap up to $1.40 which also needs to be filled, but this is a stock for the long term, and we have a nice zone to add or initiate a position.

Clean Seed Capital (CSX.V)

And another one:

Clean Seed Capital operates in the agriculture equipment industry in North America. It offers seeding and planting equipment. The company focuses on development of the SMART Seeder MAX-S prototype and commercialization of the related SMART Seeder technology. The company is also involved in the software development business.

Yup, we are at a major flip zone. We did close below it on Tuesday, but we climbed up back above support on a day when the overall markets were weak. Watch for a large green candle here with significant volume. The stock tends to see 22,000 shares traded a day on average. In the last four days we have seen volume profiles of 31,520 , 22,500 , 21,500 , 26,200.

Bee Vectoring Technologies (BEE.CN)

One of the coolest companies I follow. Bee Vectoring Technologies International Inc is an agriculture technology company, develops and provides natural commercial farming solutions. Its solutions include the Hive and Bees, an inoculum dispenser system; Vectorpak with Vectorite, a recipe of ingredients that allows bees to carry crop BVT-CR7 and other beneficial fungi or bacteria in their outbound flights to the crops; active ingredients, such as BVT-CR7, an organic strain of a natural occurring endophytic fungus; and pollen distribution systems. The company’s patented bee vectoring technology uses commercially-reared bees to deliver targeted crop controls through the natural process of pollination. It provides natural pest and disease management solutions for various crops, such as strawberries, sunflowers, apples, tomatoes, canola crops, blueberries, and other crops.

A huge support zone. Not just any support zone, but one that holds the all time record lows for Bee Vectoring. Four times in the past, we saw massive buying and a nice pop from this support. Look at Thursday’s candle. A huge wick with 344,505 shares traded at time of writing. A stock that sees an average volume of 64,000. This is what I mean about picking up shares of these companies at good support levels. Really liking this one here.

CO2 Gro Inc (GROW.V)

CO2 Gro provided an update this week. Here are some highlights from Q3:

- During Q3 2021, the Company reported revenues of $122,103 versus Q2 2021 $91,660 and $24,857 in Q3 2020. YTD 2021 revenues are $230,360 vs. $100,331 in YTD 2020.

- Commercial installation sale to an Arizona greenhouse grower for US $30,000 for 10% of their facility’s grow area. The customer intends to install CO2 Delivery Solutions™ into the remaining 90% of their greenhouse capacity through 2022.

- In Q3, 2021 seven new commercial feasibilities were signed to reach 200M square feet of potential commercial opportunity owned by these customers.

- Participated in Ontario’s Ministry of Economic Development, Job Creation and Trade (MEDJCT) and Toronto Regional Board of Trade Mexico Cleantech Virtual Trade Mission during Q3 2021 that introduced GROW to Mexican protected ag growers, associations and additional potential marketing partners.

- Signed a non-exclusive agreement with Jose Andres Garcia Munoz to cover the Spanish protected ag and greenhouse markets.

- Participated in six conferences in person or virtually held in the US, Mexico, Japan and the Netherlands to expand awareness of the benefits CO2 Delivery Solutions™ provides to protected ag growers.

And there is a lot of progress on commercial feasibility. Too many to list, so check them all out here.

I sound like a broken record already, but we are at a major support zone. Look at the beginning of 2021. We broke above $0.20 and never looked back. As my readers know, whenever a resistance zone is broken, it becomes new support AND one day we expect to see price pullback to retest it. It can happen a day or a couple of days after the breakout, or it may take weeks to months. After almost 12 months, CO2 Grow is back at $0.20. Some significant volume is coming in here buying near support. This is evident from the wicks on the candles we are seeing. A very nice basing formation here.

Water Ways Technologies (WWT.V)

One of my favorite companies, and a very popular company among my readers and followers. Water Ways Technologies released Q3 2021 earnings. Record Sales. Here are some highlights:

- Record sales for the nine months period ended September 30, 2021, totaling CAD$15,765,000 compared to CAD$9,553,000 for the nine months period ended September 30, 2020, for total revenue growth of 65%.

- Sales for the three months period ended September 30, 2021, totaling CAD$3,637,000 compared to CAD$2,565,000 for the three months period ended September 30, 2020, for total revenue growth of 42%%.

- Service Project revenue stream increased substantially to CAD$8,014,000 compared to CAD$2,237,000 for the nine months period ended September 30, 2021 and 2020, respectively, for total project revenue growth of 258%.

- Gross profit increased by 66% to $558,000 compared to $336,000 for the nine months period ended September 30, 2021 and 2020, respectively.

- Gross profit increased by 93% to $2,941,000 compared to $1,524,000 for the nine months period ended September 30, 2021 and 2020, respectively.

- Adjusted EBITDA for the nine months period ended September 30, 2021 reached CAD$687,000 compared to an Adjusted EBITDA loss of CAD$439,000 for the nine months period ended September 30, 2020 (See below for definition of “Adjusted EBITDA”, a non-GAAP measure driven substantially by Share based payments).

I want to step back on this one to give you guys a broader view. This $0.33 zone was our major resistance target from months ago. We are now making substantial closes above it. And we are holding above it! Look at the pullbacks. We even had a huge red day, but buyers piled in and forced a close back above $0.33. Very powerful stuff technically. And, this stock held up well on the overall market weakness. What next? A candle body close above $0.35. The line I drew lines up with the record highs made back on the IPO day in 2019. We get this close, and the stock has a real possibility of going vertical on the breakout.

EarthRenew (ERTH.CN)

EarthRenew reported Q3 2021 earnings this week. The Company is reporting revenue for the 9 month of $7,565,180 on a proforma basis including revenue related to the acquisition of Replenish Nutrients Ltd. Revenue for the quarter ended September 30, 2021 is $2,559,209.

CEO Keith Driver commented, “We continue to see the strategic year-over-year growth in revenue from the sale of regenerative fertilizer. We aim to finish strong in the fourth quarter fall season, and we are nearing commissioning of Replenish’s expanded Beiseker facility to grow production capacity to 20,000 tonnes.”

This is a stock that has shown up often in recent roundups. The technicals are very attractive. If you recall, I said that we need the breakout above $0.20 to confirm a trend shift. It did not happen, and why it pays to be patient. Instead, we broke below $0.175. Below support. We must recover $0.175. This would be bullish if it occurs because it would mean a false breakdown. Bears are trapped, and we can shoot off to the upside. If this does not happen and the bears have control, the stock can drift lower down to $0.075.

Agrify Corporation (AGFY)

I like what I am seeing here, especially because Agrify sees large volume on a daily basis.

Yup, a major flip zone here. The $13.50 zone is seeing some buying. Look at Thursday’s candle wick so far. For a substantial push, we need to clear $16.00, but this area is a great zone for adding or entering a position. Let’s watch for a following strong green candle on Friday.