The first photovoltaic cell was produced in 1954 allowing humanity to harness the power of the sun to generate electricity. The technology was embryonic with a four percent efficiency rate, making solar panel produced power incredibly expensive at $300/watt. This relegated solar panels to academic use and high-priced applications such as powering satellites.

Over the next sixty years, the science improved considerably. Now solar panels can produce power with up to 23% efficiency at between $3-$5/watt, generating up to $30,000 in energy savings over a 20-year span. Solar power has matured into a powerful contributor to the green energy revolution.

What was an already sizeable $52.5 billion global market in 2018 is now expected to grow at 20% CAGR to $233 billion by 2026, but beyond Tesla’s less-than-ethical high-profile purchase of the now defunct Solar City, solar power providers exist below the typical investor’s radar. So, who are some the players with sunlight-driven revenue that might present an interesting portfolio opportunity?

UGE International (UGE.V) is a worldwide distributor of solar energy with offices in Toronto, Canada, New York, and the Philippines. The company, capital light, focused on value creation and long-term returns, owns its projects from development to operation.

With contracts typically lasting at least 25 years and an asset life of 40 or more years, there is a lengthy profit generating tail which becomes a stable financial backdrop to short term revenues such as developer fees, consulting services and project sales.

UGE is building organic growth and has already exceeded its 2021 target of 120MV, hitting 145MW as of November 22, 2021. With 790MW in the pipeline and 2MW in operating assets, the company is functional with a future.

Shares are tightly held with 43% management and insider ownership. Q3 2021 financial highlights included:

- 37% generated energy production revenue growth from the prior quarter totaling $64,560 from 295,155 kWh of energy during the quarter.

- $465,325 in generated revenue from client-financed agreements, projects in the Philippines and engineering services.

- Net loss of $1.3 million or $0.04 per share during the quarter.

As you can see, UGE is in growth mode and losses are to be expected for at least the near future as the company continues to scale its operations. This is a buy and hold stock.

Innergex Renewable Energy (INE.T) is a developer, owner, and operator of run-of-river hydroelectric facilities, wind energy and solar farms in North America. The company offers a diversified option to the renewable energy investment portfolio. It operates installations across Canada, USA, France, and Chile.

Innergex owns interest in 79 operating facilities, has eight projects under development and numerous prospective projects in its pipeline. The company announced on November 17, 2021, that it had concluded the tax equity funding for the 200MW Amazon Solar Farm Ohio – Hillcrest, located in Brown County, Ohio.

Hillcrest is the largest solar facility in Ohio and since it began commercial operation in May, 100% of its generated electricity and environmental attributes has been sold under a long-term corporate power purchase agreement to an investment grade rated US corporation. (Amazon?)

The company’s aggregate installed capacity is 3,101 MW with a storage capacity of 150 MWh. As part of its diversified offering, Innergex has 40 hydroelectric stations, 32 wind farms and seven solar farms. Looking ahead, the firm holds interest in nine projects under development with two of those in construction with a net installed capacity of 171 MW and an energy storage capacity of 329 MWh.

Prospective projects within Innergex’s pipeline will possess an aggregate gross capacity of 7,281 MW.

In the three months ending September 30, 2021, the company brought in $184,564 in revenues and paid dividends to shareholders. Worth taking a look at.

Boralex (BLX.T) is a Canadian power company based in Quebec that develops, builds and operates renewable energy power facilities in Canada, France, the UK and the US. The company had a total installed capacity of 2,455 MW in 2020.

Back in February, Boralex inked a power purchase agreement with Hydro-Quebec for the Apuiat wind project, in partnership with the Innu Nation in Quebec. This was a major milestone in the company’s corporate objectives which include organic and inorganic growth.

Boralex plans to nearly double its current capacity of 2,455 MW to 4,400 MW by 2025 and more than double that figure to 12,000 MW by 2030. One of the avenues the company is pursuing to achieve these targets is the submission of solar projects totalling 800 MW it made at the end of August under NYSERDA’s Tier 1 RFP in the State of New York.

The company announced strong growth with operating income of $7.0 million in Q3 2021, up 112% from $3.0 million in Q3 2020. There is also a strong financial backbone to achieving its goals as Boralex announced it had renewed and extended its corporate credit facility and letter of credit facility totaling $525.0 million for a remaining term of five years.

The pandemic impacted Boralex as even though the company reported production was up 22% from the same period a year ago, it was still 7% less than anticipated and resulted in a net loss of $22.0 million for the quarter.

Boralex, like its competitors is still in growth mode and it will be a while before it has a positive bottom line. Also a buy and hold.

Solar Alliance (SOLR.V) is a pure solar play providing solar energy services in Tennessee, Kentucky, North Carolina and South Carolina, but is able to operate across North America.

The company provides solar energy solutions for manufacturing, data centres, professional buildings, agriculture and utilities.

Since its inception, Solar Alliance has developed more than $1.0 billion USD of renewable energy projects. The company experienced 59% revenue growth year over year since 2020 and has a project pipeline that is currently worth approximately $82.0 million CAD.

With near-term plans of expanding operations to Canada, the company continues to build on its milestones including the Maker’s Mark Distillery 200 MW ground mount solar project in Kentucky in partnership with Caterpillar, its definitive design agreement for a 56 MW solar project in Illinois, its completion of a 2.4 MW solar project for Bridgestone and an expanded relationship with Caterpillar in Kentucky.

Solar Alliance’s binding agreements for two US operating assets which are construction ready, will generate recurring revenue over a 30-year lifespan.

Solar Alliance seems a little scattered and I am not as confident about this one as the others, but it is your money of course. Please remember to do your due diligence before making any investment decision as I am not an investment professional, just an interested third-party.

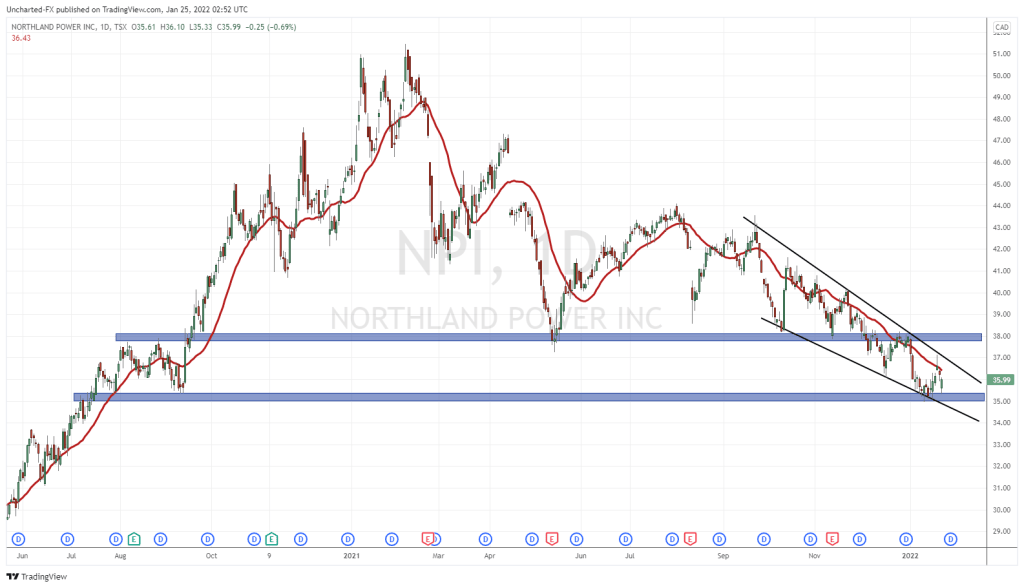

If you’re looking for an in-depth technical breakdown of the sector and the above companies, check out Vishal’s chart attack here.

Our own Reza Golzadeh throws in his Invest or Not thoughts here.

For even more video opinions, check out our Investor Roundtable here.

The rest is up to you, do your homework, pick your winners, take care of your future and build a better planet. Good luck to all!

–Gaalen Engen